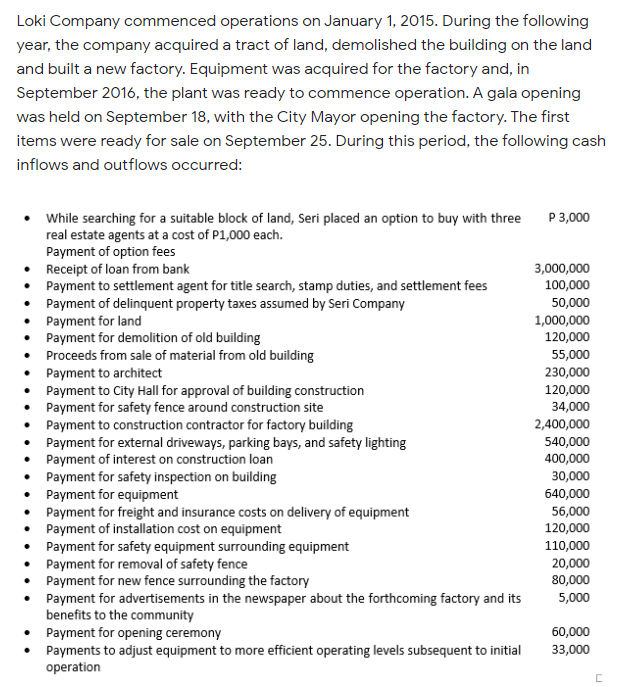

Loki Company commenced operations on January 1, 2015. During the following year, the company acquired a tract of land, demolished the building on the land and built a new factory. Equipment was acquired for the factory and, in September 2016, the plant was ready to commence operation. A gala opening was held on September 18, with the City Mayor opening the factory. The first items were ready for sale on September 25. During this period, the following cash inflows and outflows occurred: • While searching for a suitable block of land, Seri placed an option to buy with three real estate agents at a cost of P1,000 each. Payment of option fees • Receipt of loan from bank • Payment to settlement agent for title search, stamp duties, and settlement fees • Payment of delinquent property taxes assumed by Seri Company Payment for land Payment for demolition of old building Proceeds from sale of material from old building Payment to architect Payment to City Hall for approval of building construction • Payment for safety fence around construction site Payment to construction contractor for factory building Payment for external driveways, parking bays, and safety lighting Payment of interest on construction loan • Payment for safety inspection on building • Payment for equipment • Payment for freight and insurance costs on delivery of equipment Payment of installation cost on equipment Payment for safety equipment surrounding equipment Payment for removal of safety fence Payment for new fence surrounding the factory Payment for advertisements in the newspaper about the forthcoming factory and its benefits to the community Payment for opening ceremony • Payments to adjust equipment to more efficient operating levels subsequent to initial operation P 3,000 3,000,000 100,000 50,000 1,000,000 120,000 55,000 230,000 120,000 34,000 2,400,000 540,000 400,000 30,000 640,000 56,000 120,000 110,000 20,000 80,000 5,000 60,000 33,000

Loki Company commenced operations on January 1, 2015. During the following year, the company acquired a tract of land, demolished the building on the land and built a new factory. Equipment was acquired for the factory and, in September 2016, the plant was ready to commence operation. A gala opening was held on September 18, with the City Mayor opening the factory. The first items were ready for sale on September 25. During this period, the following cash inflows and outflows occurred: • While searching for a suitable block of land, Seri placed an option to buy with three real estate agents at a cost of P1,000 each. Payment of option fees • Receipt of loan from bank • Payment to settlement agent for title search, stamp duties, and settlement fees • Payment of delinquent property taxes assumed by Seri Company Payment for land Payment for demolition of old building Proceeds from sale of material from old building Payment to architect Payment to City Hall for approval of building construction • Payment for safety fence around construction site Payment to construction contractor for factory building Payment for external driveways, parking bays, and safety lighting Payment of interest on construction loan • Payment for safety inspection on building • Payment for equipment • Payment for freight and insurance costs on delivery of equipment Payment of installation cost on equipment Payment for safety equipment surrounding equipment Payment for removal of safety fence Payment for new fence surrounding the factory Payment for advertisements in the newspaper about the forthcoming factory and its benefits to the community Payment for opening ceremony • Payments to adjust equipment to more efficient operating levels subsequent to initial operation P 3,000 3,000,000 100,000 50,000 1,000,000 120,000 55,000 230,000 120,000 34,000 2,400,000 540,000 400,000 30,000 640,000 56,000 120,000 110,000 20,000 80,000 5,000 60,000 33,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PB: Johnson, Incorporated, had the following transactions during the year: Purchased a building for...

Related questions

Question

The amount to be reported as expenses (excluding depreciation ) in Seri’s income statement is

A. P60,000

B. P100,000

C. P65,000

D. P67,000

Transcribed Image Text:Loki Company commenced operations on January 1, 2015. During the following

year, the company acquired a tract of land, demolished the building on the land

and built a new factory. Equipment was acquired for the factory and, in

September 2016, the plant was ready to commence operation. A gala opening

was held on September 18, with the City Mayor opening the factory. The first

items were ready for sale on September 25. During this period, the following cash

inflows and outflows occurred:

While searching for a suitable block of land, Seri placed an option to buy with three

real estate agents at a cost of P1,000 each.

Payment of option fees

• Receipt of loan from bank

• Payment to settlement agent for title search, stamp duties, and settlement fees

• Payment of delinquent property taxes assumed by Seri Company

• Payment for land

Payment for demolition of old building

• Proceeds from sale of material from old building

• Payment to architect

• Payment to City Hall for approval of building construction

• Payment for safety fence around construction site

• Payment to construction contractor for factory building

• Payment for external driveways, parking bays, and safety lighting

• Payment of interest on construction loan

• Payment for safety inspection on building

• Payment for equipment

Payment for freight and insurance costs on delivery of equipment

• Payment of installation cost on equipment

• Payment for safety equipment surrounding equipment

• Payment for removal of safety fence

• Payment for new fence surrounding the factory

• Payment for advertisements in the newspaper about the forthcoming factory and its

benefits to the community

• Payment for opening ceremony

Payments to adjust equipment to more efficient operating levels subsequent to initial

operation

P 3,000

3,000,000

100,000

50,000

1,000,000

120,000

55,000

230,000

120,000

34,000

2,400,000

540,000

400,000

30,000

640,000

56,000

120,000

110,000

20,000

80,000

5,000

60,000

33,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning