Average Inventory conversion period

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 5MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Topic Video

Question

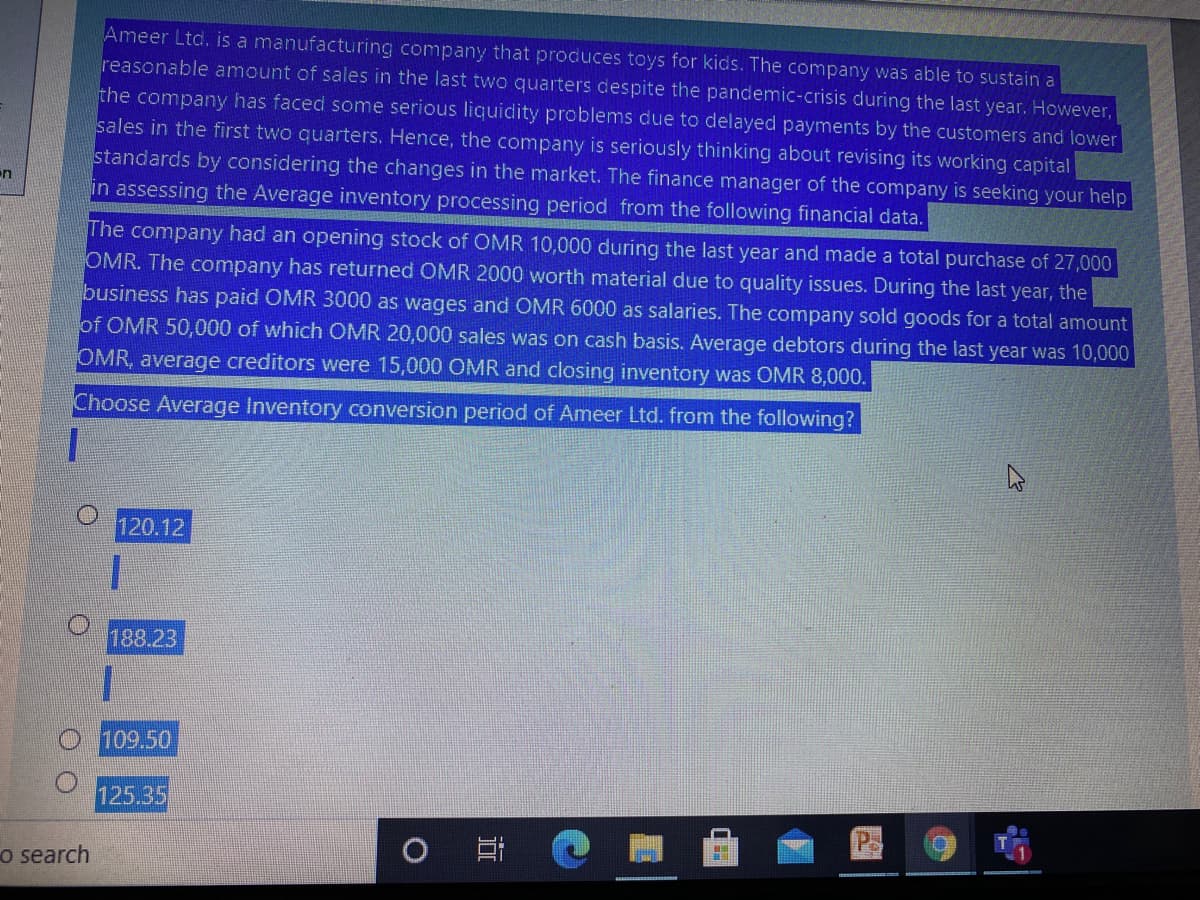

Transcribed Image Text:Ameer Ltd. is a manufacturing company that produces toys for kids. The company was able to sustain a

reasonable amount of sales in the last two quarters despite the pandemic-crisis during the last year. However,

the company has faced some serious liquidity problems due to delayed payments by the customers and lower

sales in the first two quarters. Hence, the company is seriously thinking about revising its working capital

standards by considering the changes in the market. The finance manager of the company is seeking your help

in assessing the Average inventory processing period from the following financial data.

en

The company had an opening stock of OMR 10,000 during the last year and made a total purchase of 27,000

OMR. The company has returned OMR 2000 worth material due to quality issues. During the last year, the

business has paid OMR 3000 as wages and OMR 6000 as salaries. The company sold goods for a total amount

of OMR 50,000 of which OMR 20,000 sales was on cash basis. Average debtors during the last year was 10,000

OMR, average creditors were 15,000 OMR and closing inventory was OMR 8,000.

Choose Average Inventory conversion period of Ameer Ltd. from the following?

120.12

188.23

109.50

125.35

o search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning