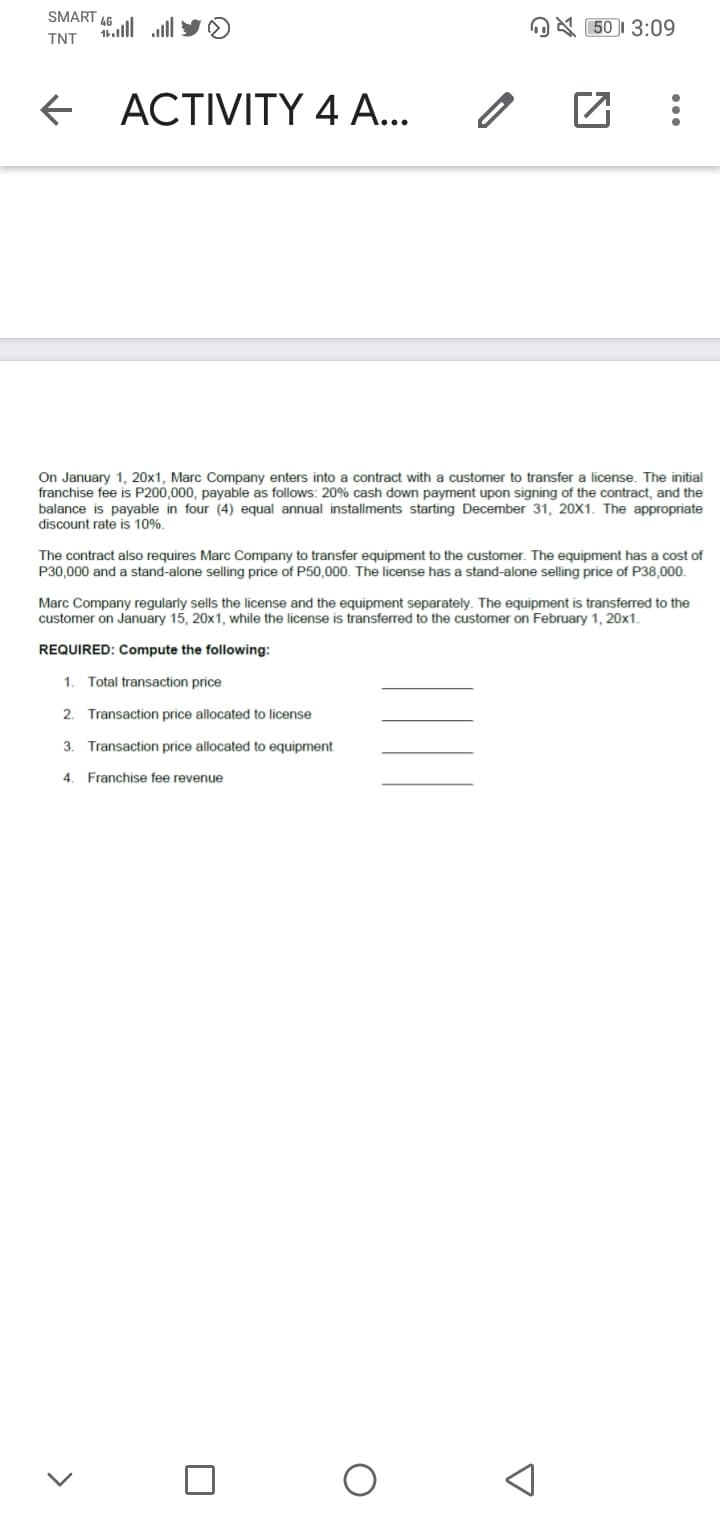

On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. The initial franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract, and the balance is payable in four (4) equal annual installments starting December 31, 20X1. The appropriate discount rate is 10%. The contract also requires Marc Company to transfer equipment to the customer. The equipment has a cost of P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P38,000. Marc Company regularly sells the license and the equipment separately. The equipment is transferred to the customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1. REQUIRED: Compute the following: 1. Total transaction price 2. Transaction price allocated to license 3. Transaction price allocated to equipment 4. Franchise fee revenue

On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. The initial franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract, and the balance is payable in four (4) equal annual installments starting December 31, 20X1. The appropriate discount rate is 10%. The contract also requires Marc Company to transfer equipment to the customer. The equipment has a cost of P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P38,000. Marc Company regularly sells the license and the equipment separately. The equipment is transferred to the customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1. REQUIRED: Compute the following: 1. Total transaction price 2. Transaction price allocated to license 3. Transaction price allocated to equipment 4. Franchise fee revenue

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.1EX: Current liabilities Bon Nebo Co. sold 25,000 annual subscriptions of Bjorn for 85 during December...

Related questions

Question

Transcribed Image Text:SMART 46

.alll ll

OA 50I 3:09

TNT

ACTIVITY 4 A...

On January 1, 20x1, Marc Company enters into a contract with a customer to transfer a license. The initial

franchise fee is P200,000, payable as follows: 20% cash down payment upon signing of the contract, and the

balance is payable in four (4) equal annual installments starting December 31, 20X1. The appropriate

discount rate is 10%.

The contract also requires Marc Company to transfer equipment to the customer. The equipment has a cost of

P30,000 and a stand-alone selling price of P50,000. The license has a stand-alone selling price of P38,000.

Marc Company regularly sells the license and the equipment separately. The equipment is transferred to the

customer on January 15, 20x1, while the license is transferred to the customer on February 1, 20x1.

REQUIRED: Compute the following:

1. Total transaction price

2. Transaction price allocated to license

3. Transaction price allocated to equipment

4. Franchise fee revenue

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning