b) Calculate the total production cost and cost per unit for arms and brackets using the activity-based costing system. c) Explain why the company decided to adopt activity-based costing system instead of absorption costing system?

b) Calculate the total production cost and cost per unit for arms and brackets using the activity-based costing system. c) Explain why the company decided to adopt activity-based costing system instead of absorption costing system?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 10E: SmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that...

Related questions

Question

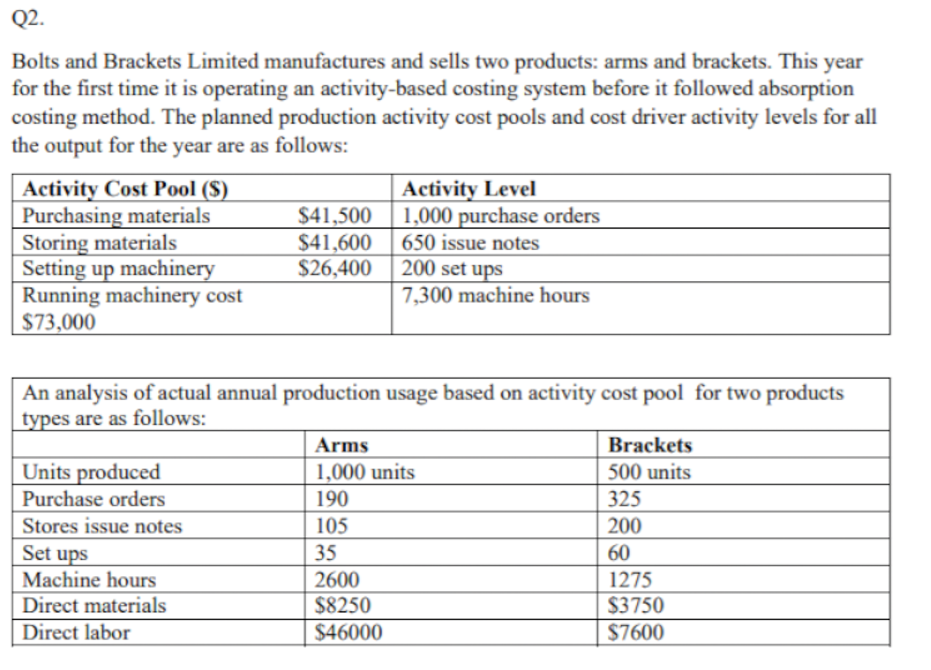

Transcribed Image Text:Q2.

Bolts and Brackets Limited manufactures and sells two products: arms and brackets. This year

for the first time it is operating an activity-based costing system before it followed absorption

costing method. The planned production activity cost pools and cost driver activity levels for all

the output for the year are as follows:

Activity Cost Pool ($)

Purchasing materials

Storing materials

Setting up machinery

Running machinery cost

$73,000

Activity Level

$41,500 | 1,000 purchase orders

650 issue notes

200 set ups

7,300 machine hours

$41,600

$26,400

An analysis of actual annual production usage based on activity cost pool for two products

types are as follows:

Arms

Brackets

Units produced

1,000 units

500 units

Purchase orders

190

325

Stores issue notes

Set ups

105

200

35

60

Machine hours

2600

1275

Direct materials

$8250

$46000

$3750

$7600

Direct labor

Transcribed Image Text:b) Calculate the total production cost and cost per unit for arms and brackets using the

activity-based costing system.

c) Explain why the company decided to adopt activity-based costing system instead of

absorption costing system?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College