At the end of 2020, the interest over this three-year period at Andover Bank is $ 2211.68. (Enter your response rounded to the nearest penny.) At the end of 2020, the interest over this three-year period at Lowell Bank is $ 2250.43. (Enter your response rounded to the nearest penny.) At the end of 2020, you will have earned more on your Lowell Bank CD, because O A. the average rate of interest charged by Andover is less than the average rate of interest charged by Lowell. B. even a modest increase in the interest rate compounded over time will make the earnings higher. O C. it all depends on which bank has the higher interest rate in the beginning. OD. Lowell Bank uses compound interest calculation; Andover does not.

At the end of 2020, the interest over this three-year period at Andover Bank is $ 2211.68. (Enter your response rounded to the nearest penny.) At the end of 2020, the interest over this three-year period at Lowell Bank is $ 2250.43. (Enter your response rounded to the nearest penny.) At the end of 2020, you will have earned more on your Lowell Bank CD, because O A. the average rate of interest charged by Andover is less than the average rate of interest charged by Lowell. B. even a modest increase in the interest rate compounded over time will make the earnings higher. O C. it all depends on which bank has the higher interest rate in the beginning. OD. Lowell Bank uses compound interest calculation; Andover does not.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

7

Asap please....

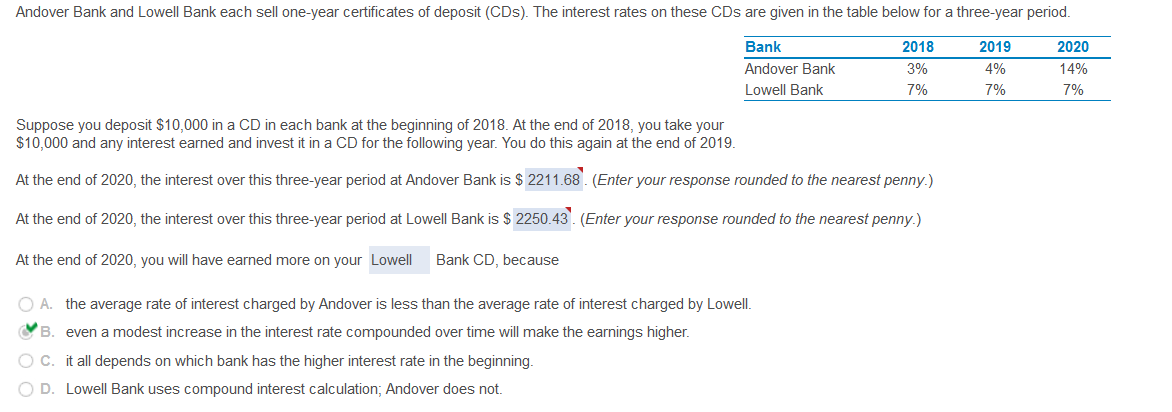

Transcribed Image Text:Andover Bank and Lowell Bank each sell one-year certificates of deposit (CDs). The interest rates on these CDs are given in the table below for a three-year period.

Bank

2018

2019

2020

3%

4%

14%

Andover Bank

Lowell Bank

7%

7%

7%

Suppose you deposit $10,000 in a CD in each bank at the beginning of 2018. At the end of 2018, you take your

$10,000 and any interest earned and invest it in a CD for the following year. You do this again at the end of 2019.

At the end of 2020, the interest over this three-year period at Andover Bank is $2211.68. (Enter your response rounded to the nearest penny.)

At the end of 2020, the interest over this three-year period at Lowell Bank is $ 2250.43. (Enter your response rounded to the nearest penny.)

Bank CD, because

At the end of 2020, you will have earned more on your Lowell

O A. the average rate of interest charged by Andover is less than the average rate of interest charged by Lowell.

B. even a modest increase in the interest rate compounded over time will make the earnings higher.

O C. it all depends on which bank has the higher interest rate in the beginning.

O D. Lowell Bank uses compound interest calculation; Andover does not.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning