Autonumerics, Inc. has just invested $600,000 in a manufacturi11g process that is estimated to generate an after-tax annual cash flow of $250.000 in each of the next five years. At the end of year 5. no further market for the product and no salvage value for the manufacturing process is expected. If a manufacturing problem delays plant start-up for one year (leaving only four years of process life), what additional after-tax cash flow will be needed to maintain the same internal rate of return as if no delay had occurred?

Autonumerics, Inc. has just invested $600,000 in a manufacturi11g process that is estimated to generate an after-tax annual cash flow of $250.000 in each of the next five years. At the end of year 5. no further market for the product and no salvage value for the manufacturing process is expected. If a manufacturing problem delays plant start-up for one year (leaving only four years of process life), what additional after-tax cash flow will be needed to maintain the same

Internal Rate of Return (IRR) is the required rate of return at which the present value of cash inflows equals the present value of cash outflows. In simple words, the IRR is the rate at which the net present value of investment proposal is equals to zero.

The cost of the investment is $600,000 and the annual cash flows is $250,000 per year for 5 years.

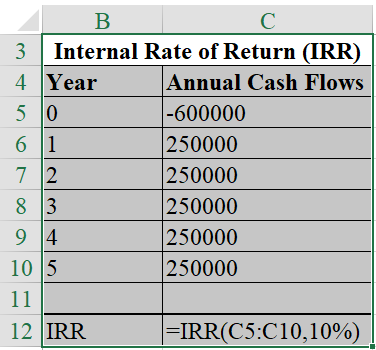

Compute the internal rate of return (IRR), using MS-excel as shown below:

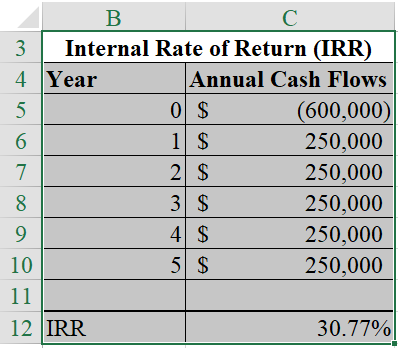

The result of the above excel table is as follows:

Hence, the IRR is 30.77%.

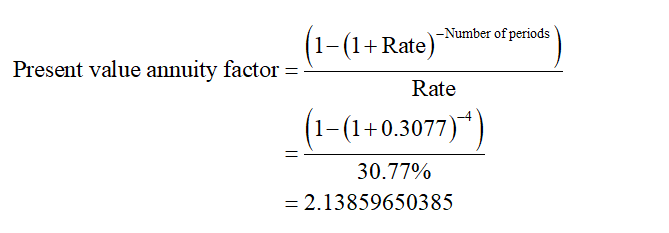

Compute the present value annuity factor (PVIFA), using the equation as shown below:

Hence, the present value annuity factor is 2.13859650385.

Step by step

Solved in 6 steps with 5 images