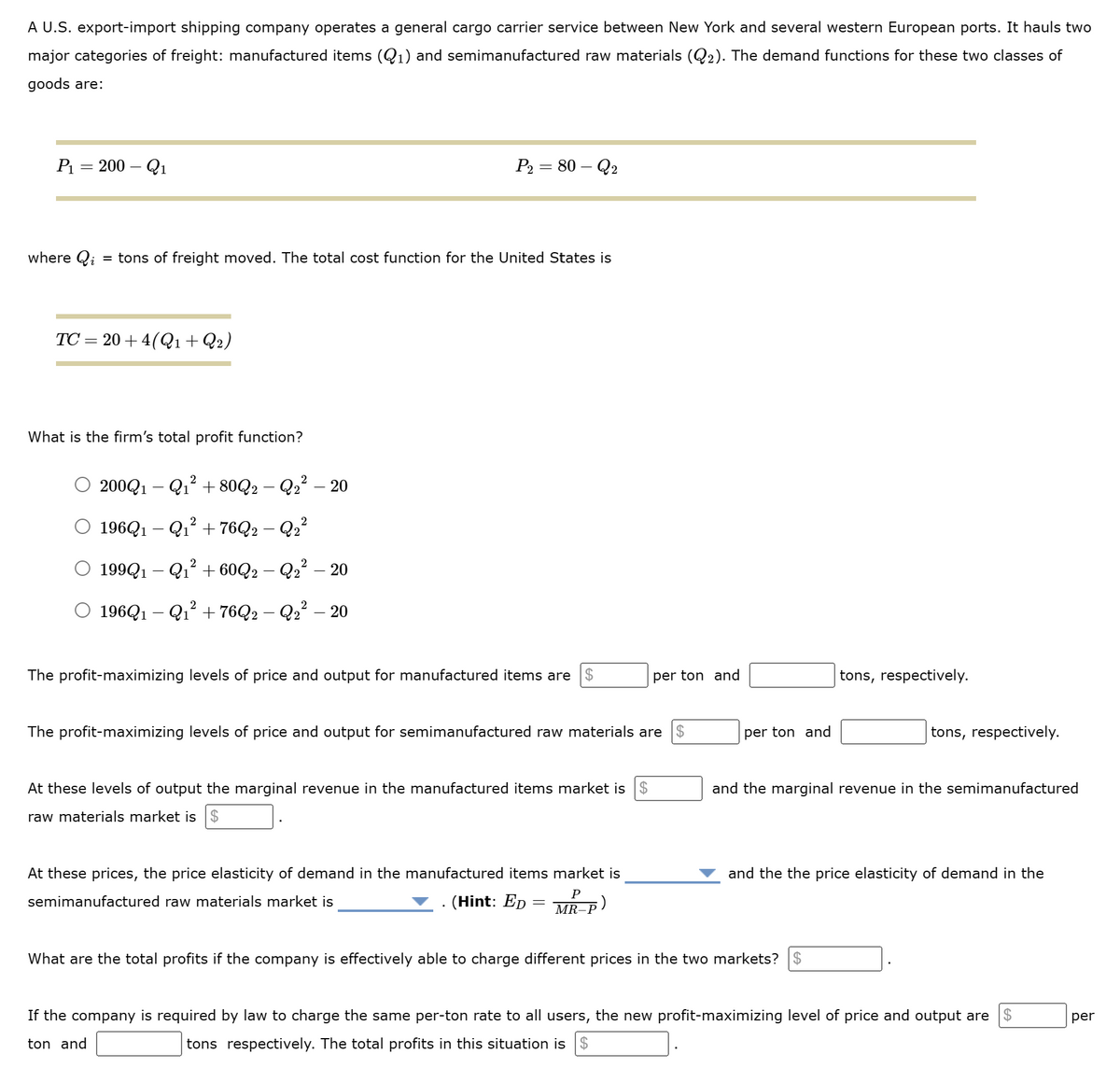

A U.S. export-import shipping company operates a general cargo carrier service between New York and several western European ports. It hauls two major categories of freight: manufactured items (Q₁) and semimanufactured raw materials (Q₂). The demand functions for these two classes of goods are: P₁ = 200-Q₁ where Q₁ = tons of freight moved. The total cost function for the United States is TC=20+4(Q1 + Q2) What is the firm's total profit function? O 200Q1-Q₁² +80Q2-₂²-20 O 196Q1-Q₁²+76Q2 − Q2² O O 196Q1-Q₁² +76Q2-Q₂² - 20 P2= 80-Q2 199Q1-Q₁²+60Q2-Q₂²-20 The profit-maximizing levels of price and output for manufactured items are The profit-maximizing levels of price and output for semimanufactured raw materials are $ At these levels of output the marginal revenue in the manufactured items market is raw materials market is per ton and At these prices, the price elasticity of demand in the manufactured items market is semimanufactured raw materials market is (Hint: Ep = MR-p) per ton and tons, respectively. tons, respectively. and the marginal revenue in the semimanufactured What are the total profits if the company is effectively able to charge different prices in the two markets? $ and the the price elasticity of demand in the If the company is required by law to charge the same per-ton rate to all users, the new profit-maximizing level of price and output are ton and tons respectively. The total profits in this situation is $ per

A U.S. export-import shipping company operates a general cargo carrier service between New York and several western European ports. It hauls two major categories of freight: manufactured items (Q₁) and semimanufactured raw materials (Q₂). The demand functions for these two classes of goods are: P₁ = 200-Q₁ where Q₁ = tons of freight moved. The total cost function for the United States is TC=20+4(Q1 + Q2) What is the firm's total profit function? O 200Q1-Q₁² +80Q2-₂²-20 O 196Q1-Q₁²+76Q2 − Q2² O O 196Q1-Q₁² +76Q2-Q₂² - 20 P2= 80-Q2 199Q1-Q₁²+60Q2-Q₂²-20 The profit-maximizing levels of price and output for manufactured items are The profit-maximizing levels of price and output for semimanufactured raw materials are $ At these levels of output the marginal revenue in the manufactured items market is raw materials market is per ton and At these prices, the price elasticity of demand in the manufactured items market is semimanufactured raw materials market is (Hint: Ep = MR-p) per ton and tons, respectively. tons, respectively. and the marginal revenue in the semimanufactured What are the total profits if the company is effectively able to charge different prices in the two markets? $ and the the price elasticity of demand in the If the company is required by law to charge the same per-ton rate to all users, the new profit-maximizing level of price and output are ton and tons respectively. The total profits in this situation is $ per

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter14: Pricing Techniques And Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:A U.S. export-import shipping company operates a general cargo carrier service between New York and several western European ports. It hauls two

major categories of freight: manufactured items (Q₁) and semimanufactured raw materials (Q₂). The demand functions for these two classes of

goods are:

P₁

=

200 - Q₁

where Qi = tons of freight moved. The total cost function for the United States is

TC=20+4(Q1 + Q2)

What is the firm's total profit function?

200Q1-Q₁² +80Q2 − Q2² - 20

○ 196Q1 − Q₁² + 76Q2 − Q2²

2

P₂ = 80 - Q2

199Q1-Q₁² +60Q2 - Q₂² - 20

O 196Q1-Q₁² + 76Q2 - Q₂² - 20

The profit-maximizing levels of price and output for manufactured items are $

The profit-maximizing levels of price and output for semimanufactured raw materials are

$

At these levels of output the marginal revenue in the manufactured items market is $

raw materials market is $

per ton and

At these prices, the price elasticity of demand in the manufactured items market is

semimanufactured raw materials market is

(Hint: Ep

;)

P

MR-

per ton and

tons, respectively.

tons, respectively.

and the marginal revenue in the semimanufactured

What are the total profits if the company is effectively able to charge different prices in the two markets? $

and the the price elasticity of demand in the

$

If the company is required by law to charge the same per-ton rate to all users, the new profit-maximizing level of price and output are

ton and

tons respectively. The total profits in this situation is $

per

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

At these levels of output the marginal revenue in the manufactured items market is

and the marginal revenue in the semimanufactured raw materials market is

.

At these prices, the price elasticity of demand in the manufactured items market is and the the price elasticity of demand in the semimanufactured raw materials market is . (Hint: ED=PMR−P��=�MR−�)

What are the total profits if the company is effectively able to charge different prices in the two markets?

.

If the company is required by law to charge the same per-ton rate to all users, the new profit-maximizing level of price and output are

per ton and

tons respectively. The total profits in this situation is

.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning