Charger Inc. had the following items that require adjusting entries at the end of the year. a. Charger pays its employees $4,000 every Friday for a 5-day work week. This year December 31 falls on a Wednesday. b. Charger earned income of $790,000 for the year for tax purposes. Its effective tax rate is 35%. These taxes must be paid by April 15 of next year. c. Charger borrowed $240,000 with a note payable dated August 1. This note specifies 6%. The interest and principal are due on March 31 of the following year. d. Charger's president earns a bonus equal to 10% of income in excess of $620,000. Income for the year was $790,000. This bonus is paid in May of the following year and any expense is charged to wages expense. Required: Prepare the adjusting journal entries to record these transactions at the end of the current year.

Charger Inc. had the following items that require adjusting entries at the end of the year. a. Charger pays its employees $4,000 every Friday for a 5-day work week. This year December 31 falls on a Wednesday. b. Charger earned income of $790,000 for the year for tax purposes. Its effective tax rate is 35%. These taxes must be paid by April 15 of next year. c. Charger borrowed $240,000 with a note payable dated August 1. This note specifies 6%. The interest and principal are due on March 31 of the following year. d. Charger's president earns a bonus equal to 10% of income in excess of $620,000. Income for the year was $790,000. This bonus is paid in May of the following year and any expense is charged to wages expense. Required: Prepare the adjusting journal entries to record these transactions at the end of the current year.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 9Q

Related questions

Question

Transcribed Image Text:Instructions

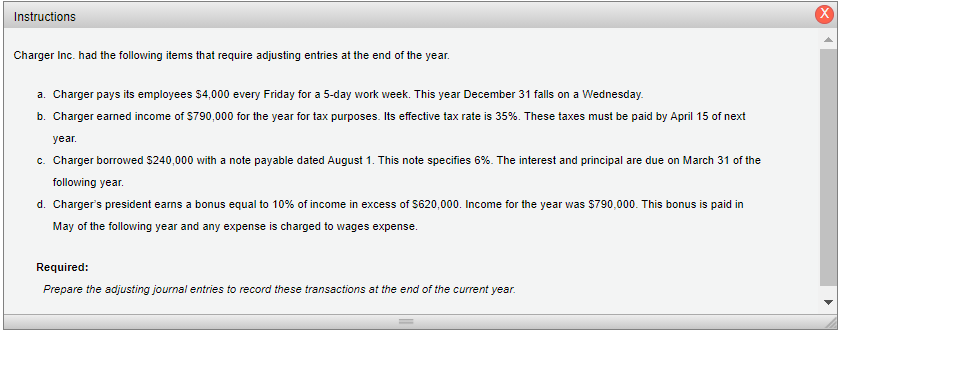

Charger Inc. had the following items that require adjusting entries at the end of the year.

a. Charger pays its employees 54,000 every Friday for a 5-day work week. This year December 31 falls on a Wednesday.

b. Charger earned income of S790,000 for the year for tax purposes. Its effective tax rate is 35%. These taxes must be paid by April 15 of next

year.

c. Charger borrowed $240,000 with a note payable dated August 1. This note specifies 6%. The interest and principal are due on March 31 of the

following year.

d. Charger's president earns a bonus equal to 10% of income in excess of $620,000. Income for the year was $790,000. This bonus is paid in

May of the following year and any expense is charged to wages expense.

Required:

Prepare the adjusting journal entries to record these transactions at the end of the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning