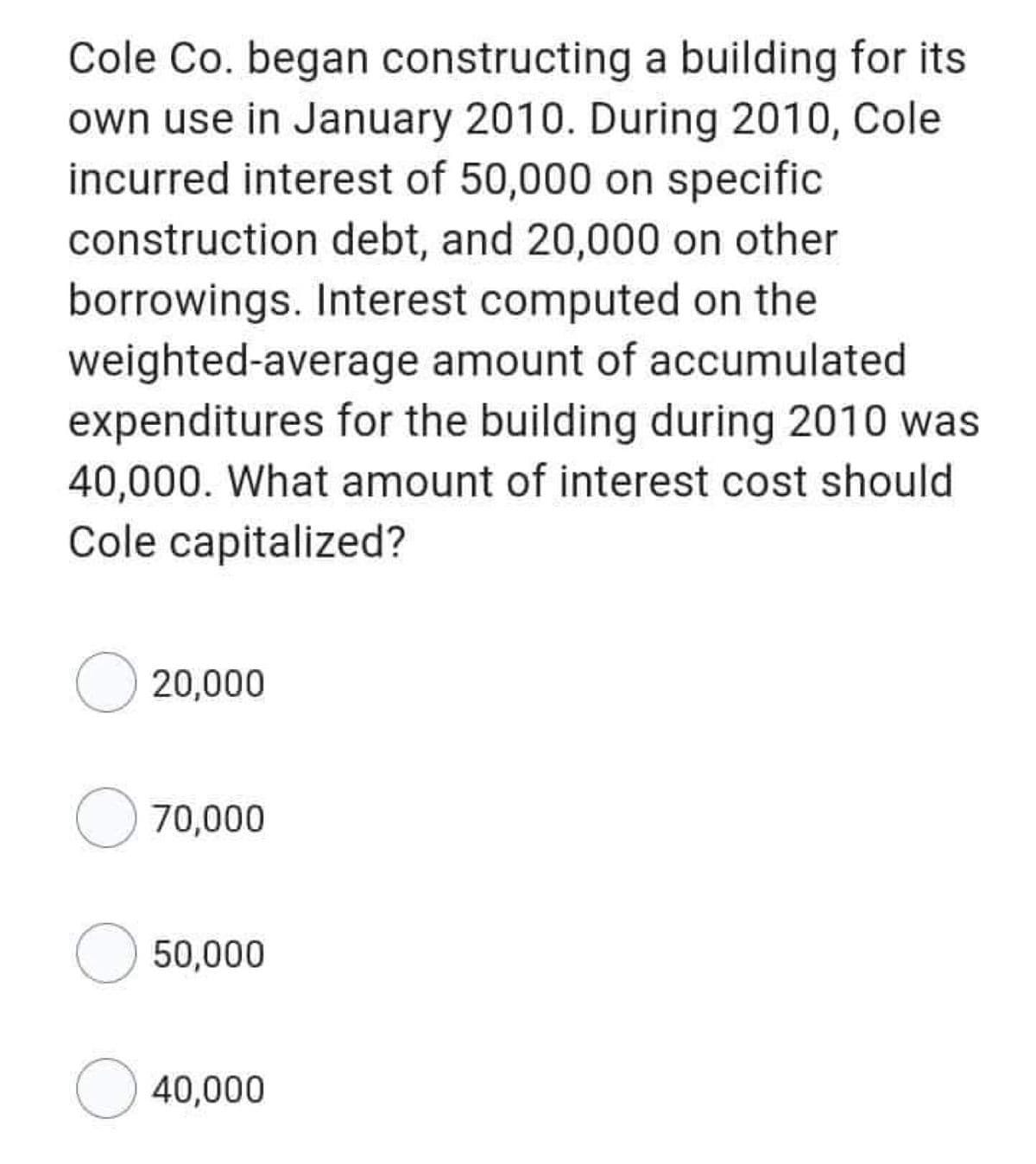

Cole Co. began constructing a building for its own use in January 2010. During 2010, Cole incurred interest of 50,000 on specific construction debt, and 20,000 on other borrowings. Interest computed on the weighted-average amount of accumulated expenditures for the building during 2010 was 40,000. What amount of interest cost should Cole capitalized? 20,000 O 70,000 50,000 40,000

Q: ppose the spot rate is A$1.77/GBP. An Audi can be purchased in Sydney, Australia, for A$30,00 in…

A: According to purchase power parity the price of goods in two countries must be in equilibrium with…

Q: Interest rate. A 2-year loan of $4650.25 cumulated $269.75 in simple interest. Calculate e interest…

A: Loan Amount = $4,650.25 Time Period = 2 Years Accumulated Simple Interest = $269.75

Q: 10. Antonio asks for a one-year loan at a bank when the one-year Treasury rate is 2%. a. If the loan…

A: When companies are unable to finance the requirement of business they take the help of loans. loans…

Q: 35. What is the amount of the annuity at the end of 10 years?

A: Future value of the Annuity: It is estimated by the product of the present stream of cash flows and…

Q: Calculate how much will Sonja have in a savings account 12 years if she deposits RM 3,000 now and RM…

A: Future value of amount includes the amount deposited and interest accumulated over the period of…

Q: The GBPUSD exchange rate was $1.4500 per pound on June 10, 2021. The GBPUSD exchange rate today is…

A: The foreign exchange rate is rate of one currency with respect to other currency and it will be also…

Q: 10. Mary Canfield purchased the All-Canadian Compound bond fund. While this fund doesn't charge a…

A: Total contingent sales load = amount × sales load percentage Amount = $11,800 Sales load percentage…

Q: different investment alternatives. Some of these options include: A ) Stock B ) Mutual Funds C)…

A: Stocks - stocks may provide huge upside potential of the investment but the return is not fixed and…

Q: You invest in bonds yielding an interest rate of 2.5 percent, utility stock yielding an interest…

A: Interest rate depends on the type of investment and risk involved in the investment type and money…

Q: 5-21. Determine the FW of the following engineering project when the MARR is 10% per year. Is the…

A: Future value of a present value is the value of that amount after taking into account the time value…

Q: Assume that the DPI of a 10-year fund at the end of its 4th year is 1.1x and that, by that time,…

A: A management fee plus a performance fee make up the 2 and 20 hedge fund compensation structure. A…

Q: The Balance Sheet for Consolidated Industrial shows the following balances: cash = $500,000; patents…

A: The balance sheet is prepared to know the financial position of the company of assets and…

Q: purchase price was $1,000. Also, assume that today comparable bonds are paying 7.0 percent. a) What…

A: Bond Price: The price of a bond can be estimated by discounting its future expected coupon payments…

Q: A laptop was purchased worth Php 90000. This is through an installment of 2 year and there is also…

A: Time value of money is used in the calculation of the monthly instalment to be paid, the future…

Q: Jackie Marte purchased tve $1000 corporate bonds issued by Starbucks The bonds pey 5.90 percente…

A: Interest per annum can be calculated as: = Face Value of the Bond * Coupon rate

Q: Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using…

A: As per the given information: Amount financed - $800 Number of payments - 18 APR - 17%

Q: Suppose you are currently spending $42.20 per month on streaming entertainment services such as…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Is stakeholder management critical?

A: Stakeholders are all such individuals who are having interest in the company or who will be affected…

Q: (Capital asset pricing model) Grace Corporation is considering the following investments. The…

A: The Capital Asset Pricing Model is used to determine the expected return of security. As per Capital…

Q: ORDINARY if the proble

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: It is expected that the beta of industries that are highly cyclical will be ________ and that of…

A: The beta of the stock reflect the risk associated with it and higher beta represents higher risk and…

Q: What would the price be today of a 10-year bond issued 7 years ago with 3 years of maturity left…

A: Bond valuation (BV) refers to a method or technique which is used to compute the current value or…

Q: 8. a. What is the annual interest amount for a $2,000 bond that pays 7.5 percent interests? b.…

A: Coupon rate : It is the rate of interest that the bond issuer has to pay on the face value of the…

Q: A Project has a cost of $65,000 and it's expected cash inflows are $12,000 per year for 9 years and…

A: MIRR- Formula to be used: MIRR = Terminal Cash inflowsPV of cash outflows1n-1 Data given: Cash…

Q: Starset, Incorporated, has a target debt-equity ratio of 0.76. Its WACC is 10.5 percent, and the tax…

A: Pretax cost of debt can be calculated through the WACC equation and debt-equity ratio. Here…

Q: 1. Barbarian Pizza is analyzing the prospect of purchasing an additional fire brick oven. The oven…

A: Data given: Cost of oven=$200,000 Salvage value=$120000 Useful life= 10 years Increase in annual…

Q: All of the following is true about a Stock dividend except, Select one: a. The stock price declines…

A: Stock dividend is a method of wealth distribution bybthe companies to its shareholders in the…

Q: X-person has committed to a payment that needs to pay BD 80,000 every year at the end of each next…

A: Future value of investment includes the amount being deposited and interest being accumulated over…

Q: 8. a. What is the annual interest amount for a $2,000 bond that pays 7.5 percent interests? b.…

A: Annual interest amount on bond With the par or face value of bonds (FV) and annual interest rate…

Q: You want to purchase a building to open your restaurant and you are given 3 different payment…

A: Present value of option would be the value of option that would decide which option would be better.…

Q: The following table shows information about return of stock and bond. Suppose that your Portfolio…

A:

Q: You deposit $50,000 into a fund that pays 5% per year compounded annually. You plan to make the…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Amalgamated Industries has Sales of 3,500, COGS of 1,500, and EBIT of 600. If Depreciation is 400,…

A: Here, Sales is 3,500 COGS is 1,500 EBIT is 600 Depreciation is 400 Interest Expense is 200 Taxes is…

Q: ow much money will you have 13 years from now?

A: Future Value: It is computed by the product of the present amount and the future value factor. It…

Q: yen would you n

A: Exchange of currency also called Forex exchange refers to the trading of one currency with…

Q: Chrissy is looking to buy a delivery fee. She is considering the following two credit Financing…

A: Monthly payments refer to the amount which is to be due and paid at a certain period of months for…

Q: LO4 The company intends to issue 20-year bonds with a face value of $1,000. The bonds carry a coupon…

A: Bonds are issued to raise long-term debt for the company. Bonds pay periodically interest to their…

Q: An fos of Un $1945 جد تو 13 Xpress camesa it hus expected l at the end of at

A: In the sinking fund we need to find out annual amount to be accumulated over the period of time and…

Q: If the current USDJPY exchange rate is 135.00 Japanese yen per U.S. dollar, the price of a Big Mac…

A: The law of one price is a concept which will advocate for uniform price across different nation for…

Q: nd yo What annual rate of return did you earn of your investment?

A: Annual Rate of Return: It represents the annual rate made on investment or charged annually on a…

Q: Blue Sun has total assets of $350, current assets of $225, and sales of $600. What is their Asset…

A: Asset turnover ratio is an efficiency ratio which will help in finding out the ability of company to…

Q: Project M requires an initial outlay at t = 0 of $66,607, its expected cash inflows are $12,000 per…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: Mr. Alex, a British arbitrageur, has the following data. The one-year interest rate offered in the…

A: Given: UK interest rate =8% Australia interest rate = 5% Spot rate = £0.3000/AUD Forward rate =…

Q: A European put option written on a non- dividend paying stock that is currently worth ₺100 in the…

A: Put call parity equation Put call parity relationship holds when the put option and call option are…

Q: installment loan at 18%. The final payment is to be made on $238.42 principal.what is the final…

A: A vehicle, home, or college degree can all be financed with an installment loan. After a lender…

Q: the benefits of merging and diversifying one's assets in or

A: Merging is making one asset out of two and diversifying is increasing investment in different types…

Q: It is January 2nd and senior management of Chester meets to determine their investment plan for the…

A: Face value is referred as the nominal value, which is referred as the coin value, stamp or fund that…

Q: Use a banker's year described above to answer this question. To complete the sale of a house, the…

A: Simple Interest: It is the interest charged on loan/savings account . Calculation: Daily interest is…

Q: Amalgamated Industries' financial statements show the following balances: Accounts Payable = 550;…

A: The term Working Capital means the amount of money required to run the business on daily basis. It…

Q: Calculate the NPV for each case for this project

A: Net Present Value: It represents the project's or investment's profitability in absolute dollars.…

Step by step

Solved in 2 steps

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year?

- LO.2, 3, 9 On June 5, 2018, Javier Sanchez purchased and placed in service a new 7-year class asset costing 560,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). During 2018, his business generated a net income of 945,780 before any 179 immediate expense election. a. Rather than using bonus depreciation, Javier would like to use 179 to expense 200,000 of this asset and then use regular MACRS to cost recover the remaining cost. Given this information, determine the cost recovery deductions that Javier can claim with respect to this asset in 2018 and 2019. b. Complete Javiers Form 4562 (page 1) for 2018. His Social Security number is 123-45-6789.At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.

- Assuming that the effects of interest capitalization are material, calculate the amount ofinterest costs to be capitalized by Matthew Corporation in 2014 in relation to the following events: On January 1, Matthew began construction for a new storage building for its own use. Expenditures incurred evenly throughout the year totaled $900,000. Matthew borrowed $1,000,000 specifically for construction of the storage building at an annual interest rate of 6%. What is the amount of interest that should be capitalized? a. $54,000b. $27,000c. $2,700d. $0 Inventories costing $200,000 were routinely manufactured during the year. Matthew borrowed $200,000 at 8% to finance inventory-related costs. What is the amount of interest that should be capitalized? a. $16,000b. $8,000c. $800d. $0 On September 1, Matthew began construction of a custom-designed machine to the specifications of a customer. As of December 31, $200,000 of materials, labor, and overhead have been assigned to the machine.…Cooper, Inc., is constructing a building that qualifies for interest capitalization. The following information is available: Capitalization period: January 1, 2013-December 31, 2014Expenditures on project (incurred evenly): 2013 $30,0002014 $50,000Amounts borrowed and outstanding (all debt incurred January 1, 2013) $10,000 at 10% (specifically for the construction project)$18,000 at 11% (general debt)$30,000 at 13% (general debt) Assume that in 2013 unused borrowed funds were invested and earned interest revenue amounting to $800. How much interest now should be capitalized to the asset account in 2013? a. $1,000b. $1,500c. $1,612.50d. $1,812.50Cooper, Inc., is constructing a building that qualifies for interest capitalization. The following information is available: Capitalization period: January 1, 2013-December 31, 2014Expenditures on project (incurred evenly): 2013 $30,0002014 $50,000Amounts borrowed and outstanding (all debt incurred January 1, 2013) $10,000 at 10% (specifically for the construction project)$18,000 at 11% (general debt)$30,000 at 13% (general debt) What is the amount of interest that should be capitalized in 2014?a. $6,400b. $6,600c. $6,710d. $6,910

- Cooper, Inc., is constructing a building that qualifies for interest capitalization. The following information is available: Capitalization period: January 1, 2013-December 31, 2014Expenditures on project (incurred evenly): 2013 $30,0002014 $50,000Amounts borrowed and outstanding (all debt incurred January 1, 2013) $10,000 at 10% (specifically for the construction project)$18,000 at 11% (general debt)$30,000 at 13% (general debt) What is the amount of interest that should be capitalized in 2013?a. $1,000b. $1,500c. $1,612.50d. $1,812.50 What is the amount of interest that should be capitalized in 2014?a. $6,400b. $6,600c. $6,710d. $6,910 Assume that in 2013 unused borrowed funds were invested and earned interest revenue amounting to $800. How much interest now should be capitalized to the asset account in 2013?a. $1,000b. $1,500c. $1,612.50d. $1,812.50WHITE started constructing a building to be used for producing its goods in January 2021, WHITE incurred interest of $100,000 from its borrowings to finance the construction. In 2021, the Company also earned interest income of $20,000 and dividend income of $30,000 from its temporary placement of the proceeds According to IAS23, how much borrowing cost should be capitalized by in 2021?Cole Co. began constructing a building for its own use in January 2016. During 2016, Cole incurred interest of $50,000 on specific construction debt, and $20,000 on other borrowings. Interest computed on the weighted-average amount of accumulated expenditures for the building during 2016 was $40,000. What amount of interest should Cole capitalize? a. $20,000 b. $40,000 c. $50,000 d. $70,000