Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: (1) earned cash revenues of $30,700, (2) paid cash expenses of $13,900, and (3) paid a $2,200 cash dividend to its stockholders. These were the only events that affected the company during Year 1. Required a. Record the effects of each accounting event under the appropriate general ledger account headings. b. Prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31, Year 1, for Mijka Company.

Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: (1) earned cash revenues of $30,700, (2) paid cash expenses of $13,900, and (3) paid a $2,200 cash dividend to its stockholders. These were the only events that affected the company during Year 1. Required a. Record the effects of each accounting event under the appropriate general ledger account headings. b. Prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31, Year 1, for Mijka Company.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.11AMCP: Entries Prepared from a Trial Balance and Proof of the Cash Balance Russell Company was incorporated...

Related questions

Topic Video

Question

Transcribed Image Text:Homework

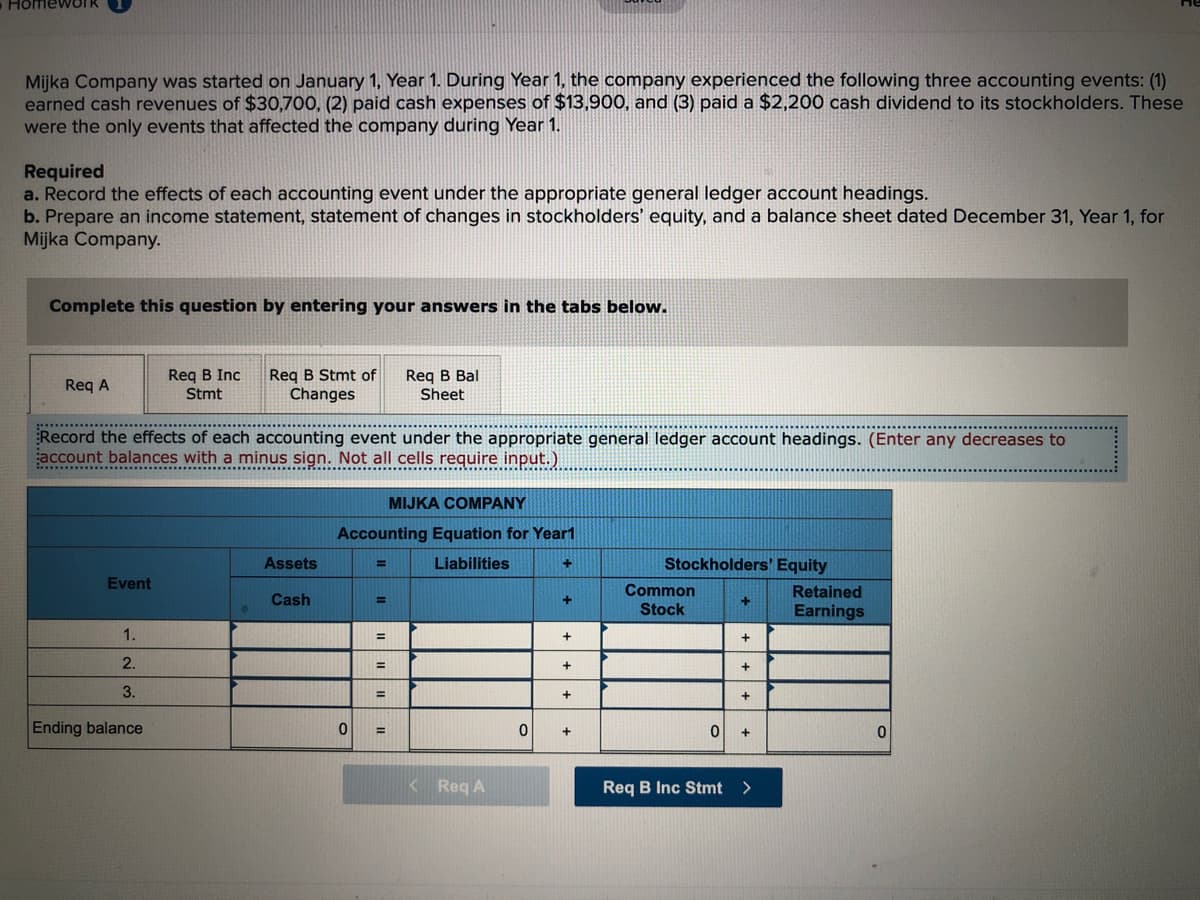

Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: (1)

earned cash revenues of $30,700, (2) paid cash expenses of $13,900, and (3) paid a $2,200 cash dividend to its stockholders. These

were the only events that affected the company during Year 1.

Required

a. Record the effects of each accounting event under the appropriate general ledger account headings.

b. Prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31, Year 1, for

Mijka Company.

Complete this question by entering your answers in the tabs below.

Req B Stmt of

Changes

Reg B Inc

Req A

Req B Bal

Sheet

Stmt

Record the effects of each accounting event under the appropriate general ledger account headings. (Enter any decreases to

account balances with a minus sign. Not all cells require input.)

. .. ... ............r...............u*

MIJKA COMPANY

Accounting Equation for Year1

Assets

Liabilities

Stockholders' Equity

%3D

Event

Common

Retained

Cash

Stock

Earnings

1.

%3D

+

2.

%3D

3.

%3D

Ending balance

%3D

KReq A

Req B Inc Stmt >

Transcribed Image Text:HomeworK

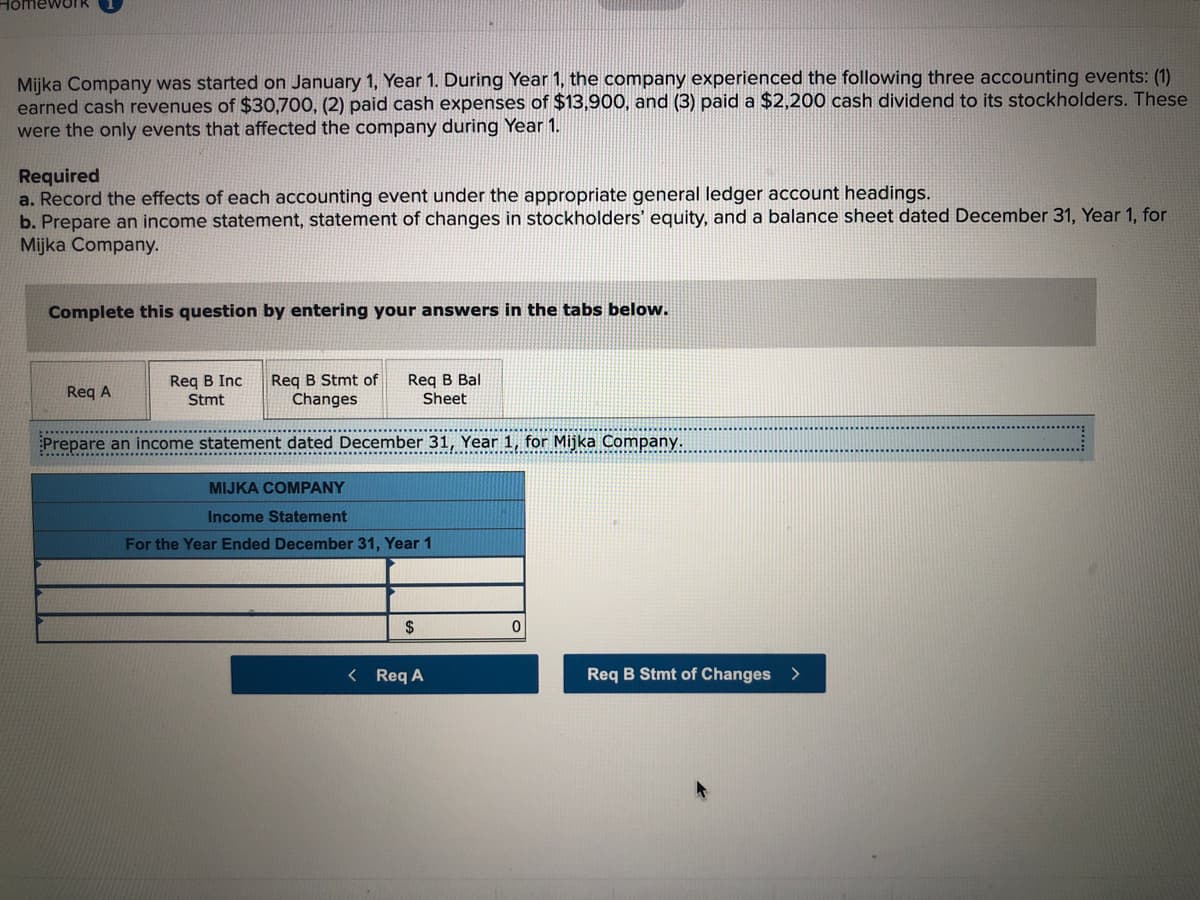

Mijka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: (1)

earned cash revenues of $30,700, (2) paid cash expenses of $13,900, and (3) paid a $2,200 cash dividend to its stockholders. These

were the only events that affected the company during Year 1.

Required

a. Record the effects of each accounting event under the appropriate general ledger account headings.

b. Prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31, Year 1, for

Mijka Company.

Complete this question by entering your answers in the tabs below.

Req B Inc

Stmt

Reg B Stmt of

Changes

Req B Bal

Sheet

Req A

Prepare an income statement dated December 31, Year 1, for Mijka Company.

MIJKA COMPANY

Income Statement

For the Year Ended December 31, Year 1

$

< Req A

Req B Stmt of Changes >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning