August 1, 2020 - Opened an account with PNB amounting to P400,000. August 2, 2020 – Bought Laundry Equipment costing P200,000, paying cash of P120,000 and issued a note for the balance. August 3, 2020 – Paid the business permits and business registration paying a total of P5,300. August 4, 2020- Paid the following: Rental for 6 months at P2,000 per month Cost of renovation of the rented office (Leasehold Improvements) P20,000, August 5, 2020 - Acquired a second-hand delivery van on credit P120,000. August 8, 2020- Bought various laundry supplies on account amounting to P15,000 August 10, 2020- Rendered services to various customers for cash P7,500 August 11, 2020- Billed Medical Hospital for the services rendered from Aug. 4-10, amounting to P40,000 August 14, 2020- Paid PLDT for the telephone subscription for the month of August P990. August 15, 2020- Paid the 1st half salary of the staff P5,000, August 16, 2020- Paid the personal loan of Giles amounting to P10,000, August 20, 2020- Paid the month rental amounting to P6,650 net of 5% withholding tax. August 25, 2020-Collected cash from Medical Hospital amounting to P40,000, August 26, 2020- Deposited to bank cash received from customers for services rendered P16,200, August 28, 2020- Paid in full the account on Aug. 8. August 29, 2020 – Paid partial for the delivery van bought on Aug. 5 amounting to P60,000. August 31, 2020- Paid the 2nd half salary of staff P4,500, net of SSS premium w/holding of P300 and Philhealth premium withholding of P200

August 1, 2020 - Opened an account with PNB amounting to P400,000. August 2, 2020 – Bought Laundry Equipment costing P200,000, paying cash of P120,000 and issued a note for the balance. August 3, 2020 – Paid the business permits and business registration paying a total of P5,300. August 4, 2020- Paid the following: Rental for 6 months at P2,000 per month Cost of renovation of the rented office (Leasehold Improvements) P20,000, August 5, 2020 - Acquired a second-hand delivery van on credit P120,000. August 8, 2020- Bought various laundry supplies on account amounting to P15,000 August 10, 2020- Rendered services to various customers for cash P7,500 August 11, 2020- Billed Medical Hospital for the services rendered from Aug. 4-10, amounting to P40,000 August 14, 2020- Paid PLDT for the telephone subscription for the month of August P990. August 15, 2020- Paid the 1st half salary of the staff P5,000, August 16, 2020- Paid the personal loan of Giles amounting to P10,000, August 20, 2020- Paid the month rental amounting to P6,650 net of 5% withholding tax. August 25, 2020-Collected cash from Medical Hospital amounting to P40,000, August 26, 2020- Deposited to bank cash received from customers for services rendered P16,200, August 28, 2020- Paid in full the account on Aug. 8. August 29, 2020 – Paid partial for the delivery van bought on Aug. 5 amounting to P60,000. August 31, 2020- Paid the 2nd half salary of staff P4,500, net of SSS premium w/holding of P300 and Philhealth premium withholding of P200

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from...

Related questions

Question

Help me journalize this thank you

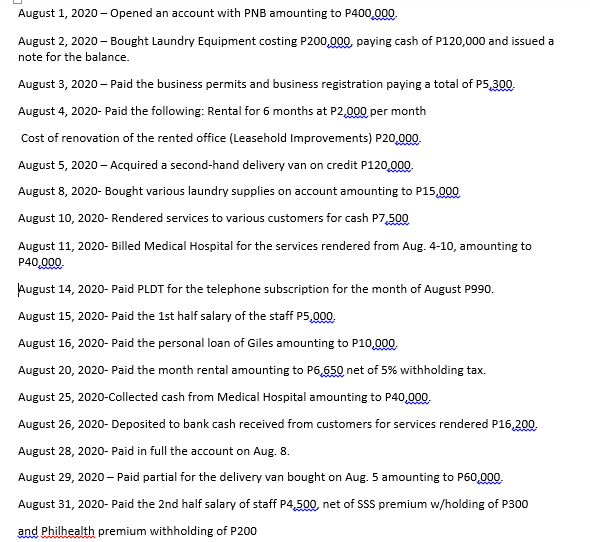

Transcribed Image Text:August 1, 2020 - Opened an account with PNB amounting to P400,000.

August 2, 2020 - Bought Laundry Equipment costing P200,000, paying cash of P120,000 and issued a

note for the balance.

August 3, 2020 – Paid the business permits and business registration paying a total of P5,300.

August 4, 2020- Paid the following: Rental for 6 months at P2,000 per month

Cost of renovation of the rented office (Leasehold Improvements) P20,000

August 5, 2020 - Acquired a second-hand delivery van on credit P120,000.

August 8, 2020- Bought various laundry supplies on account amounting to P15,000

August 10, 2020- Rendered services to various customers for cash P7,500

August 11, 2020- Billed Medical Hospital for the services rendered from Aug. 4-10, amounting to

P40,000.

August 14, 2020- Paid PLDT for the telephone subscription for the month of August P990.

August 15, 2020- Paid the 1st half salary of the staff P5,000.

August 16, 2020- Paid the personal loan of Giles amounting to P10,000.

August 20, 2020- Paid the month rental amounting to P6,650 net of 5% withholding tax.

August 25, 2020-Collected cash from Medical Hospital amounting to P40,000.

August 26, 2020- Deposited to bank cash received from customers for services rendered P16,200.

August 28, 2020- Paid in full the account on Aug. 8.

August 29, 2020 – Paid partial for the delivery van bought on Aug. 5 amounting to P60,000.

August 31, 2020- Paid the 2nd half salary of staff P4,500, net of SSS premium w/holding of P300

and Philhealth premium withholding of P200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning