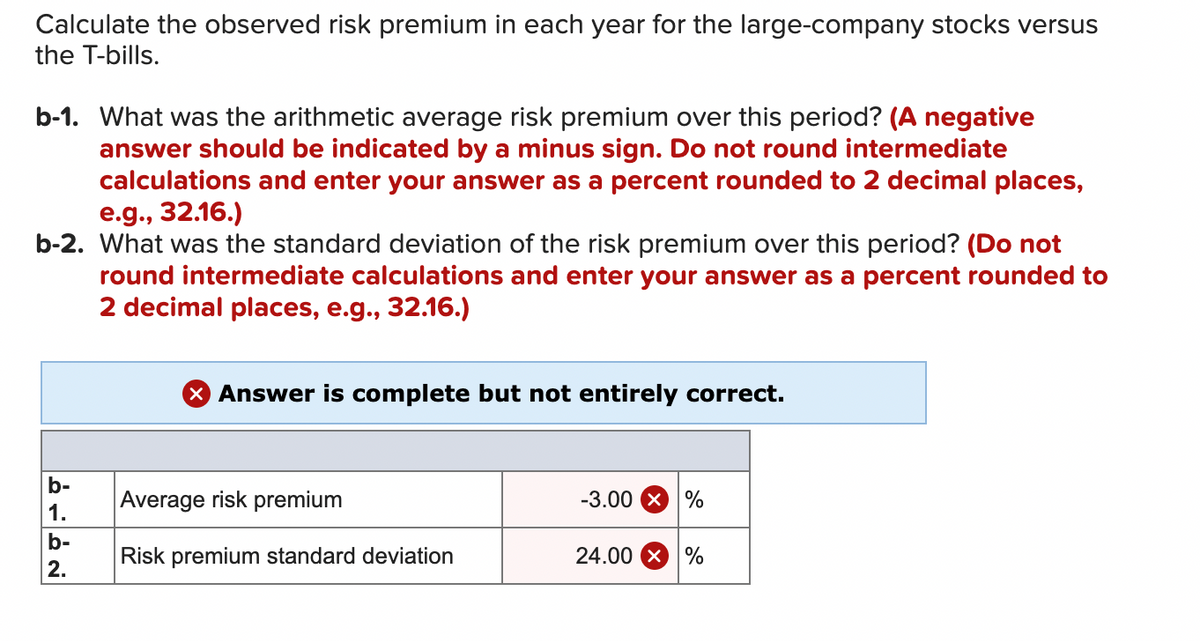

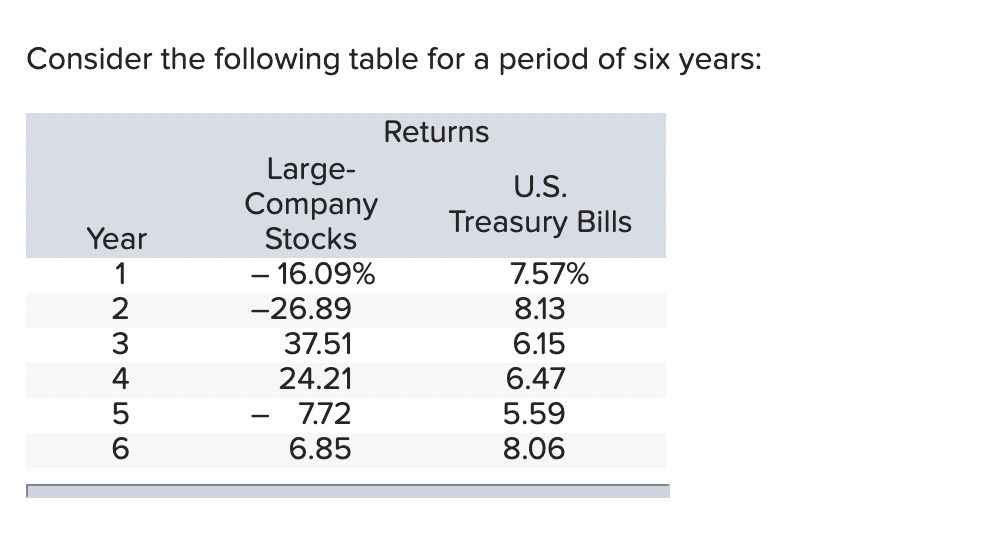

b-1. What was the arithmetic average risk premium over this period? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-2. What was the standard deviation of the risk premium over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Q: Use the information below to answer the following questions. Polish Zloty Euro Mexican Peso Swiss…

A: USD/EURO = 1.2303 USD/Swiss Franc = 1.0246

Q: In a "mixed contract," one involving both the dale of goods and services, does the UCC apply or does…

A: Contract is referred as the legal enforceable agreement, which defines, creates, and also governs…

Q: You want to withdraw $ 21,769 from your account at the end of one year and $ 34,587 at the end of…

A: As per the given information: Withdrawals at the end of the one year - $21,769 Withdrawals at the…

Q: How would I complete this problem fully by hand?

A: Data given: Loan amount is $15,000 Nominal interest rate is 11% n= 1 year

Q: Chet just bought an $80,000 BMW and now has regular annual payments of $8,000 per year starting one…

A: Solution:- When an amount is borrowed, it can either be repaid as a lump sum payment or in…

Q: withdrawal is to be made 5 years from now, how long will it take for the fund to be depleted?

A: Future Value: It represents the compounded amount of the present sum invested over a period of…

Q: Use the information below to find the cost, including a commission of $10 per bond, of buying 75…

A: Face Value "FV" of the bond is considered as $1000 Last Price = 101.375 of the par value Commission…

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Given, The initial cost is $8.02 million Cashflows per years $4.83 million for 3 years Discount rate…

Q: A local real estate investor in Orlando is considering three alternative investments: a motel, a…

A: Expected profit or loss If there is the chance of occurrence of three states with their…

Q: Filer Manufacturing has 6,382,006 shares of common stock outstanding. The current share price is…

A: Equity is the amount that would remain in the hands of a company's shareholders after all of its…

Q: 4. Find the compound amount and interest on P360,000 for 8 years and 6 months at 10% compounded…

A: Under Compounded Interest Interest is on Principal + Interest amount both while in simple interest…

Q: Filer Manufacturing has 6,820,579 shares of common stock outstanding. The current share price is…

A: Data given: A) First bond issue Face value = $45,114,745 Coupon=0.05 n=10 years Sells for 83…

Q: Find the value of X so that the present value of the following cash flow is equal to $70,000.…

A: Present value is one of the most important concepts and techniques of the time value of money and…

Q: ABC Corporation ordinary shares have total market value of P4,000,000 and annual revenues of…

A: Given: Value ABC = P4000,000 Annual revenue ABC = P7500000 Undervalued by = P200000 Annual Revenue…

Q: Harley worked for many years to save enough money to start his own residential landscape design…

A: External rate of return is the rate at which the extra cash flow form the project is expected to…

Q: At what nominal annual rate of interest will money double itself in six years, three months if…

A: Present Value: The present value is the present sum of a series of fixed payments. The series of…

Q: A man secured a ₱ 9,771 loan at 2 % interest rate. Find the annual amortization to extinguish it in…

A: Present Value of Annuity Due refers to a concept which determines the value of cash flows at present…

Q: Compute the price of a 5-year 6.4% coupon with par value if 100$ that pays interest annually…

A: Bond valuation (BV) refers to a method or technique which is used to compute the current value or…

Q: Create investment portfolio (use a Philippine insurance and investment products)

A: In order to create an investment portfolio, the following steps should be considered: i) Asset…

Q: What is the uniform series of payments equivalent to the following present values a) $50,000. The…

A: Installment : It is a sum of money that is due as among one of the several equal payments for an…

Q: Branson Manufacturing has a target debt-equity ratio of .55. Its cost of equity is 10 percent, and…

A: Given, The Target debt-equity ratio is 0.55 Cost of equity is 10%Pre-tax cost of debt is 6% Tax rate…

Q: You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost…

A: Given: Exchange rate 1.1 Euro dollar rate 6% Euro swiss rate 5% Interest rate 12%

Q: A coal mine has Gross income = $250,000 and Mining expenses - $210,000. Question. What is the…

A: The following information has been provided in the question: Gross income =$250,000 Mining expenses…

Q: 2. 2.1 2.2 2.3 2.4 Getum Ltd is considering investing in project Zeta. The following details relate…

A: NPV is a technique under capital budgeting which help in decision making on the basis of future Cash…

Q: Q2: Consider the net cash flows ($) given below for mutually exclusive projects X and Y. Which…

A: IRR is a techniques under Capital budgeting which provide the actual rate of return earned by the…

Q: Please answer the following, based on the information provided for the firm ABC: the company…

A: Current Selling price is $980 Par Value of Bond is $1000 Coupon rate is 6% To Find: Pre tax Cost of…

Q: Suppose you purchase a $1000 Face-Value Zero-Coupon Bond with maturity 30 years and yield to…

A: Par Value of Bond is $1,000 Time period is 30 years Yield to maturity is 4% To Find: Price of bond…

Q: Given the information below, John the CEO needs to make the capital budgeting decision. Which…

A: Net Present Value: It is a measure of absolute profitability applied in the area of capital…

Q: find the future value of $1800 in 3 years at 8% interest

A: According to the concept of the time value of money principle, the value of money will fluctuate…

Q: What is the amount that a company can borrow today if its ann capacity is 10,000 KD, the loan…

A: Loans are paid by annual payments and these carry the payment for loan and pay for interest amount…

Q: What is the over-the-counter (OTC) market?

A: There are many types of over-the -counter markets which are as follows: a) The OTCQX b)OTCQB c) The…

Q: investment growth

A: Stock price refers to the price at which a stock is trading in the market. It is the value that…

Q: 24 Bank-customer relationship in Islamic banks is not always a debtor-creditor relationship due to…

A: 24 Bank-customer relationship in Islamic banks is not always a debtor-creditor relationship due to…

Q: Bank Negara Malaysia was established on ________* A. 26 January 1959 B. 24 January…

A: The position of Bank Negara Malaysia's monetary policy is to uphold price stability while continuing…

Q: Question 2 A race car driver wishes to insure his car for the racing season for $50,000/=. The…

A: The following information has been provided in the question: Insurance amount =$50,000 Probability…

Q: Explain in detail the secondary function of banks. Be able to cite examples for each function

A: Banks are one of the most important financial institutions. A bank performs a host of functions and…

Q: Develop a 12 month CAPITAL EXPENSE BUDGET for a 500 Long Term care facility. Dollar amounts are…

A: Capital expenditure or CAPEX includes purchase of land, machinery, equipment, furniture and…

Q: 7. Charles Inc. has an ending inventory of $423,425, and the cost of goods sold for the year just…

A: Solution:- Inventory Turnover ratio computes the pace at which the inventory is being used.

Q: new hal

A: The cash flow statement refers to the number of cash inflows and outflows in a company that is…

Q: Use calculator to evaluate ordinary annuity formula $80 5% 20 years

A: FV = P ×[(1 + r)n - 1]rPV =P ×[1 - (1 + r)-n]r Here , FV = Future Value of Annuity PV = Present…

Q: Macquarie and the UK Government have agreed a valuation of £1bn on the Green Investment Bank’s…

A: Here, Tax Rate is 20% Increase in required Return is 2%

Q: Solve for the unknown interest rate in each of the following: (Do not round intermediate…

A: Future value is a value of an investment on a specific date in the future. It is calculated as:…

Q: 3 These are the examples of non-banking financial intermediaries except:* A. Discount house…

A: Non-banking financial intermediaries: A financial institution that lacks a full banking license and…

Q: 15 Mudarabah and Musharakah fall under profit and loss sharing transactions and have other risks…

A: Mudarabah and Musharakah fall under profit and loss sharing transactions and have other risks…

Q: Which one of the following is a property of a pure arbitrage portfolio? a. Negative investment. b.…

A: Arbitrage is the practice of purchasing and selling the same assets in multiple markets. This is…

Q: he Malaysian financial system is structured into two major categories, Financial Institutions and…

A: The financial system of Malaysian help in the regulation of money in the country. It basically…

Q: 25 What lesson did we derive from Suratul Baqara Q2:280 in relation to Islamic banks’…

A: Reciting Surah Al-Baqarah has various advantages, but its protection from Shaitan (Satan) and all…

Q: You are a financial analyst for the Brittle Company. The director of capital budgeting has asked you…

