at the beginning of the year, the shareholders' equity section of the statement of financial position of R&B Corporation reflected the ollowing Common shares (no par value, authorized 65,000 shares, outstanding 32,500 shares) Contributed surplus Retained earnings Accumulated other comprehensive Income $390,000 14,500 177,500 10,500 On February 1, the board of directors declared a 14 percent stock dividend to be issued on April 30 The market value per share was $20 on the declaration date. Required: 1. For comparative purposes, prepare the shareholders' equity section of the statement of financial position (a) before the stock dividend and (b) after the stock dividend

at the beginning of the year, the shareholders' equity section of the statement of financial position of R&B Corporation reflected the ollowing Common shares (no par value, authorized 65,000 shares, outstanding 32,500 shares) Contributed surplus Retained earnings Accumulated other comprehensive Income $390,000 14,500 177,500 10,500 On February 1, the board of directors declared a 14 percent stock dividend to be issued on April 30 The market value per share was $20 on the declaration date. Required: 1. For comparative purposes, prepare the shareholders' equity section of the statement of financial position (a) before the stock dividend and (b) after the stock dividend

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEB: STOCK DIVIDENDS Martinez Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

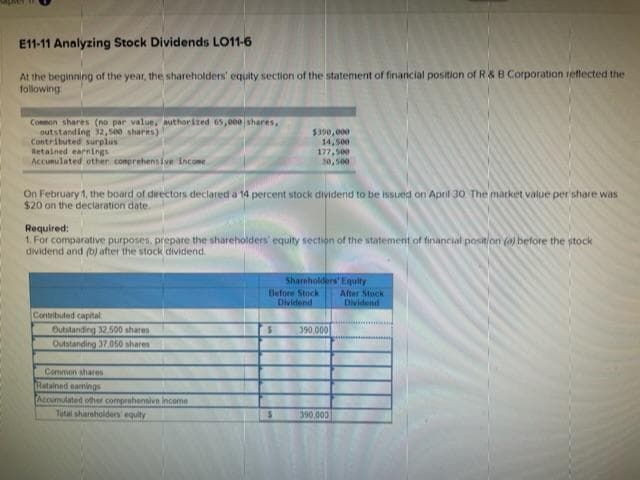

Transcribed Image Text:E11-11 Analyzing Stock Dividends LO11-6

At the beginning of the year, the shareholders' equity section of the statement of financial position of R & B Corporation reflected the

following

Common shares (no par value, authorized 65,000 shares,

outstanding 32,500 shares)

Contributed surplus

Retained earnings

Accumulated other comprehensive Income

On February 1, the board of directors declared a 14 percent stock dividend to be issued on April 30 The market value per share was

$20 on the declaration date.

Required:

1. For comparative purposes, prepare the shareholders equity section of the statement of financial position (a) before the stock

dividend and (b) after the stock dividend

Contributed capital

Outstanding 32.500 shares

Outstanding 37,050 shares

$390,000

14,500

177,500

30,500

Common shares

Retained earnings

Accumulated other comprehensive income

Tatal shareholders' equity

Shareholders' Equity

Before Stock

Dividend

390,000

390,000

After Stock

Dividend

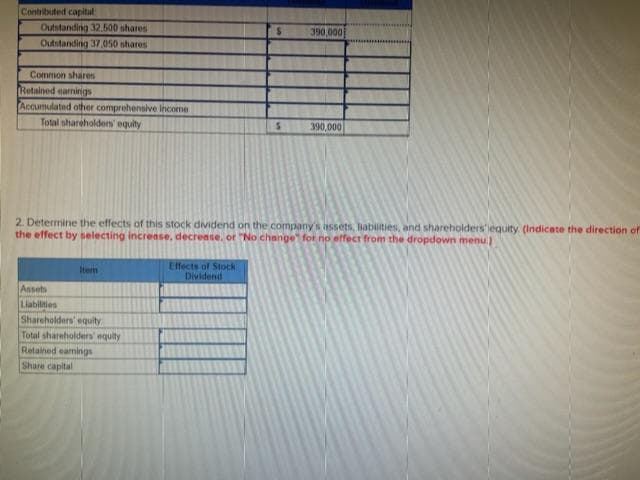

Transcribed Image Text:Contributed capital

Outstanding 32.500 shares

Outstanding 37,050 shares

Common shares

Retained earnings

Accumulated other comprehensive income

Total shareholders' equity

Item

Assets

Liabilities

Shareholders' equity

2. Determine the effects of this stock dividend on the company's assets, Babilities, and shareholders equity (Indicate the direction of

the effect by selecting increase, decrease, or "No change for no effect from the dropdown menu.)

Total shareholders' equity

Retained earnings

Share capital

S

Effects of Stock

Dividend

390,000

390,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning