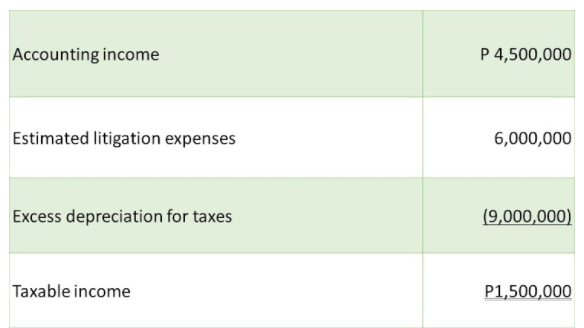

At the end of 2012, its first year of operations, Glow Company prepared a reconciliation between accounting income and taxable income as reflected in the table below. The estimated litigation expense of P6,000,000 will be deductible in 2013 when it is expected to be actually paid. Use of the depreciable assets will result in taxable amounts of P3,000,000 in each of the next three years. The income tax rate is 30% for all years. Assuming no payment has been paid for income taxes, what is the income tax payable at the end of 2012? How much is deferred tax asset at D

At the end of 2012, its first year of operations, Glow Company prepared a reconciliation between accounting income and taxable income as reflected in the table below. The estimated litigation expense of P6,000,000 will be deductible in 2013 when it is expected to be actually paid. Use of the depreciable assets will result in taxable amounts of P3,000,000 in each of the next three years. The income tax rate is 30% for all years. Assuming no payment has been paid for income taxes, what is the income tax payable at the end of 2012? How much is deferred tax asset at D

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 30CE

Related questions

Question

At the end of 2012, its first year of operations, Glow Company prepared a reconciliation between accounting income and taxable income as reflected in the table below. The estimated litigation expense of P6,000,000 will be deductible in 2013 when it is expected to be actually paid. Use of the

How much is deferred tax asset at December 31, 2012?

a. P450,000

b. P900,000

c. P1,350,000

d. P1,800,000

Transcribed Image Text:Accounting income

P 4,500,000

Estimated litigation expenses

6,000,000

Excess depreciation for taxes

(9,000,000)

Taxable income

P1,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT