At the end of 2020, Majors Furniture Company falled to accrue $61,500 of Interest expense that accrued during the last five months of 2020 on bonds payable. The bonds mature in 2032. The discount on the bonds is amortized by the straight-line method. The following entry was recorded on February 1, 2021, when the semiannual Interest was pald: Interest expense Discount on bonds payable Cash Required: 1-a. Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described. (Ignore Income taxes.) 1-b. Prepare the journal entries that should have been recorded, if done correctly to start. Req 1A Complete this question by entering your answers in the tabs below. View transaction list Req 18 Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described. (Ignore income taxes.) (Do not round intermediate calculations and round your final answers to nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet < 2 1 Record the entry to correct the error. 73,800 Note: Enter debits before credits. Event 1 Record entry 1,300 72,500 General Journal Clear entry Debit Credit View general journal >

At the end of 2020, Majors Furniture Company falled to accrue $61,500 of Interest expense that accrued during the last five months of 2020 on bonds payable. The bonds mature in 2032. The discount on the bonds is amortized by the straight-line method. The following entry was recorded on February 1, 2021, when the semiannual Interest was pald: Interest expense Discount on bonds payable Cash Required: 1-a. Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described. (Ignore Income taxes.) 1-b. Prepare the journal entries that should have been recorded, if done correctly to start. Req 1A Complete this question by entering your answers in the tabs below. View transaction list Req 18 Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described. (Ignore income taxes.) (Do not round intermediate calculations and round your final answers to nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet < 2 1 Record the entry to correct the error. 73,800 Note: Enter debits before credits. Event 1 Record entry 1,300 72,500 General Journal Clear entry Debit Credit View general journal >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 16E

Related questions

Question

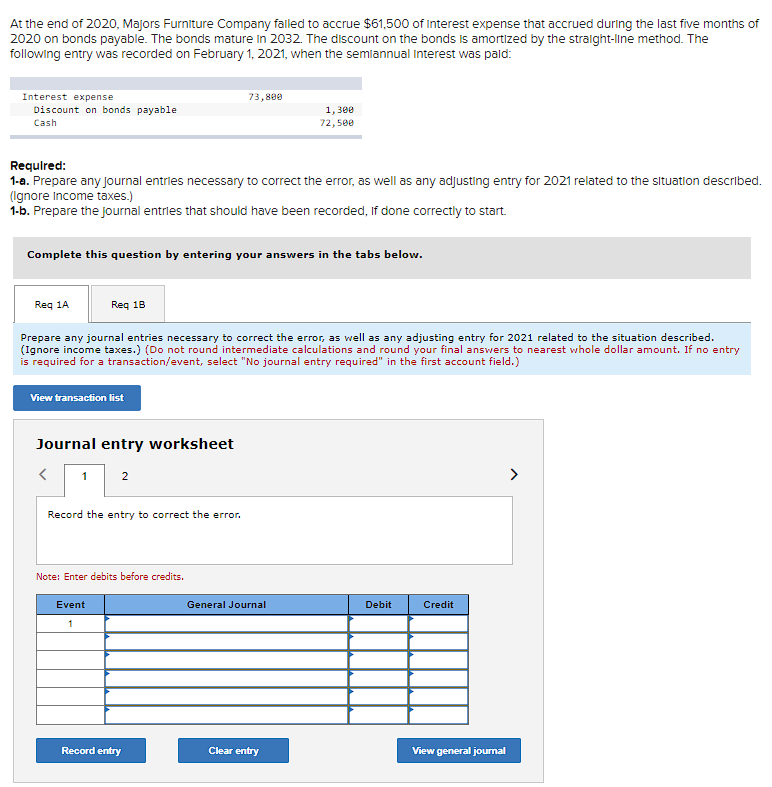

Transcribed Image Text:At the end of 2020, Majors Furniture Company failed to accrue $61,500 of Interest expense that accrued during the last five months of

2020 on bonds payable. The bonds mature in 2032. The discount on the bonds is amortized by the straight-line method. The

following entry was recorded on February 1, 2021, when the semiannual Interest was pald:

Interest expense

Discount on bonds payable

Cash

Required:

1-a. Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described.

(Ignore Income taxes.)

1-b. Prepare the journal entries that should have been recorded, If done correctly to start.

Req 1A

Complete this question by entering your answers in the tabs below.

Req 18

View transaction list

Prepare any journal entries necessary to correct the error, as well as any adjusting entry for 2021 related to the situation described.

(Ignore income taxes.) (Do not round intermediate calculations and round your final answers to nearest whole dollar amount. If no entry

is required for a transaction/event, select "No journal entry required" in the first account field.)

Journal entry worksheet

<

1

2

73,800

Record the entry to correct the error.

Note: Enter debits before credits.

Event

1

Record entry

1,300

72,500

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College