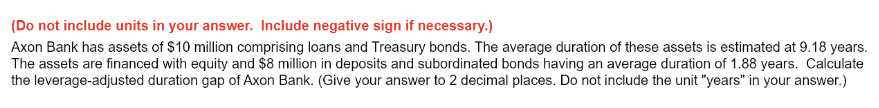

Axon Bank has assets of $10 million comprising loans and Treasury bonds. The average duration of these assets is estimated at 9.18 years. The assets are financed with equity and $8 million in deposits and subordinated bonds having an average duration of 1.88 years. Calculate the leverage-adjusted duration gap of Axon Bank. (Give your answer to 2 decimal places. Do not include the unit "years" in your answer.)

Q: RACE Mutual fund is a no-load fund that had a net asset value of $25.60 1 year ago. Today, the net…

A: Data given: Beginning Price=Beginning NAV=$25.60 Ending Price=Ending NAV=$28.83 Dividend paid=$0.72…

Q: zero coupon bond with a face value of $900,000 is issued on January 1, Year One. It will mature in…

A: Zero coupon bonds are not paid any coupon payment but they are paid face value on the maturity of…

Q: Fijisawa Inc. is considering a major expansion of its product line and has estimated the following…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: You just won a lottery that promises to pay you $8,000,000 exactly 10 years from today. A company…

A: Present value is a financial concept that represents the value of a future sum of money in terms of…

Q: Let f(x) = 3x {your final answer just number} Find x such that f(x) = 243

A: f (x) =3x and f (x) = 243

Q: Stocks A and B have the following returns: (Click on the following icon in order to copy its…

A: A portfolio is the combination of stocks, assets, bonds, commodities that an investor form in order…

Q: A 21%-tax bracket firm (Lessee) is considering the use, for two years, of a truck that costs…

A: Lease agreement is that under which two parties are involved one is lessor and another is lesser.…

Q: Suppose you purchase a 10-year bond with 11% annual coupons. You hold the bond for four years and…

A: The internal rate of return (IRR) is a financial research indicator used to determine the financial…

Q: The "Pure Modigliani and Miller Result" establishes, under restrictive assumptions, that the firm's…

A: Modigliani and miller said that Cost of debt is lower than cost of equity because bondholders have a…

Q: Your Answer Correct Answer Ivanhoe Luxury Liners has preferred shares outstanding that pay an annual…

A: Preference shares are referred to as the shares the stock of the corporation along with the…

Q: An investment project has annual cash inflows of $4,200, $5,300, 6,100 and $7,400 and a discount…

A: It represents the period in which the initial investment of the project will recover. The…

Q: Projects X and Y have an initial cost of $10,000, followed by positive cash inflows. Project X’s…

A: A financial calculation known as the net present value (NPV) of a project determines the present…

Q: e you want to purchase a home for $475,000 with a 30-year mortgage at 4.34% interest. Suppose also…

A: Mortgage loans are very important in the purchase of home because mortgage make home buying easy and…

Q: Refer to the following table that shows the movement of prices during a certain year. Use these…

A: Growth rate refers to the change in the percentage which should be applied to GDP, corporate…

Q: APPLE MARKET VALUE= $115.05 CALLS LAST PRICE 7.10 7.10 6.60 6.20 5.70 5.09 EXP DATE: DEC 4, 2020…

A: The payoff formula for writing (selling) a put option is: Payoff = Premium received - Max [(Strike…

Q: Bones Ely owns a $1,000 face-value bond with three years to maturity. The bond makes annual interest…

A: First we need to calculate bond price. Bond price will be present value of face value and present…

Q: ws the following returns: 2010 8% 2013 -7% 2011 2% 2014 3% 2012…

A: Different ways are available for the measurement of the financial performance and determine any…

Q: An investment of $15,785 is accumulated at 6.5% compounded quarterly for 5 years. At that time the…

A: Future Value (FV) refers to the value of an investment or cash flow at a specific future date,…

Q: 10. Compounding Annual Rates For each of the cases in the table below: a) Calculate the future value…

A: It represents the expected value of the present amount and is estimated by compounding the present…

Q: A payday loan company charges a $25 fee for a $550 payday loan that will be repaid in 17 days.…

A: Given, Payday loan company charges fee = $25 Payday loan amount = $550 Duration = 17 days

Q: What is the NPV of the following cashflows, assuming a discount rate of 12%? Year Cashflow 0…

A: Net present value (NPV) is a financial metric that is used to evaluate the profitability of an…

Q: Your company is considering a project that has an up-front cost at Year 0 of $500.000 and a cost of…

A: Net Present Value (NPV0)=$710,198.64 Chance of success = 70% If project starts from Year 1, that is…

Q: he bonds issued by Stainless Tubs bear a 6 percent coupon, payable semiannually. The bonds mature in…

A: Yield to maturity is the rate of return realized on bond when bond is held till maturity and all…

Q: An annuity with a cash value of $9,900 pays $290 at the beginning of every month. The investment…

A: Loans are paid by monthly payments that carry the payment for interest and payment for loan also but…

Q: Every 3 months, Carolyn gets an allowance of $80 that she puts into a savings account with a 1.2%…

A: Quarterly allowance = $80 Interest rate = 1.2% compounded semi-annually Period = 6 years

Q: Drake Electricity sells electricity throughout the Northwestern Province of Zambia. Because of…

A: As per the given information: Dividend - K0.75 per-share dividendIncrease in dividend - 15% per year…

Q: Assume that Project A has the cash flows listed below and a relevant cost of capital of 13 percent.…

A: NPV is a Financial metric used to calculate the present value of future cash flows. It is a popular…

Q: The Chief Operations Officer (COO) of a manufacturing firm recommends one of the manufacturing sites…

A: The process that analyzes and evaluates any project's profitability and help in deciding whether the…

Q: the properties after 10 years with the increase annual rate taken into consideration and what value…

A: Let's calculate the final price of the properties after 10 years with the annual rate of increase…

Q: Terrance invested $1,500 in a mutual fund on January 1, 2010. He has brought you all of the annual…

A: Return on mutual fund is calculated based on the value appreciation as shown below. Return=Year end…

Q: Lacy has a $40,500.00 student loan when she graduates on May 4, and the prime rate is set at 5.5%.…

A: A student loan refers to a loan that is extended only to students to finance their education fees.…

Q: rs an expansion project. It currently has 100 million outstanding shares trading at $20 per share.…

A: NPV is net present value and is the difference between the present value of cash flow and initial…

Q: You have just made your first $5,000 contribution to your retirement account. Assume you earn a…

A: The concept of time value money is an important factor in the decision making because the value of…

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: Debt refers to the money that a company borrows to fund its operations. It is one of the most common…

Q: “Bankruptcy is a convenient way to avoid paying your debts.” Discuss the accuracy of statement

A: Bankruptcy is a legal process that provides individuals or businesses who are unable to pay their…

Q: Calculate the value of each of the bonds shown in the following table, all of which pay interest…

A: The coupon payment on the bond is calculated using following equation Coupon payment = Par…

Q: A pension fund projects its cash flow obligations to be constant at $5Mln for the next 10 years and…

A: Present value is the equivalent value of money based on time and interest rate of the cash flow that…

Q: Tiffany is 45 and has three children in elementary school and college. She has been contributing to…

A: Social Security Benefits are federal government programs used to provide many benefits to…

Q: Gateway Communications is considering a project with an initial fixed assets cost of $1.49 million…

A: Data given: Initial fixed assets cost=$1490,000 n= 9 years Sale of assets=$ 246,000 Savings in…

Q: Find the present value of payments of 50 at the end of the first quarter, 55 at the end of the…

A: Present value refers to the current worth of a future sum or a stream of cash flows. It is…

Q: Question I need help with (answered last question for context to this one) : If Fab Corp can earn…

A: The estimated annual growth rate of Fab Corp's net income can be calculated using the Retention Rate…

Q: a project will increase sales by $92,800 and cash expenses by $53,200. The project will cost $89,000…

A: Operating cash flow is an important concept. It considers depreciation as a provision to get tax…

Q: Eight months ago, you purchased 400 shares of AAA stock for $46.40 a Share. The company pays…

A: Purchase price = $46.40 per share Selling price = $48.30 per share Quarterly dividend = $1.05 per…

Q: Part A Tiffany has $5,000 of her savings in a bank account. What would be different if she had that…

A: Investment refers to employing funds in instruments that generate returns for the investor. There…

Q: Quartz Corporation is a relatively new firm. Quartz has experienced enough losses during its early…

A: In a possible lease transaction between the lessor and the lessee, the lessee's reservation price…

Q: D e s c r i b e , c o m p a r e , an d c o n tr a s t t h e f o l l o w i n g c o m m…

A: "Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: What is the difference between the “Organic View” and the “Mechanistic View” of government? What are…

A: Public finance is the study of government expenditures, taxation, debt, and other financial…

Q: A 100,000 loan is being repaid with level monthly payments with payments at the end of each month.…

A: Monthly payment refers to the amount that is paid periodically towards loan repayment. The monthly…

Q: True or False: Private equity investors can easily sell or exchange their investments for cash…

A: False: Private equity investors typically have a longer investment horizon and may face restrictions…

Q: Assume that 1-year T-bills currently yield 5.00% and the future inflation rate is expected to be…

A: The risk-free rate indicates an amount of return on a totally risk-free investment over a particular…

A 285.

Step by step

Solved in 3 steps

- Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and the interest rate on this debt is 10%, the same as the rate on new bank loans. These bank loans are not used for seasonal financing but instead are part of the companys permanent capital structure. The long-term debt consists of 30,000 bonds, each with a par value of 1,000, an annual coupon interest rate of 6%, and a 20-year maturity. The going rate of interest on new long-term debt, rd, is 10%, and this is the present yield to maturity on the bonds. The common stock sells at a price of 60 per share. Calculate the firms market value capital structure.Axon Bank has assets of $10 million comprising loans and Treasury bonds. The average duration of these assets is estimated at 9.18 years. The assets are financed with equity and $8 million in deposits and subordinated bonds having an average duration of 1.88 years. Calculate the leverage-adjusted duration gap of Axon Bank. (Give your answer to 2 decimal places. Do not include the unit "years" in your answer.)ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 12 years to maturity that is quoted at 111.5 percent of face value. The issue makes semiannual payments and has an embedded cost of 8.4 percent annually. a. What is the company’s pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 25 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

- Viserion, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 18 years to maturity that is quoted at 109 percent of face value. The issue makes semiannual payments and has an embedded cost of 6 percent annually. a. What is the company’s pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 22 percent, what is the aftertax cost of debt?A bank has an average asset duration of 5.3 years and an average liability duration of 2.5 years. This bank has $700 million in total assets and $500 million in total liabilities. This bank has: A positive leverage adjusted duration gap of 2.8 years A negative leverage adjusted duration gap of 2.8 years A positive leverage adjusted duration gap of 7.8 years A positive leverage adjusted duration gap of 3.5 yearsSunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to maturity that is quoted at 106 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.2 percent annually. • What is the company’s pretax cost of debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. • If the tax rate is 22 percent, what is the aftertax cost of debt?

- U can do by excel but pls explain the formula how you put and also please explain the concept. Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 25 years to maturity that is quoted at 103 percent of face value. The issue makes semiannual payments and has an embedded cost of 8 percent annually. a. What is the company's pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 21 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity that is quoted at 103.5 percent of face value. The issue makes semiannual payments and has an embedded cost of 5.2 percent annually. What is the company’s pretax cost of debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. If the tax rate is 21 percent, what is the aftertax cost of debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with nine years to maturity that is quoted at 117 percent of face value. The issue makes semiannual payments and has an embedded cost of 11 percent annually. What is the company’s pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Pretax cost of debt % If the tax rate is 34 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Aftertax cost of debt %

- Hills Department Stores has $54 million of current assets and $58 million of noncurrent assets. It forecastsan EBIT of $10.4 million and pays income taxes at a 35% rate. Short-term bank notes carry a 5%interest rate, and the company can issue long-term bonds at 7%. The company has set a targetdebt ratio of 45%. Required: A. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sabbreviated balance sheet. B. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sfinancial half of its income statement. C. Based on the financial statements above, calculate the return on equity ratio in order toevaluate the company's risk and return. D. Based on the financial statements above, calculate the current ratio in order to evaluatethe company's risk and return. Please see attached spreadsheet and if you could please help me step by step by the information provided into the attached spreadsheet, I would be grateful.Suppose that a 1 percent increase in the (annual) interest rate leads to a 3.9 percent drop in the equity value of the bank. The ratio Debt/Assets=0.85 for this bank. Using a duration analysis, you estimated the effective duration gap for the bank implied by these numbers. You assumed that a one percent change in the rate is approximately the same as a one percentage point change in the rate. This implied duration gap is: Group of answer choices 0.59 years 3.32 years 0.17 years 2.73 years 4.59 yearsICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with nine years to maturity that is quoted at 115 percent of face value. The issue makes semiannual payments and has an embedded cost of 10.2 percent annually. What is the company’s pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Pretax cost of debt % If the tax rate is 30 percent, what is the aftertax cost of debt?