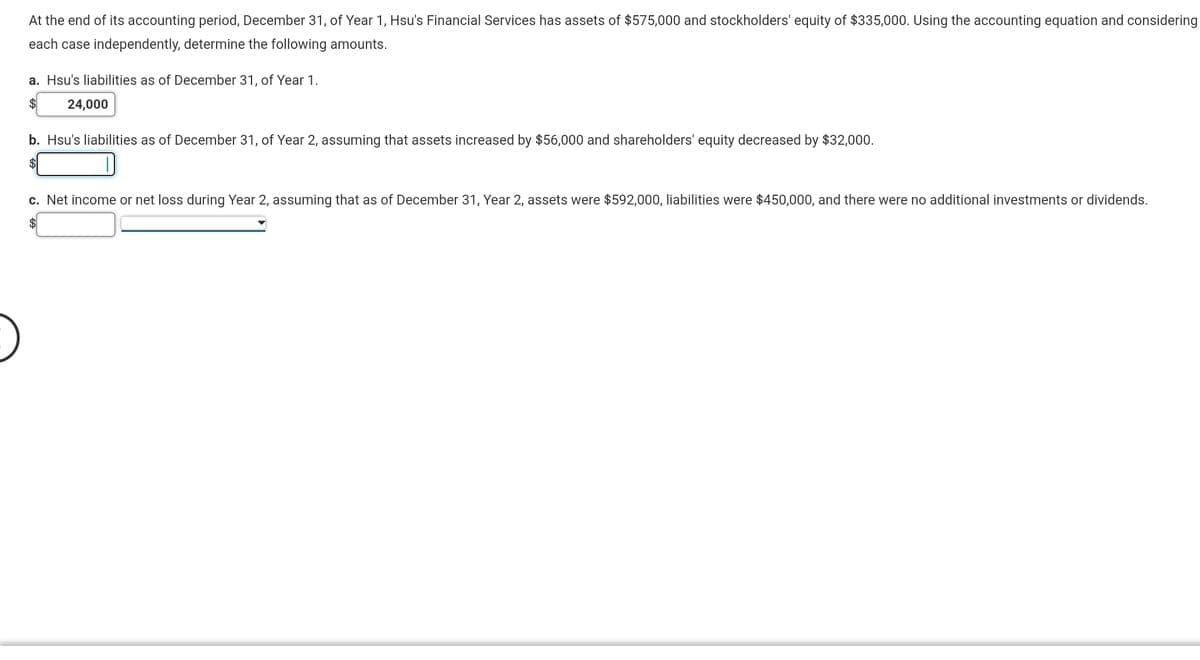

At the end of its accounting period, December 31, of Year 1, Hsu's Financial Services has assets of $575,000 and stockholders' equity of $335,000. Using the accounting equation and considering each case independently, determine the following amounts. a. Hsu's liabilities as of December 31, of Year 1. 24,000 b. Hsu's liabilities as of December 31, of Year 2, assuming that assets increased by $56,000 and shareholders' equity decreased by $32,000. c. Net income or net loss during Year 2, assuming that as of December 31, Year 2, assets were $592,000, liabilities were $450,000, and there were no additional investments or dividends.

At the end of its accounting period, December 31, of Year 1, Hsu's Financial Services has assets of $575,000 and stockholders' equity of $335,000. Using the accounting equation and considering each case independently, determine the following amounts. a. Hsu's liabilities as of December 31, of Year 1. 24,000 b. Hsu's liabilities as of December 31, of Year 2, assuming that assets increased by $56,000 and shareholders' equity decreased by $32,000. c. Net income or net loss during Year 2, assuming that as of December 31, Year 2, assets were $592,000, liabilities were $450,000, and there were no additional investments or dividends.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.4E: The Accounting Equation Ginger Enterprises began the year with total assets of $500,000 and total...

Related questions

Question

file

Transcribed Image Text:At the end of its accounting period, December 31, of Year 1, Hsu's Financial Services has assets of $575,000 and stockholders' equity of $335,000. Using the accounting equation and considering

each case independently, determine the following amounts.

a. Hsu's liabilities as of December 31, of Year 1.

$

24,000

b. Hsu's liabilities as of December 31, of Year 2, assuming that assets increased by $56,000 and shareholders' equity decreased by $32,000.

$1

c. Net income or net loss during Year 2, assuming that as of December 31, Year 2, assets were $592,000, liabilities were $450,000, and there were no additional investments or dividends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning