Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 16P

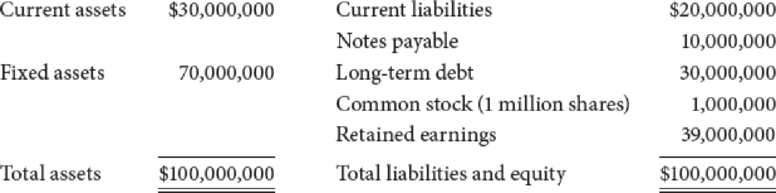

Suppose the Schoof Company has this book value balance sheet:

The notes payable are to banks, and the interest rate on this debt is 10%, the same as the rate on new bank loans. These bank loans are not used for seasonal financing but instead are part of the company’s permanent capital structure. The long-term debt consists of 30,000 bonds, each with a par value of $1,000, an annual coupon interest rate of 6%, and a 20-year maturity. The going rate of interest on new long-term debt, rd, is 10%, and this is the present yield to maturity on the bonds. The common stock sells at a price of $60 per share. Calculate the firm’s market value capital structure.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ABC company will contract a new loan in the sum of $2,000,000 that is secured by machinery and the loan has an interest rate of 6 percent. The company has also issued 4,000 new bond issues with an 8 percent coupon, paid semi-annually, and matures in 10 years. The bonds were sold at par and incurred a floatation cost of 2 percent per issue.

1. Does the New loan have anything to do with calculating the cost of debt?

2. Should the new loan be considered in the calculation of the weighted average cost of capital (WACC) of the company? if so how should it be added to the WACC formula.

stealth bank has deposits of $700 million. And hold reserves of $20 million and has purchased government bonds worth $350 million. The banks loans, if sold at the current market value, would be worth $600 million. What is the value of the biggest total liabilities?

Konga Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to maturity that is quoted at 95 percent of face value. The issue makes semi-annual payments and has a coupon rate of 7 percent. What is the company’s pretax cost of debt?

Chapter 9 Solutions

Financial Management: Theory & Practice

Ch. 9 - Define each of the following terms: a. Weighted...Ch. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - Distinguish between beta (i.e., market) risk,...Ch. 9 - Suppose a firm estimates its overall cost of...Ch. 9 - Calculate the after-tax cost of debt under each of...Ch. 9 - LL Incorporateds currently outstanding 11% coupon...Ch. 9 - Duggins Veterinary Supplies can issue perpetual...Ch. 9 - Prob. 4PCh. 9 - Summerdahl Resorts common stock is currently...

Ch. 9 - Booher Book Stores has a beta of 0.8. The yield on...Ch. 9 - Prob. 7PCh. 9 - David Ortiz Motors has a target capital structure...Ch. 9 - A companys 6% coupon rate, semiannual payment,...Ch. 9 - The earnings, dividends, and stock price of Shelby...Ch. 9 - Radon Homes’ current EPS is $6.50. It was $4.42 5...Ch. 9 - Spencer Supply’s stock is currently selling for...Ch. 9 - Prob. 13PCh. 9 - Prob. 14PCh. 9 - On January 1, the total market value of the...Ch. 9 - Suppose the Schoof Company has this book value...Ch. 9 - The following table gives the current balance...Ch. 9 - Start with the partial model in the file Ch09 P18...Ch. 9 - During the last few years, Jana Industries has...Ch. 9 - b. What is the market interest rate on Jana’s...Ch. 9 - Prob. 3MCCh. 9 - d. (1) What are the two primary ways companies...Ch. 9 - What is the estimated cost of equity using the...Ch. 9 - f. What is the cost of equity based on the...Ch. 9 - g. What is your final estimate for the cost of...Ch. 9 - h. Janas target capital structure is 30% long-term...Ch. 9 - i. Use Janas target weights to calculate the...Ch. 9 - Prob. 10MCCh. 9 - k. Should the company use its overall WACC as the...Ch. 9 - l. What procedures can be used to estimate the...Ch. 9 - m. Jana is interested in establishing a new...Ch. 9 - n. What are three types of project risk? How can...Ch. 9 - o. Explain in words why new common stock that is...Ch. 9 - p. What four common mistakes in estimating the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?arrow_forwardSuppose that a bank has $10 billion of one-year loans and $30 billion of five-year loans. These are financed by $35 billion of one-year deposits and $5 billion of five-year deposits. The bank has equity totaling $2 billion and its return on equity is currently 12%. Estimate what change in interest rates next year would lead to the bank's return on equity being reduced to zero. Assume that the bank is subject to a tax rate of 30%.arrow_forwardHills Department Stores has $54 million of current assets and $58 million of noncurrent assets. It forecastsan EBIT of $10.4 million and pays income taxes at a 35% rate. Short-term bank notes carry a 5%interest rate, and the company can issue long-term bonds at 7%. The company has set a targetdebt ratio of 45%. Required: A. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sabbreviated balance sheet. B. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sfinancial half of its income statement. C. Based on the financial statements above, calculate the return on equity ratio in order toevaluate the company's risk and return. D. Based on the financial statements above, calculate the current ratio in order to evaluatethe company's risk and return. Please see attached spreadsheet and if you could please help me step by step by the information provided into the attached spreadsheet, I would be grateful.arrow_forward

- ZZZ company has $27 million of current assets and $29 million of noncurrent assets. It forecasts an EBIT of $5.2 million and pays income taxes at a 21% rate. Short-term bank notes carry a 4% interest rate, and the company can issue long-term bonds at 7%. The company has set a target debt ratio of 45%. Required: A. For a maturity mix of 60% current and 40% long-term debt, prepare the company's abbreviated balance sheet. B. For a maturity mix of 60% current and 40% long-term debt, prepare the company's financial half of its income statement. C. Based on the financial statements above, calculate the (1) return on equity ratio and the (2) current ratio in order to evaluate the company's risk and return. I also would love to see the excel formulas pleasearrow_forwardICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 9 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.6 percent annually. What is the company's pretax cost of debt? If the tax rate is 24 percent, what is the aftertax cost of debt? Pretax cost of debt: __________% Aftertax cost of debt: __________%arrow_forwardA bank has assets of $500,000,000 and equity of $40,000,000. The assets have an average duration of 5.5 years, and the liabilities have an average duration of 2.5 years. An 8-year fixed-rate T-bond with the same coupon as the fixed-rate on the swap has a duration of 6 years, and the duration of a floating-rate bond that reprices annually is one year. The bank wishes to hedge its balance sheet with swap contracts that have notional contracts of $100,000. What is the optimal number of swap contracts into which the bank should enter? 2,500 contracts. 2,760 contracts. 13,800 contracts. 3,200 contracts. None of the above.arrow_forward

- Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 10 years to maturity that is quoted at 109 percent of face value. The issue makes semiannual payments and has an embedded cost of 7 percent annually. What is the company's pretax cost of debt? If the tax rate is 23 percent, what is the aftertax cost of debt?arrow_forwardBBB company has $54 million of current assets and $58 million of noncurrent assets. It forecastsan EBIT of $10.4 million and pays income taxes at a 35% rate. Short-term bank notes carry a 5%interest rate, and the company can issue long-term bonds at 7%. The company has set a targetdebt ratio of 45%. Required: A. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sabbreviated balance sheet. B. For a maturity mix of 60% current and 40% long-term debt, prepare the company'sfinancial half of its income statement. C. Based on the financial statements above, calculate the return on equity ratio in order toevaluate the company's risk and return. D. Based on the financial statements above, calculate the current ratio in order to evaluatethe company's risk and return.arrow_forwardJ&R Renovation, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 20 years to maturity that is quoted at 109 percent of face value. The issue makes semiannual payments and has a coupon rate of 7 percent annually. a. What is the company's pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 21 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a.Pretax cost of debt:_____% b. Aftertax cost of debt: _____%arrow_forward

- J&R Renovation, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 20 years to maturity that is quoted at 108 percent of face value. The issue makes semiannual payments and has a coupon rate of 5 percent annually. a. What is the company's pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the tax rate is 22 percent, what is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAssume you are treasury manager in a company and the company requires $1,000,000 ($1 Million) in 6 months for the duration of 1 year. You can finance this need by trading zero-coupon bonds, i.e., buying or selling zero-coupon bonds or go to bank to organize a forward contract. The bank quotes a forward rate 14% per annum semi-annual compounding applied from 6 months to 18 months. The prices of zero-coupon bonds with maturity 6 months and 12 months are listed in the above table and the price of zero-coupon bond with maturity 18 months is calculated in Part II. Ignoring all the other costs and given all the information above, are you going to accept the bank’s offer? Justify your decision.arrow_forwardSolve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 9 percent. a. How much would you pay for a 10-year bond with a par value of $1,000 and a 7.9 percent coupon rate? Assume interest is paid annually. b. How much would you pay for a share of preferred stock paying a $5.3-per-share annual dividend forever? c. A company is planning to set aside money to repay $159 million in bonds that will be coming due in ten years. How much money would the company need to set aside at the end of each year for the next ten years to repay the bonds when they come due? How would your answer change if the money were deposited at the beginning of each year? Note: Round your answers to 2 decimal places. \table[[a. PV,,],[b. PV,,],[c1. PMT,,million],[c2. PMT,9.60,million]]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting - Long-term Liabilities - Bonds; Author: Finance & Accounting Videos by Prof Coram;https://www.youtube.com/watch?v=_1fwsJIGMos;License: Standard Youtube License