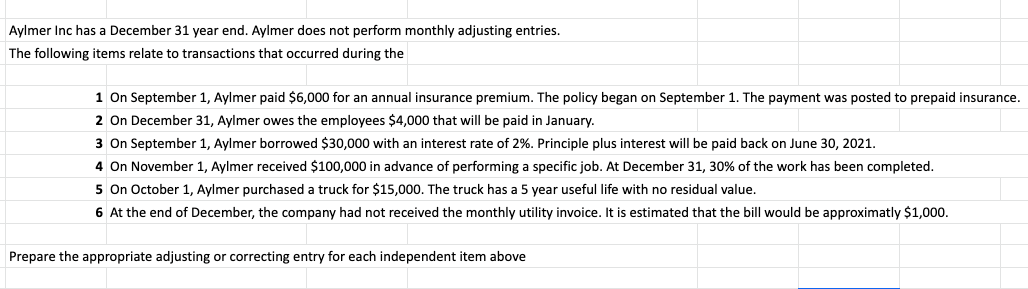

Aylmer Inc has a December 31 year end. Aylmer does not perform monthly adjusting entries. The following items relate to transactions that occurred during the 1 On September 1, Aylmer paid $6,000 for an annual insurance premium. The policy began on September 1. The payment was posted to prepaid insurance. 2 On December 31, Aylmer owes the employees $4,000 that will be paid in January. 3 On September 1, Aylmer borrowed $30,000 with an interest rate of 2%. Principle plus interest will be paid back on June 30, 2021. 4 On November 1, Aylmer received $100,000 in advance of performing a specific job. At December 31, 30% of the work has been completed. 5 On October 1, Aylmer purchased a truck for $15,000. The truck has a 5 year useful life with no residual value. 6 At the end of December, the company had not received the monthly utility invoice. It is estimated that the bill would be approximatly $1,000. Prepare the appropriate adjusting or correcting entry for each independent item above

Aylmer Inc has a December 31 year end. Aylmer does not perform monthly adjusting entries. The following items relate to transactions that occurred during the 1 On September 1, Aylmer paid $6,000 for an annual insurance premium. The policy began on September 1. The payment was posted to prepaid insurance. 2 On December 31, Aylmer owes the employees $4,000 that will be paid in January. 3 On September 1, Aylmer borrowed $30,000 with an interest rate of 2%. Principle plus interest will be paid back on June 30, 2021. 4 On November 1, Aylmer received $100,000 in advance of performing a specific job. At December 31, 30% of the work has been completed. 5 On October 1, Aylmer purchased a truck for $15,000. The truck has a 5 year useful life with no residual value. 6 At the end of December, the company had not received the monthly utility invoice. It is estimated that the bill would be approximatly $1,000. Prepare the appropriate adjusting or correcting entry for each independent item above

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 8EB: On July 1, a client paid an advance payment (retainer) of $10,000, to cover future legal services....

Related questions

Question

Kindly looking for answers ASAP. Thank you so much.

Transcribed Image Text:Aylmer Inc has a December 31 year end. Aylmer does not perform monthly adjusting entries.

The following items relate to transactions that occurred during the

1 On September 1, Aylmer paid $6,000 for an annual insurance premium. The policy began on September 1. The payment was posted to prepaid insurance.

2 On December 31, Aylmer owes the employees $4,000 that will be paid in January.

3 On September 1, Aylmer borrowed $30,000 with an interest rate of 2%. Principle plus interest will be paid back on June 30, 2021.

4 On November 1, Aylmer received $100,000 in advance of performing a specific job. At December 31, 30% of the work has been completed.

5 On October 1, Aylmer purchased a truck for $15,000. The truck has a 5 year useful life with no residual value.

6 At the end of December, the company had not received the monthly utility invoice. It is estimated that the bill would be approximatly $1,000.

Prepare the appropriate adjusting or correcting entry for each independent item above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning