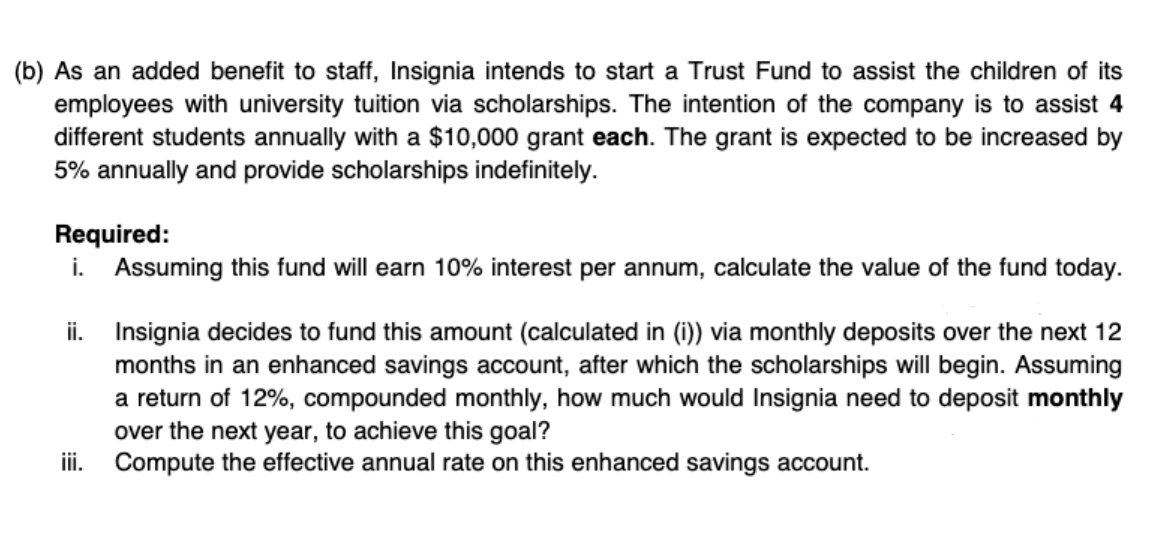

(b) As an added benefit to staff, Insignia intends to start a Trust Fund to assist the children of its employees with university tuition via scholarships. The intention of the company is to assist 4 different students annually with a $10,000 grant each. The grant is expected to be increased by 5% annually and provide scholarships indefinitely. Required: i. Assuming this fund will earn 10% interest per annum, calculate the value of the fund today. ii. Insignia decides to fund this amount (calculated in (i)) via monthly deposits over the next 12 months in an enhanced savings account, after which the scholarships will begin. Assuming a return of 12%, compounded monthly, how much would Insignia need to deposit monthly over the next year, to achieve this goal? iii. Compute the effective annual rate on this enhanced savings account.

(b) As an added benefit to staff, Insignia intends to start a Trust Fund to assist the children of its employees with university tuition via scholarships. The intention of the company is to assist 4 different students annually with a $10,000 grant each. The grant is expected to be increased by 5% annually and provide scholarships indefinitely. Required: i. Assuming this fund will earn 10% interest per annum, calculate the value of the fund today. ii. Insignia decides to fund this amount (calculated in (i)) via monthly deposits over the next 12 months in an enhanced savings account, after which the scholarships will begin. Assuming a return of 12%, compounded monthly, how much would Insignia need to deposit monthly over the next year, to achieve this goal? iii. Compute the effective annual rate on this enhanced savings account.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 17P: Comprehensive The following are three independent situations: 1. K. Herrmann has decided to set up a...

Related questions

Question

Transcribed Image Text:(b) As an added benefit to staff, Insignia intends to start a Trust Fund to assist the children of its

employees with university tuition via scholarships. The intention of the company is to assist 4

different students annually with a $10,000 grant each. The grant is expected to be increased by

5% annually and provide scholarships indefinitely.

Required:

i. Assuming this fund will earn 10% interest per annum, calculate the value of the fund today.

ii. Insignia decides to fund this amount (calculated in (i)) via monthly deposits over the next 12

months in an enhanced savings account, after which the scholarships will begin. Assuming

a return of 12%, compounded monthly, how much would Insignia need to deposit monthly

over the next year, to achieve this goal?

ii. Compute the effective annual rate on this enhanced savings account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning