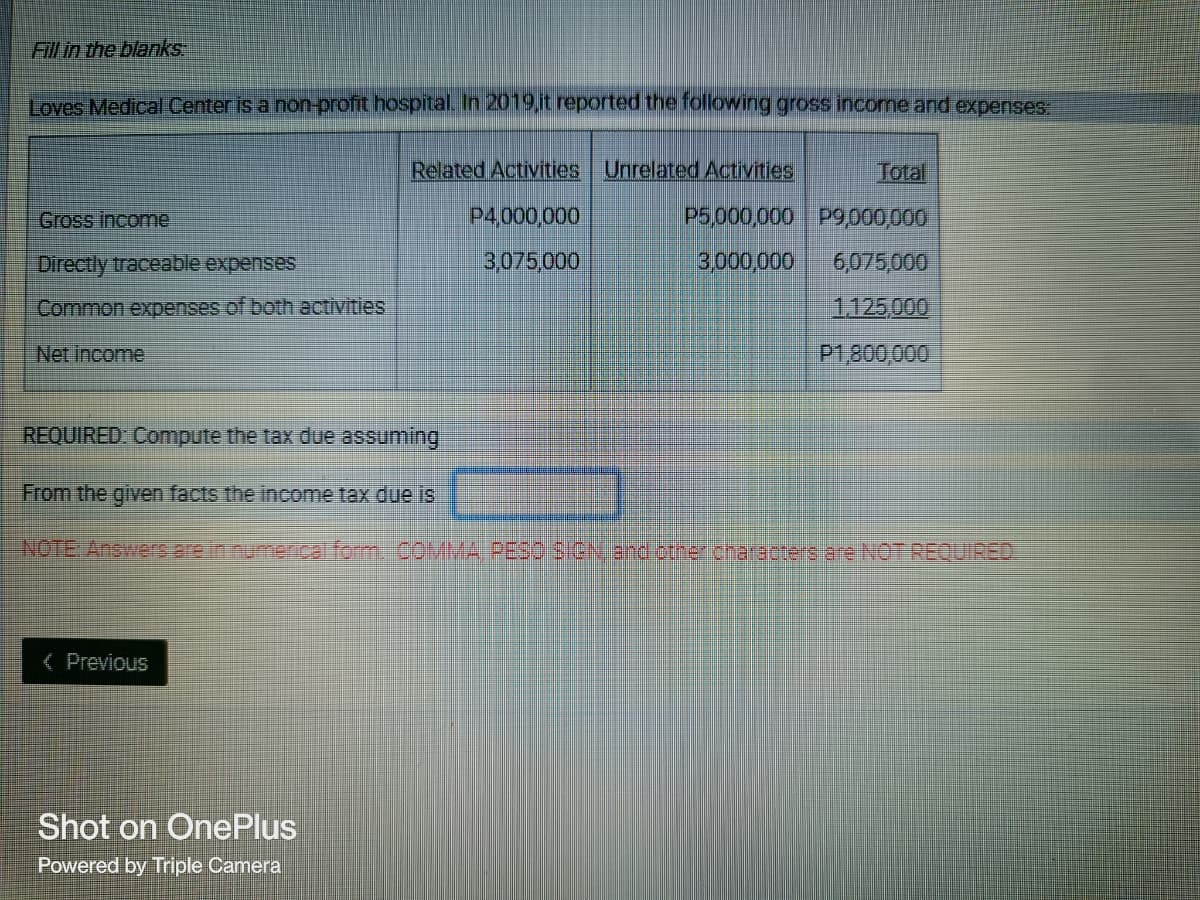

Compute the tax due assuming

Q: Discuss the concept of professional skepticism and its importance in audit.

A: Professional skepticism is defined as a questioning mindset, being aware of events that may signal a…

Q: Fill in the blanks La Pagayo Corporation commenced business operations in calendar year 2001. It is…

A: For the year 2006, Normal Corporate Income Tax {NCIT} = 130,000 Minimum Corporate Income Tax {MCIT}…

Q: The key difference between a forward and a futures contract is: A forward contract is bought and…

A: Here discuss about the details of forward contract and future contract which are related with the…

Q: ABC Co. purchased goods with invoice price of P1,000 on account on Dec. 27, 2019. The related…

A: Under FOB shipping point, freight collect, the buyer is responsible to pay all the freight charges.

Q: how the requisite journal entries to correct the balance.

A: Here to made the correction entry to clear the suspense account which was incurred shortage due to…

Q: Define the following terms: ‘stakeholder’; ‘shareholder’ and ‘stakeholder analysis’. Using a named…

A: stakeholder: any individual or organization, which affects a company or gets affected by a company,…

Q: Choose the correct statement below: A. Contingent liability is both probable and measurable. B. An…

A: The answer for the multiple choice question on choosing the correct statement and relevant…

Q: 3

A: A lawsuit is a legal action filed in a court to obtain remedy from or redress for alleged harm.…

Q: Sae Hood Factory, Inc pays its workers on the following basis daily: 20 pieces of less P0.50 each;…

A: Working note : 1 Computation of pay per piece No of pieces Gross pay per piece (on daily basis)…

Q: John Corporation manufactures laser printers. John currently manufactures the 32,000 imaging drums…

A: There is a mistake in above question manufacturing cost per unit is P 88( 23+65). P 88*32000= P…

Q: account receivable, Enter the The following transactions appeared in the books of Sencam Traders for…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: ing to Costs and expenses for the year were as follows: Particulars Cost of revenue Selling,…

A: Formula: Contribution = Revenue - Variable Cost Break Even Point = Fixed Cost / Contribution per…

Q: What is accounting?

A: Accounting : Accounting is the process of recording,analyzing, measuring and summarizing…

Q: On January 1, 2022, Balagtas Corp. issued 5-year bonds with face amount of P5,000,000 at 118.0. The…

A: >Bonds Payable are the source of finance for the companies. >The bondholders are…

Q: Required: A. Prepare a schedule of cash collections for July, August, and September B. Prepare a…

A: Depreciation is a non-cash expenses, so need to record the item in cash budget.

Q: prepare manufacturing acc

A: The requirement is to prepare the manufacturing account for James ltd. The manufacturing account…

Q: Calculate the depreciation expense in the year of 2014 by using Straight line method Asif Company…

A: Introduction: Depreciation: Depreciation is an expense to be shown in Income statement. Decreasing…

Q: abor cost $ 7 Unit-level overhead $ 6 Batch-level set-up cost (4,000 units per batch) $ 30,000…

A: To calculate whether the cost of making the parts is higher than purchasing , relevant making cost…

Q: Using the direct method, the amount of Janitorial Department cost allocated to Sales Department no.…

A: Cost allocation refers to the process which is used by the company to allocate the cost of product…

Q: a. How much is the depletion charge in 2022? b. Assuming that of the 300,000 ounces of gold…

A: Depletion refers to the reducing in the value of natural resources of the earth from extraction of…

Q: Jerry Ltd. Processes a patent material used in building the material is produced in three…

A: Process I Account Particulars Units tons Amount ($) Particulars Units tons Amount ($) Raw…

Q: 8. In the Philippines, If an employee is to render overtime on a regular day, how much would be the…

A: Lets understand the basics. As per labor rule in Philippines, there are different rates to pay if…

Q: equest a

A: Manufacturing overhead rates refer to the regulated factory expenses designated for each unit of…

Q: Brianna Whitman works for Schaum, Whitney, & Matte, LLP, in Washington, D.C., which pays employees…

A: Introduction:- Calculation of basic needs as follows under:- According to IRS it is statutory…

Q: 33. Q sells to wholesalers on terms of 2/15, 3/30. An analysis of Q’s trade receivable balances at…

A: Net realizable value of accounts receivable=Collectible amount-Cash discount

Q: Given the future cash flows (from cost savings) of an equipment for the next three years, use a…

A: 1. Profitability Index - It is the ratio that measures the return on investment made in the years by…

Q: ng is the retained earnings account for the year 2022 for Acadian Corp. ed earnings, January 1, 2022…

A: Statement of Retained earning is an essential part of the financial statement of the companies that…

Q: Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y5. The accounting cycle…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Show in tabular form (depreciation schedule) the computation for the depreciation expenses,…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: A fire on 28th Feb destroyed some of a company’s inventory and its inventory records. The following…

A: Inventory is the value of goods manufactured, purchased or traded by the company.

Q: an excerpt from trial balance of ABC company shows the following: accounts receivable 1,000,000…

A: A bad debt appears to be a cost incurred by a company when the repayment of previously issued credit…

Q: At 1 July 2019, the fair value of the non-controlling interest was $39 000 and SydMel Ltd adopts the…

A:

Q: 11. Inflation - how can inflation affect the real estate market? In what different ways?

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Q. No. 1. From the following information of Albert Company as on 31t December 2018: Noncurrent asset…

A: The statement of financial condition is another name for the balance sheet. As of the report date,…

Q: Sheridan Hardware payroll for November 2020 is summarized below. Payroll Wages Due FICA State…

A:

Q: Percision Electric Vehicles creates two sales teams to increase the sales of their vehicles. Each…

A: The strategy given in the question will help as follows: 1. By creating two team, there will be…

Q: List the three key benefits companies get from preparing a budget. The budget allows managers to be…

A: An estimate of income and expenditure for a set period of time is called budget.

Q: Hi the volume variance portion is missing

A: A volume variance is the difference between the actual quantity sold or consumed and the budgeted…

Q: On January 1, 20x1, ABC sold a used vehicle with a historical cost of P2,000,0000 and accumulated…

A: Carrying value of Vehicle sold: Historical cost = p2,000,000 Accumulated depreciation = p700,000…

Q: Jain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual…

A: Introduction: Journals: Recording of a business transactions in a chronological order. Each and…

Q: asic- 50% Hra- 20% Da - 12

A: Salary slip which is also known and called as pay slip. It is the slip in which all the incomes and…

Q: ABC Company reported net income of P4,360,000 for the current year. The net income included…

A: The cash flow from investing activities includes the cash flow from sale purchase of investment,…

Q: Princeton's detailed age analysis of trade receivables at 31 December 2020 shows the following:…

A: Trade receivables are those receivables which the company have which has not been received by the…

Q: m Job 117 was completed, direct materials totaled $9,518; direct labor, $14,467; and factory…

A: The cost per unit is derived from the variable costs and fixed costs incurred by a production…

Q: Muspest Supplies is currently evaluating the cost of manufacturing some of the components utilised…

A: Relevant cost is the cost which is relevant in decision making. Total number of parts per month…

Q: DECEMBER 31, 20, ACCORDING TO THE TRIAL BALANCE, THE OFFICE SUPPLIES ACCOUNT HAS A BALANCE OF…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: ols to determinate appropriate business decisions under different economic, political and legal…

A: If a firm wants to succeed in the marketplace, it must have a thorough understanding of the factors…

Q: Explain the use of spreadsheet software in business and apply this to the work of a financial…

A: Introduction:- Spreadsheet software is a software application. It is most suitable for organizing,…

Q: ! Required information [The following information applies to the questions displayed below.]…

A: As per IRS the short term loan invested in municipal bonds is not allowed as deduction.

Q: For taxable year 2018, the company's sixth year of operations, the records of Mega Specialties, a…

A: Lets understand the basics. For solving this question, we are require to use below formula. Net…

Step by step

Solved in 2 steps

- Integrity Reconstructive is a private, not-for-profit hospital. The following information is available about the operations. Gross patient services charges totaled P4,500,000. Included in the above revenues are: charity services, P165,000; contractual adjustments, P400,000; and courtesy allowances, P14,000. Received marketable securities valued at P115,000 for the purchase of new diagnostic equipment. The marketable securities were sold for P124,000 and diagnostic equipment was purchased at a cost of P138,000. Revenue from the hospital gift shop was P31,000 and from the cafeteria revenues were P160,000. Incurred and paid nursing service costs of P1,000,000 and general service costs of P500,000. How much is the net patient service revenue?Integrity Reconstructive is a private, not-for-profit hospital. The following information is available about the operations. Gross patient services charges totaled P4,500,000. Included in the above revenues are: charity services, P165,000; contractual adjustments, P400,000; and courtesy allowances, P14,000. Received marketable securities valued at P115,000 for the purchase of new diagnostic equipment. The marketable securities were sold for P124,000 and diagnostic equipment was purchased at a cost of P138,000. Revenue from the hospital gift shop was P31,000 and from the cafeteria revenues were P160,000. Incurred and paid nursing service costs of P1,000,000 and general service costs of P500,000. How much will be reported as excess of revenues over expenses in the hospital’s statement of operations?Under Cura Hospital’s established rate structure, patient service revenues of $9,000,000 would have been earned for the year ended December 31, 2019. However, only $6,750,000 was collected because of charity allowances of $1,500,000 and discounts of $750,000 to third-party payors. For the year ended December 31, 2019, what amount should Cura record as net patient service revenues? a. $6,750,000 b. $7,500,000 c. $8,250,000 d. $9,000,000

- The following selected events relate to the 2019 activities of Fall Nursing Home, Inc., a not-for-profit agency:a. Gross patient service revenue totaled $2,200,000. The provision for uncollectible accounts was estimated at $92,000. The allowance for contractual adjustments was increased by $120,000.b. After a conference with representatives of Gold Star Insurance Company, differences between the amounts accrued and subsequent settlements reduced receivables by $60,000.c. A grateful patient donated securities with a cost of $30,000 and a fair value at date of donation of $75,000. The donation was restricted to expenditure for modernization of equipment. The donation was accepted.d. Cash of $45,000 that had been restricted by a donor for the purchase of furniture was used this year. Fall chose to release the donor restriction over the useful life of the asset.e. The board voluntarily transferred $50,000 of cash to add to the resources held for capital improvements.f. Pledges of $60,000…Prepare journal entries to record the following transactions of a nonprofit hospital, with expense transactionscategorized by function:1. The hospital billed its uninsured patients for $300,000. Based on historical experience, it expects tocollect 45 percent of that amount over time.2. Nurses and doctors employed by the hospital were paid their salaries, $120,000.3. The chief administrative officer was paid her salary of $12,000.4. The hospital paid its utility bill, $6,000.5. Depreciation on the equipment was $40,800.6. Several adults donated their time (worth $6,000) selling merchandise in the hospital gift shop.7. The hospital billed Medicare $120,000 for services provided at its established rates. The prospectivebilling arrangement gives Medicare a 40 percent discount from these rates.8. A contribution without donor restrictions of $4,800 was received. If no adjustment is necessary, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields.White Valley Presbyterian Hospital is a nonprofit initial care facility. For the hospital’s calendar year ending December 31, 2019 journal entries to record the transactions listed in 1 through 14. below Third-parties payers and direct-pay patients were billed $6,500,000 at the hospital's established billing rates The hospital determined that certain of its patients qualified for charity care and that it would not seek to collect $950,000 at established billing rates from direct-pay patients The hospital estimated contractual adjustments for the year of $1,600,000 The hospital originally estimated uncollectible amounts from direct-pay patients to be $250,000 (recall that original estimated uncollectible amounts reduce revenue; only estimates specific to an individual patient are reported as bad debt expense). The hospital received capitation premiums of $2,500,000. It estimated that the cost of providing this care was $1,800,000 The hospital received payments from third-party payers…

- 1. A not-for-profit hospital performs services in the current year at a charge of $1 million. Of this amount, $200,000 is viewed as charity care services because no collection was expected at the time of the work. Additionally, officials expect another $94,000 to be bad debts. What should the hospital report as net patient service revenues? Select one: a.$906,000 b.$1,000,000 c.$706,000 d.$800,000 2. In the accounting for health care providers, what are third-party payors? Select one: a.Friends and relatives who pay the medical costs of a patient. b.Doctors who reduce fees for indigent patients. c.Insurance companies and other groups that pay a significant portion of the medical fees in the United States. d.Charities that supply medicines to hospitals and other health care providers. 3.What is a contractual adjustment? Select one: a.A year-end journal entry to recognize all of a health care entity's remaining receivables. b.An increase in a patient's…A private not-for-profit health care entity has the following account balances:Revenue from newsstand . . . $ 50,000Amounts charged to patients . 800,000Interest income . . . . . . . . . . . .. .30,000Salary expense—nurses . . . . 100,000Provision for bad debts . . . . . 10,000Undesignated gifts . . . . . . . . . 80,000Contractual adjustments . . . . 110,000What is reported as the organization’s net patient service revenue? Choose the correct.a. $880,000b. $800,000c. $690,000d. $680,000A private not-for-profit health care entity has the following account balances: What is reported as the organization’s net patient service revenue? $880,000 $800,000 $690,000 $680,000

- Record the following transactions on the books of the private not-for-profit Mansoor Hospital. The Hospital billed patients AED880,000 for services rendered. Of this amount, 5% is expected to be uncollectible. Contractual adjustments with insurance companies are expected to total AED125,000. The Hospital received AED640,000 in pledges of support in a campaign undertaken to purchase new MRI equipment. All of the pledges are payable within one year and 6% are expected to be uncollectible. Charity care in the amount of AED38,000 was performed on an indigent patient. The Hospital collected AED684,000 for the services performed in (a) above. Actual contractual adjustments for these services amounted to AED135,000. AED32,000 of receivables were identified as uncollectible and written off.2. ABC Hospital, a private non-profit hospital, has gross receipts ofP19,000,000,00 with a cost of P6,000,000,00 and allowable deductions ofP3,250,000.00 from related activities, while for its unrelated activities, it incurredP5,000,000.00 and P2,000,000.00 as cost of sales and allowable deductions,respectively, with a gross receipts of P18,000,000,00, for Calendar Year 2021.Tax due is:A not-for-profit medical center performs services in the current year at a charge of $1 million. Of this amount, $200,000 is viewed as charity services because no collection was expected at the time of the work. The direct costs of that work were $80,000 and the indirect costs were $50,000. What amount of these costs has to be disclosed? Choose the correct.a. $50,000b. $80,000c. $130,000d. $280,000