Hills Inc. acquired subsidiary X for 550 ($,000) in 20X2 and also bought Property, plant and equipment for 350($,000). Note: Figures are in ($,000) Additional Notes; 1.It was found out that Hills proceeds from sale of equipment was 20,000 and they also received a dividend of 200,000 and Interest of 200,000. 2.Hill Inc paid lease liabilities of 90,000 3.Had proceeds from Long-term borrowings of 250,000. 4. In May of 20x2 they paid dividend of 1200 Required: Prepare the Consolidated Cash Flow Statement for Hills Inc. using Indirect Method.

Hills Inc. acquired subsidiary X for 550 ($,000) in 20X2 and also bought Property, plant and equipment for 350($,000). Note: Figures are in ($,000) Additional Notes; 1.It was found out that Hills proceeds from sale of equipment was 20,000 and they also received a dividend of 200,000 and Interest of 200,000. 2.Hill Inc paid lease liabilities of 90,000 3.Had proceeds from Long-term borrowings of 250,000. 4. In May of 20x2 they paid dividend of 1200 Required: Prepare the Consolidated Cash Flow Statement for Hills Inc. using Indirect Method.

Chapter16: Multistate Corporate Taxation

Section: Chapter Questions

Problem 34P

Related questions

Question

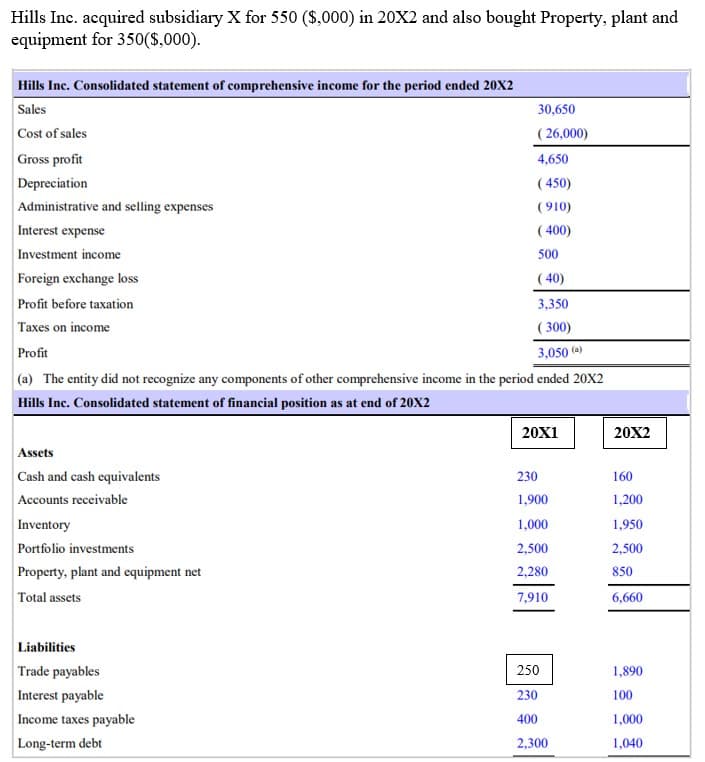

Hills Inc. acquired subsidiary X for 550 ($,000) in 20X2 and also bought Property, plant and equipment for 350($,000).

Note: Figures are in ($,000)

Additional Notes;

1.It was found out that Hills proceeds from sale of equipment was 20,000 and they also received a dividend of 200,000 and Interest of 200,000.

2.Hill Inc paid lease liabilities of 90,000

3.Had proceeds from Long-term borrowings of 250,000.

4. In May of 20x2 they paid dividend of 1200

Required:

- Prepare the Consolidated

Cash Flow Statement for Hills Inc. using Indirect Method.

Transcribed Image Text:Hills Inc. acquired subsidiary X for 550 ($,000) in 20X2 and also bought Property, plant and

equipment for 350($,000).

Hills Inc. Consolidated statement of comprehensive income for the period ended 20X2

Sales

Cost of sales

Gross profit

Depreciation

Administrative and selling expenses

Interest expense

Investment income

Foreign exchange loss

Profit before taxation

Taxes on income

Profit

(a) The entity did not recognize any components of other comprehensive income in the period ended 20X2

Hills Inc. Consolidated statement of financial position as at end of 20X2

Assets

Cash and cash equivalents

Accounts receivable

Inventory

Portfolio investments

Property, plant and equipment net

Total assets

30,650

(26,000)

4,650

(450)

(910)

(400)

500

(40)

Liabilities

Trade payables

Interest payable

Income taxes payable

Long-term debt

3,350

(300)

3,050 (a)

20X1

230

1,900

1,000

2,500

2,280

7,910

250

230

400

2,300

20X2

160

1,200

1,950

2,500

850

6,660

1,890

100

1,000

1,040

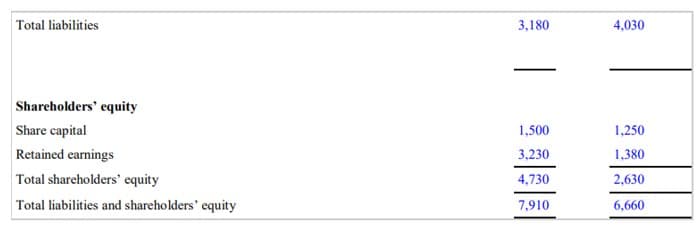

Transcribed Image Text:Total liabilities

Shareholders' equity

Share capital

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

3,180

1,500

3,230

4,730

7,910

4,030

1,250

1,380

2,630

6,660

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you