A: Given, The initial investment is $10,000 The cost of capital is 12%

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: The net present value (NPV) is one of the capital budgeting technique. The NPV is calculated by…

Q: what is the minimum dollar amount you need to sell the goods for in order for this to be a…

A: Net Present Value: It is calculated by reducing the initial cost from the total present value of…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

- Randall Corporation reported the following revenue data:Year Net revenues (in millions)$$$$6,8007,0046,7327,2762016201720182019Use 2016 as the base year. The trend percentage in 2019 is closest toa. 93%.b. 104%.c. 107%.d. 112%The accompanying data represent the annual rates of return of two companies' stock for the past 12 years. Complete parts (e) through (k). Year Rate of Return of Company 1 Rate of Return of Company 21996 0.203 0.3981997 0.310 0.5101998 0.267 0.4101999 0.195 0.4362000 -0.101 -0.0602001 -0.130 -0.1512002 -0.234 -0.3572003 0.264 0.3282004 0.090 0.2072005 0.030 -0.0142006 0.128 0.0932007 -0.035 0.027 (k) Are there any years where the rate of return of Company 2 was unusual?A Corporation had the following data concerning selected financial data taken from the records listed below.For the year ended December 312021 2020Cash 80,000 640,000Note and account receivable 400,000 1,200,000Merchandise Inventory 720,000 1,200,000Marketable Securities 240,000 80,000Land and Building (net) 2,720,000 2,880,000Bond Payable 2,160,000 2,240,000Account Payable 560,000 880,000Note Payable Short Term 160,000 320,000Sales (20% cash, 80% credit) 18,400,000 19,200,000Cost of Good Sold 8,000,000 11,200,000Required : Compute the following ratios1. current ratio as of December 31,20212. Quick ratio as of December 31, 20213. Account Receivable Turnover ratio for 20214. Merchandise inventory turn over for 20215. The Gross margin for 20206. the average age of account Receivable for 2021( use 360 days

- Selected information is taken from the financial statements of Little Company for two successive years follows. Compute the percentage change from 2020 to 2019 whenever possible. 2020 2019 Accounts receivable............................... P126, 00 P150,000 Marketable securities............................. -0- 250,000 Retained earnings................................... 80,000 (80,000) Notes receivable..................................... 120,000 -0- Notes payables........................................ 860,000 800,000 Cash......................................................... 82,400 80,000 Sales.................................................. 990,000 900,000The following data apply to the next six problems. Consider Fisher & Company's financial data as follows (unit: millions of dollars except ratio figures):Cash and marketable securities $100Fixed assets $280Sales $1,200Net income $358Inventory $180Current ratio 3.2Average collection period 45 daysAverage common equity $500 Calculate the amount of the long-term debt.(a) $134 (b) $500(c) $74 (d) $208The comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $111,000 $100,000Long-term debt 132,680 124,000Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis?

- The comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?Selected information taken from the financial statements of Wiley Company for two successibe years follows. You are to compute the percentage change from year 1 to year 2 whenever possible. Round all calculations to the nearest whole percentage. Year 2 Year 1 a. Accounts Receivable $126,000 $160,000 b. Marketable Securities -0- 250,000 c. Retained Earnings 80,000 (80,000) d. Notes Recievable 120,000 -0- e. Notes Payable 890,000 800,000 f. Cash 84,000 80,000 e. Sales 970,000 910,0001. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What is the total shareholders equity?

- 1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What total amount should be reported as as current assets?1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What total amount should be reported as as current liabilities?The condensed financial statements of Ivanhoe Company for the years 2020-2021 are presented below: (See Images) Compute the following financial ratios by placing the proper amounts for numerators and denominators. (Round per unit answers to 2 decimal places, e.g. 52.75.) (a) Current ratio at 12/31/21 $ $ (b) Acid test ratio at 12/31/21 $ $ (c) Accounts receivable turnover in 2021 $ $ (d) Inventory turnover in 2021 $ $ (e) Profit margin on sales in 2021 $ $ (f) Earnings per share in 2021 $ (g) Return on common stockholders’ equity in 2021 $ $ (h) Price earnings ratio at 12/31/21 $ $ (i) Debt to assets at 12/31/21 $ $ (j) Book value per share at 12/31/21 $