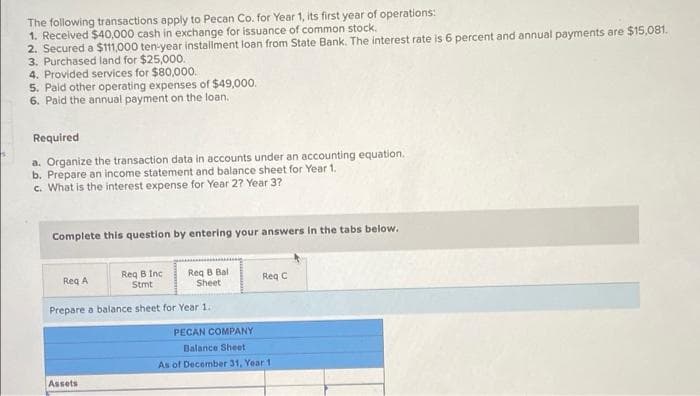

The following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received $40,000 cash in exchange for issuance of common stock. 2. Secured a $111,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $15,081. 3. Purchased land for $25,000. 4. Provided services for $80,000. 5. Paid other operating expenses of $49,000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1. c. What is the interest expense for Year 2? Year 3?

The following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received $40,000 cash in exchange for issuance of common stock. 2. Secured a $111,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $15,081. 3. Purchased land for $25,000. 4. Provided services for $80,000. 5. Paid other operating expenses of $49,000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1. c. What is the interest expense for Year 2? Year 3?

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Transcribed Image Text:The following transactions apply to Pecan Co. for Year 1, its first year of operations:

1. Received $40,000 cash in exchange for issuance of common stock.

2. Secured a $111,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $15,081.

3. Purchased land for $25,000.

4. Provided services for $80,000.

5. Paid other operating expenses of $49,000.

6. Paid the annual payment on the loan.

Required

a. Organize the transaction data in accounts under an accounting equation.

b. Prepare an income statement and balance sheet for Year 1.

c. What is the interest expense for Year 2? Year 3?

Complete this question by entering your answers in the tabs below.

Req B Inc

Stmt

Req B Bal

Sheet

Req A

Reg C

Prepare a balance sheet for Year 1.

PECAN COMPANY

Balance Sheet

As of December 31, Year 1

Assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning