Attached is an audit working paper prepared by a new staff auditor based on his testing of a client's bank reconciliation. REQUIRED: Indicate the deficiencies in the working paper prepared by the auditor for the client's bank reconciliation. Be specific with your answers.

Attached is an audit working paper prepared by a new staff auditor based on his testing of a client's bank reconciliation. REQUIRED: Indicate the deficiencies in the working paper prepared by the auditor for the client's bank reconciliation. Be specific with your answers.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter5: Professional Auditing Standards And The Audit Opinion Formulation Process

Section: Chapter Questions

Problem 27MCQ

Related questions

Question

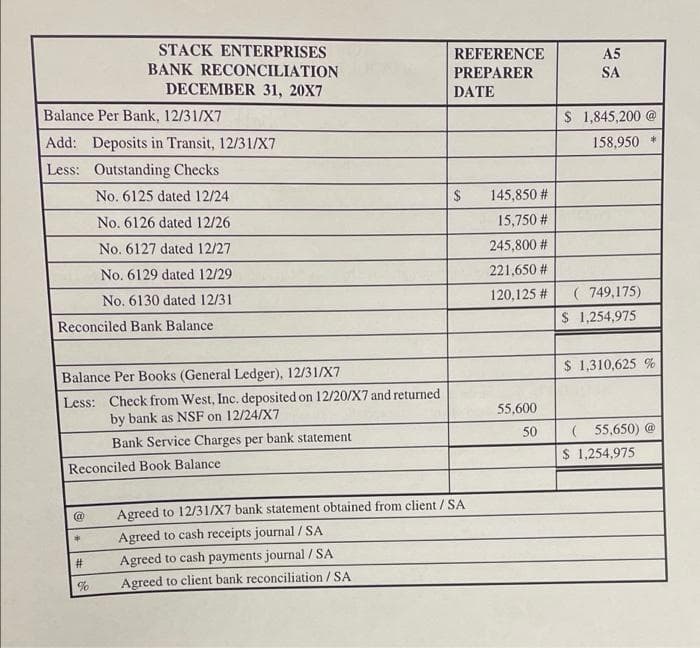

Transcribed Image Text:STACK ENTERPRISES

REFERENCE

A5

BANK RECONCILIATION

PREPARER

SA

DECEMBER 31, 20X7

DATE

Balance Per Bank, 12/31/X7

$ 1,845,200 @

Add: Deposits in Transit, 12/31/X7

Less: Outstanding Checks

158,950

No. 6125 dated 12/24

2$

145,850 #

No. 6126 dated 12/26

15,750 #

No. 6127 dated 12/27

245,800 #

No. 6129 dated 12/29

221,650 #

( 749,175)

$ 1,254,975

No. 6130 dated 12/31

120,125 #

Reconciled Bank Balance

$ 1,310,625 %

Balance Per Books (General Ledger), 12/31/X7

Less: Check from West, Inc. deposited on 12/20/X7 and returned

55,600

by bank as NSF on 12/24/X7

( 55,650) @

$ 1,254,975

50

Bank Service Charges per bank statement

Reconciled Book Balance

@

Agreed to 12/31/X7 bank statement obtained from client/ SA

Agreed to cash receipts journal / SA

Agreed to cash payments journal / SA

Agreed to client bank reconciliation/ SA

23

Transcribed Image Text:Attached is an audit working paper prepared by a new staff auditor based on his testing of a client's

bank reconciliation.

REQUIRED: Indicate the deficiencies in the working paper prepared by the auditor for the client's

bank reconciliation. Be specific with your answers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning