Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 4. Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? No Gain or Loss on exchange of assets Initial value of new land Required 3 Required 4

Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 4. Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? No Gain or Loss on exchange of assets Initial value of new land Required 3 Required 4

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 21P

Related questions

Question

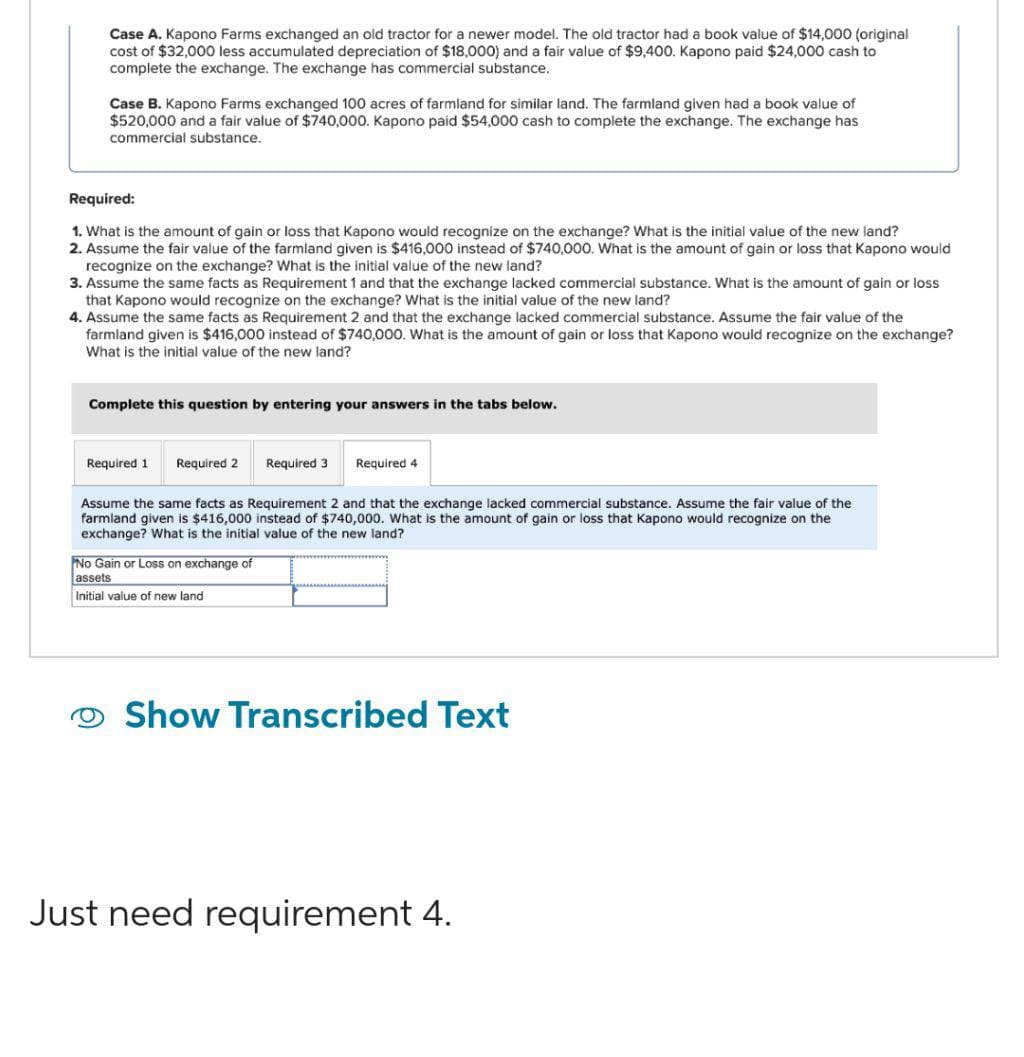

Transcribed Image Text:Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $14,000 (original

cost of $32,000 less accumulated depreciation of $18,000) and a fair value of $9,400. Kapono paid $24,000 cash to

complete the exchange. The exchange has commercial substance.

Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had book value of

$520,000 and a fair value of $740,000. Kapono paid $54,000 cash to complete the exchange. The exchange has

commercial substance.

Required:

1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land?

2. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would

recognize on the exchange? What is the initial value of the new land?

3. Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss

that Kapono would recognize on the exchange? What is the initial value of the new land?

4. Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the

farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange?

What is the initial value of the new land?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3

Required

Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the

farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the

exchange? What is the initial value of the new land?

No Gain or Loss on exchange of

assets

Initial value of new land

Show Transcribed Text

Just need requirement 4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College