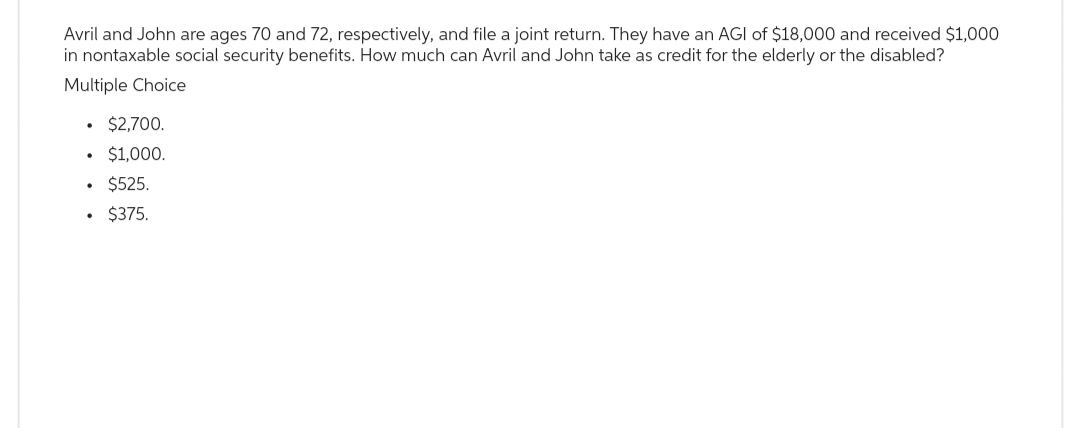

Avril and John are ages 70 and 72, respectively, and file a joint return. They have an AGI of $18,000 and received $1,000 in nontaxable social security benefits. How much can Avril and John take as credit for the elderly or the disabled?

Avril and John are ages 70 and 72, respectively, and file a joint return. They have an AGI of $18,000 and received $1,000 in nontaxable social security benefits. How much can Avril and John take as credit for the elderly or the disabled?

Chapter1: The Individual Income Tax Return

Section: Chapter Questions

Problem 14MCQ: Robin and Howie file married filing jointly and have a 13 -year-old daughter. They also provide all...

Related questions

Question

Please do not give solution in image format ?

Transcribed Image Text:Avril and John are ages 70 and 72, respectively, and file a joint return. They have an AGI of $18,000 and received $1,000

in nontaxable social security benefits. How much can Avril and John take as credit for the elderly or the disabled?

Multiple Choice

• $2,700.

• $1,000.

$525.

• $375.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT