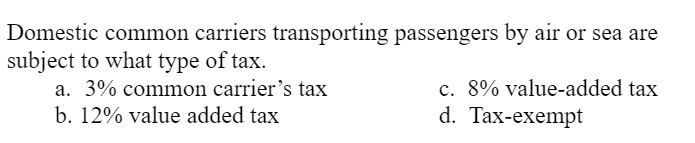

at type of tax. ommon carrier's tax value added tax

Q: Define Effective tax rate.

A: Tax: Tax refers to a compulsory payment or a contribution to the state revenue, levied by the…

Q: Compute the tax due assuming

A: Tax due is the amount which has to be paid to the government and the same has been computed on the…

Q: Explain how does the company’s effective tax rate calculated.

A: Effective interest rate: An effective interest rate is the real return on savings account or any…

Q: What are the two types of income tax return

A: Answer: Income tax return is the return that is filed for purpose to file income tax due to be paid…

Q: After-tax Income (Tax Deduction) After-tax Income (Tax Credit)

A: A single taxpayer is a person who is unmarried and filling his income tax. the pre-tax income means…

Q: What is Income tax payable?

A:

Q: Define Income tax paid

A: Income tax paid is a charge or payment made to the government by the individual or the firms in a…

Q: What effect does intraperiod tax allocation have onreported net income?

A:

Q: flat tax income tax property tax

A: A progressive tax is one in which the average tax burden grows in proportion to income.…

Q: Requirements: Discuss final income tax using the names and amounts given.

A: Final income tax is the amount of tax which is charged on the income such as interest income which…

Q: tax

A:

Q: What is the name of the amount of money that can bededucted directly from the computed tax, instead…

A: Tax or Taxes: Tax is an amount paid by the persons (individuals and business entities) to a…

Q: Which is a deductible tax expense? Surcharges and penalties

A: Deductible tax expenses In a business entity the deductible tax expenses which includes any ordinary…

Q: Explain intraperiod tax allocation.

A: Income tax allocation is an integral part of generally accepted accounting principles. Income tax…

Q: What are the different type of income tax?

A: The answer for the question on the different types of income tax is discussed hereunder : Taxes are…

Q: Explain the difference between direct and indirect tax

A: Introduction: Tax refers to an individual's simple duty to contribute their resources. It is imposed…

Q: Explain Pre-tax earnings or pre-tax income

A: The net income is the net profit of the company earned during the period. The net income includes…

Q: How are deferred tax assets and deferred tax liabilities reported on the statement of financial…

A: Deferred tax accounts has to be reported on the balance sheet of a business. It must be classified…

Q: HOW filing status affect the preparation income tax return

A: Tax return :- A tax return is a form or series of forms submitted to the Internal Revenue Service…

Q: What is the difference between a progressive tax, a proportional tax, and a regressive tax?

A: Tax is an important concept in the area of finance. The United states has three types of taxes…

Q: hen different types of income are subjected to common tax rate, the tax system is described as…

A: Answer: Tax system is the concept or foundation basis which any tax rates are introduced.

Q: Differentiate “normal tax “ from “final tax”.

A: Tax is the amount which is paid by the tax payer on the basis of the income earned by him during a…

Q: How to calculate Value-added tax

A: Value added tax is a type of tax that is charged by the central government on the sale of…

Q: What is a tax return? brief explain

A: Tax return in a form designed by designated tax authorities which helps taxpayers to disclose their…

Q: Calculate the net income after tax

A: Net profit is also called the profit available to the shareholders or Profit available after meeting…

Q: What is a deferred tax asset?

A: Deferred tax asset: When the Income Tax Expense account is more than the Income Tax Payable account,…

Q: What is the Net Income After Tax?

A:

Q: final tax and income tax

A: Tax is a form of compulsory payment made to the government of the country. The amount that is…

Q: deferred tax asset and a deferred tax liability

A: Deferred tax asset refers to the items that were shown as a result of extra payment of taxes.…

Q: What is the total tax expense?

A: Income Before tax is Given. Tax rate will be applied to the Income before tax

Q: The tax that takes into account the status of the taxpayer

A: Status of the taxpayer means the classification of the taxpayers into groups based on age, structure…

Q: What is a deferred tax liability?

A: Deferred tax liability arises due to the difference in the amount of accounting income and taxable…

Q: What is personal income tax and it's use?

A: Income tax is a type of tax that governments impose on income generated by businesses and…

Q: Determine the tax payable or overpayment if:

A: Tax is the expense over the individual or the earning body to pay the portion of their income to the…

Q: Proportional Tax- Progressive Tax- Regressive Tax- Estate Tax- Gift Tax-

A: Tax is the amount which is paid by every type of person to the government and which is used by the…

Q: What is the effect of deferred tax asset and deferred tax liability on the current year’s income tax…

A: Deferred tax assets and deferred tax liability arises because of the timing differences of the…

Q: Define Deferred Tax Liabilities.

A: Definition: Income tax expense: The expenses which are related to the taxable income of the…

Q: current tax and deferred tax.

A: First option is wrong because deferred tax expense does not include current tax. Third option is…

Q: What is the burden of the tax? Explain the key factors that determine the incidence of the tax.

A:

Q: List expenses that will be deductible for normal or income tax purpose

A: The above question mainly deals with expenses that will be deductible…

Q: How are deferred tax assets and deferred tax liabilities classified and reported in the financial…

A: Deferred tax asset is the balance sheet item, which results from the advance or overpayment payment…

Q: what are the differences between the following components of taxable income o…

A: Difference between the Deductions for AGI and Deductions from AGI: Deductions for AGI are also…

Q: Explain Residence and domicile for tax purposes

A: Tax is the liability that has to be paid by the individual and the corporation to the federal…

Q: Explain what the benifit is to having tax classified under statutory income. Aside from capital…

A: Taxable income is the amount of income computed to measure the amount of taxes to be paid to the…

Q: between refundable tax credits and non-refundable tax credits and which is more valuable

A: The amount of money that is allowed to be reduced from overall tax liability of taxpayer is known as…

[item #4]

Step by step

Solved in 2 steps

- ABC corporation provided the following data for calendar year ending December 31, 2021 ($1 = P50). Use new tax rate under CREATE Law (RA 11534) Philippines: Gross Income - P4,000,000 Deductions - P2,500,000 Abroad: Gross income - $40,000 Deductions - $15,000 Income tax paid - $3,000 j. if it is a non-resident lessor of aircraft, machineries and equipment, compute for its income tax.XYZ corporation provided the following data for calendar year ending December 31, 2021 ($ 1= P50). Use new tax rate under CREATE Law (RA 11534) Philippines Abroad Gross income P4, 000, 000 $ 40, 000 Deductions 2, 500, 000 $ 15, 000 Income Tax Paid $ 3, 000 REQUIRED: Compute for the below: a. If it is a domestic corporation, compute for its income tax after tax credit. b. If it is a resident corporation, compute for its income tax. c. If it is a non-resident corporation, compute for its income tax. d. If it opts to claim the tax paid abroad as deduction from gross income, compute for its income tax.A VAT-taxpayer made the following sales during the year:Domestic Sales P100,000Export Sales P120,0001. What is the amount subject to business tax?2. Compute the Output VAT.

- The income tax T owed in a certain state is a function of the taxable income I, both measured in dollars. The formula is given below. T = 0.13I − 300 a) Express using functional notation the tax owed on a taxable income of $12,000. T (_______) Calculate the tax owed on a taxable income of $12,000. $ (_______) b) If your taxable income increases from $12,000 to $15,000, by how much does your tax increase? $(_______) (c) If your taxable income increases from $15,000 to $18,000, by how much does your tax increase? $(_______)A domestic transportation contractor by land is engaged in the transport of passengers, goods and cargoes. If the transportation contractor is vat-registered , what business taxes is he liable? Group of answer choices 3% tax on VAT-exempt persons on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipts from transport of passengers. 12% value-added tax; 12% VAT on gross receipts· from transport of goods and cargoes and 3% common carrier's tax on gross receipt from transport of passengers. 3% common carrier's tax;Source of income Taxable income before any foreign income foreign tax credit tax paidPhilippine 480,000 -Hongkong 192,000 45,000China 96,000 30,000total 768,000 75,000Compute for the income tax due if ABC opted to claim the foreign tax credit as a deduction.

- ABC corporation provided the following data for calendar year ending December 31, 2021 ($ 1= P50). Use new tax rate under CREATE Law (RA 11534) Philippines Abroad Gross income P4, 000, 000 $ 40, 000 Deductions 2, 500, 000 $ 15, 000 Income Tax Paid $ 3, 000 REQUIRED: Compute for the below: A. If it opts to claim the tax paid abroad as deduction from gross income, Compute for its income tax. B. If it is private educational institution, Compute for its income tax due after tax credit. C. If it is a non-profit hospital, Compute for its income tax credit.A domestic transportation contractor by land is engaged in the transport of passengers, goods and cargoes. If the transportation contractor is not vat registered, what business taxes is he liable? Group of answer choices 12% VAT' on gross receipts from transport of goods on cargoes and 3% common carrier's tax on gross receipts from transport of passengers. 12% value-added tax. 3% tax on VAT-exempt persons on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipts from transport of passengers. 3% common carrier's tax.Company sold to Y Company goods worth 10,000.00, exclusive of any applicable tax. If X Company is a VAT registered taxpayer and Y Company is a non-VAT registered taxpayer, the journal entry of Y Company would include debit Purchases, 11,200.00credit Cash, 10,000.00debIt Purchases, 10,000.00credit VAT payable, 1,200.00

- The government of Lesotho charges 10% on income up to M75 000 plus 16% any amount over M70 000 up M300 000 and 26% of any amount over M300 000. Express the above as a tax function. Find the income tax for an income of M125 000. Compute the income tax of an income of M350 000.ABC corporation provided the following data for calendar year ending December 31, 2021 ($ 1= P50). Use new tax rate under CREATE Law (RA 11534) Philippines Abroad Gross income P4, 000, 000 $ 40, 000 Deductions 2, 500, 000 $ 15, 000 Income Tax Paid $ 3, 000 REQUIRED: Compute for the below: If it is a resident international carrier, Compute for its income tax. If it is a non-resident cinematographic film owner/lessor, Compute for its income tax. If it is a non-resident lessor of vessels, Compute for its income tax.According to Progressive tax system in a country an individual are exempted for the first OMR 30,000 taxable income. Higher income bracket from 30,0001 to 75,000 taxable income on which tax rate is 15%. Additional income tax bracket over and above OMR 75,000 taxable income on which tax rate is 20%. Assuming that taxable income of an individual is OMR 90,000. What will be the tax liability of an individual? a. OMR 14,250 b. Exempted c. OMR 9,750 d. OMR 6,750