Attempt in Pro Splish Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2020. Purchase Cash paid for equipment, including sales tax of $5,600 Freight and insurance cost while in transit Cost of moving equipment into place at factory Wage cost for technicians to test equipment Insurance premium paid during first year of operation on this equipment Special plumbing fixtures required for new equipment Repair cost incurred in first year of operations related to this equipment Construction Material and purchased parts (gross cost $224,000: failed to take 2% cash discount) Imputed interest on funds used during construction (stock financing) Labor costs Allocated overhead costs (fixed-$22.400; variable-$33,600) Profit on self-construction Cost of installing equipment Compute the total cost to be capitalized for each of these two pieces of equipment Purchase equipment Construction equipment eTextbook and Media S S $117.600 2,240 3,472 4,480 1.680 8,960 1,456 $224,000 15,680 212.800 56,000 33,600 4,928

Attempt in Pro Splish Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2020. Purchase Cash paid for equipment, including sales tax of $5,600 Freight and insurance cost while in transit Cost of moving equipment into place at factory Wage cost for technicians to test equipment Insurance premium paid during first year of operation on this equipment Special plumbing fixtures required for new equipment Repair cost incurred in first year of operations related to this equipment Construction Material and purchased parts (gross cost $224,000: failed to take 2% cash discount) Imputed interest on funds used during construction (stock financing) Labor costs Allocated overhead costs (fixed-$22.400; variable-$33,600) Profit on self-construction Cost of installing equipment Compute the total cost to be capitalized for each of these two pieces of equipment Purchase equipment Construction equipment eTextbook and Media S S $117.600 2,240 3,472 4,480 1.680 8,960 1,456 $224,000 15,680 212.800 56,000 33,600 4,928

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 5QE

Related questions

Question

Please do not give solution in image format thanku

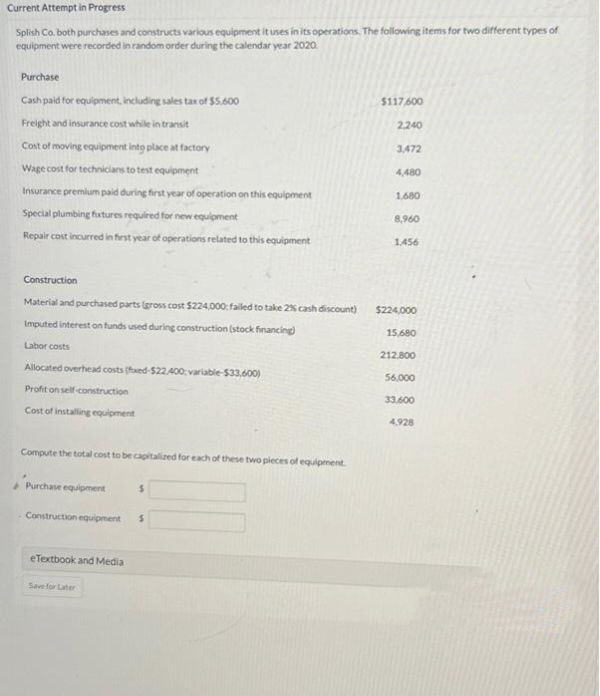

Transcribed Image Text:Current Attempt in Progress

Splish Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of

equipment were recorded in random order during the calendar year 2020.

Purchase

Cash paid for equipment, including sales tax of $5,600

Freight and insurance cost while in transit

Cost of moving equipment into place at factory

Wage cost for technicians to test equipment

Insurance premium paid during first year of operation on this equipment

Special plumbing fixtures required for new equipment

Repair cost incurred in first year of operations related to this equipment

Construction

Material and purchased parts (gross cost $224,000: failed to take 2% cash discount)

Imputed interest on funds used during construction (stock financing)

Labor costs

Allocated overhead costs (fixed-$22.400; variable-$33,600)

Profit on self-construction

Cost of installing equipment

Compute the total cost to be capitalized for each of these two pieces of equipment

Purchase equipment

- Construction equipment

eTextbook and Media

Save for Later

S

S

$117,600

2,240

3,472

4,480

1,680

8,960

1.456

$224,000

15,680

212.800

56,000

33.600

4,928

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning