ayment on its long-term note of P6,000,000 due on December 31, xtreme financial pressure and is in default in meeting interest On December 31, 2019, 019. The interest rate is 10% payable every December 31. a an agreement with the creditor, Guimaras Corporation obtained ne following changes in the terms of the note: The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. That is Guimaras Corporation's gain on debt restructuring? Cound of present value factors to three decimal points) P1,032,720 P 602,400 P 151,200 P O

ayment on its long-term note of P6,000,000 due on December 31, xtreme financial pressure and is in default in meeting interest On December 31, 2019, 019. The interest rate is 10% payable every December 31. a an agreement with the creditor, Guimaras Corporation obtained ne following changes in the terms of the note: The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. That is Guimaras Corporation's gain on debt restructuring? Cound of present value factors to three decimal points) P1,032,720 P 602,400 P 151,200 P O

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Question

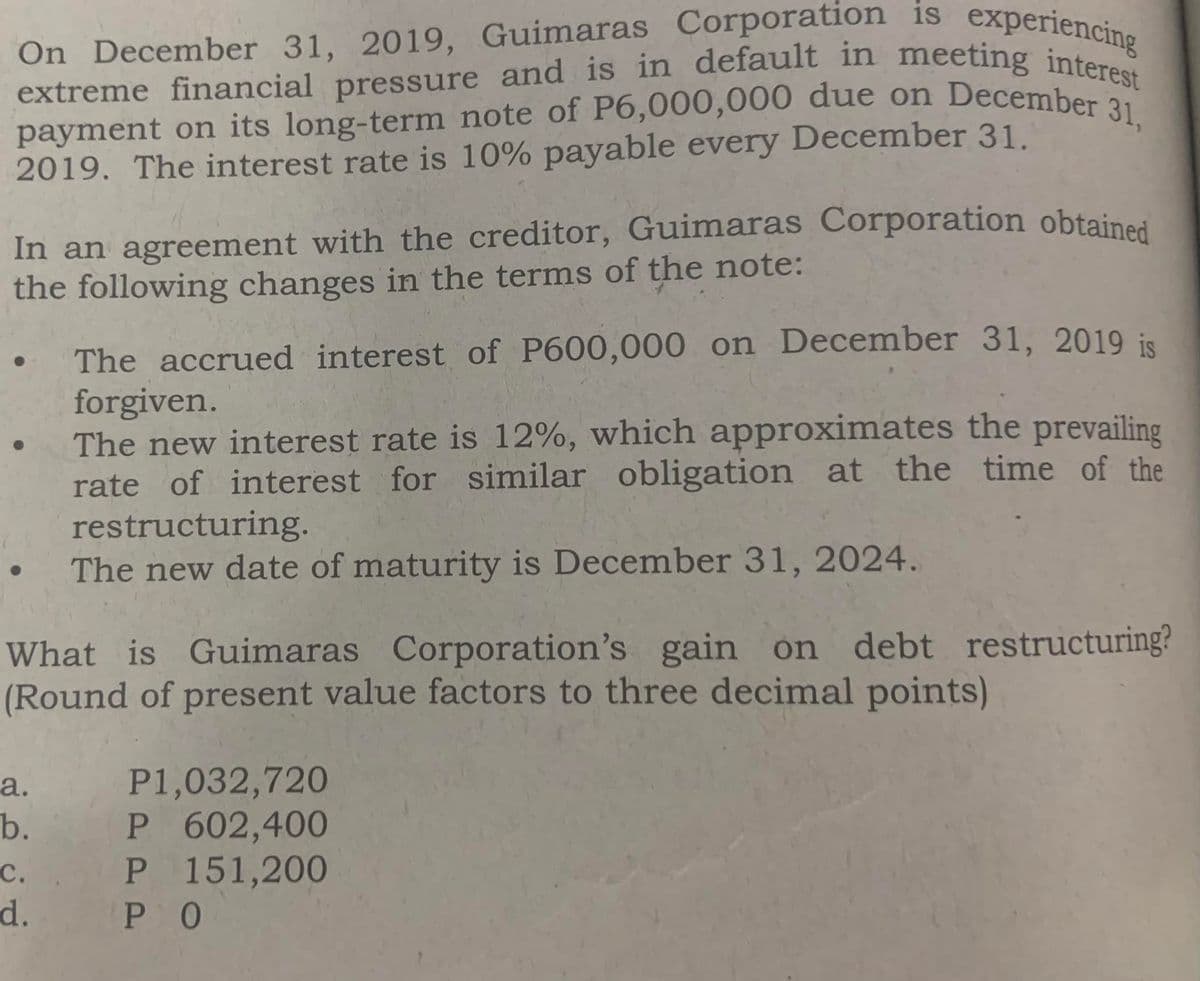

Transcribed Image Text:extreme financial pressure and is in default in meeting interest

payment on its long-term note of P6,000,000 due on December 31,

On December 31, 2019, Guimaras Corporation is experienc

2019. The interest rate is 10% payable every December 31.

In an agreement with the creditor, Guimaras Corporation obtained

the following changes in the terms of the note:

The accrued interest of P600,000 on December 31, 2019 is

forgiven.

The new interest rate is 12%, which approximates the prevailing

rate of interest for similar obligation at the time of the

restructuring.

The new date of maturity is December 31, 2024.

What is Guimaras Corporation's gain on debt restructuring?

(Round of present value factors to three decimal points)

P1,032,720

P 602,400

P 151,200

P O

а.

b.

с.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College