b) Given that nothing else is borrowed in the near future, the length of time it will take a government to completely eliminate its stock of debt will be entirely dependent on how much more annual repayments exceed the annual interest expenses. The interest expense portion of the debt is a function of the present stock of debt, y, and is given by i (y) = y - y

b) Given that nothing else is borrowed in the near future, the length of time it will take a government to completely eliminate its stock of debt will be entirely dependent on how much more annual repayments exceed the annual interest expenses. The interest expense portion of the debt is a function of the present stock of debt, y, and is given by i (y) = y - y

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

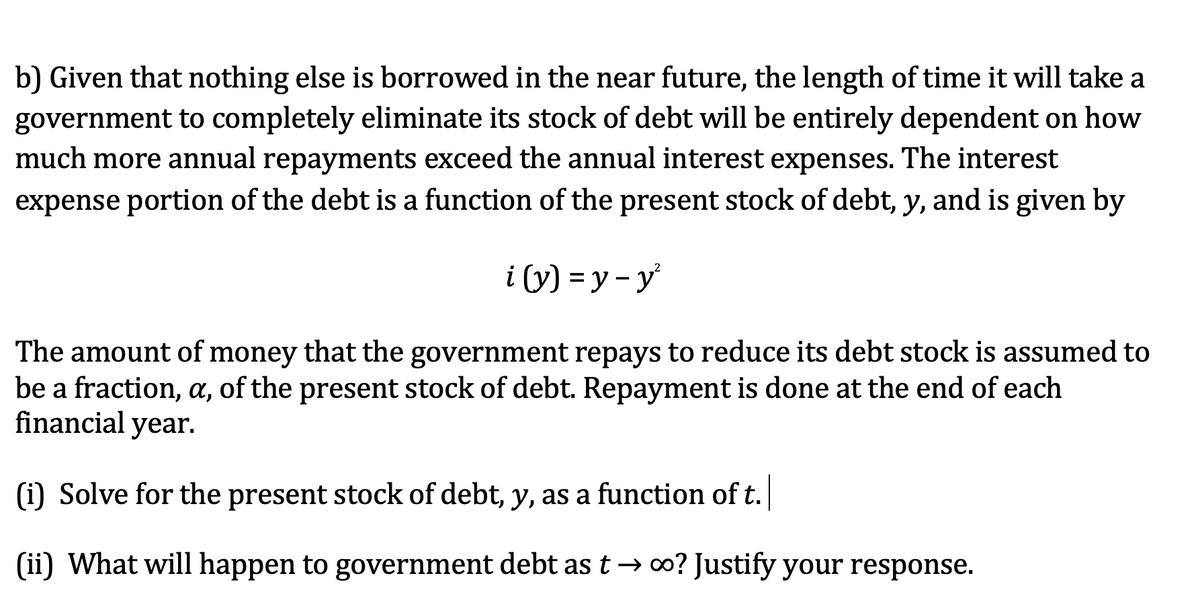

Transcribed Image Text:b) Given that nothing else is borrowed in the near future, the length of time it will take a

government to completely eliminate its stock of debt will be entirely dependent on how

much more annual repayments exceed the annual interest expenses. The interest

expense portion of the debt is a function of the present stock of debt, y, and is given by

i (y) = y - y

The amount of money that the government repays to reduce its debt stock is assumed to

be a fraction, a, of the present stock of debt. Repayment is done at the end of each

financial year.

(i) Solve for the present stock of debt, y, as a function of t.

(ii) What will happen to government debt as t → 00? Justify your response.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning