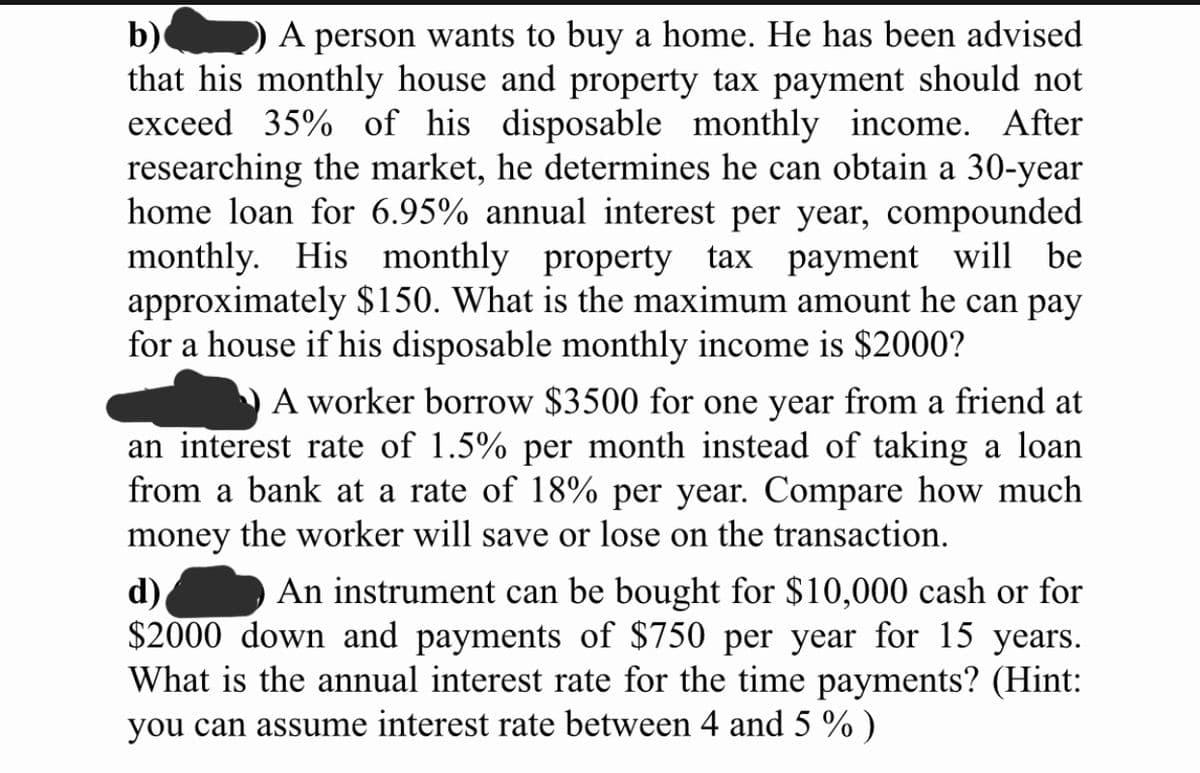

b) that his monthly house and property tax payment should not exceed 35% of his disposable monthly income. After researching the market, he determines he can obtain a 30-year home loan for 6.95% annual interest per year, compounded monthly. His monthly property tax payment will be approximately $150. What is the maximum amount he can pay for a house if his disposable monthly income is $2000? A person wants to buy a home. He has been advised

b) that his monthly house and property tax payment should not exceed 35% of his disposable monthly income. After researching the market, he determines he can obtain a 30-year home loan for 6.95% annual interest per year, compounded monthly. His monthly property tax payment will be approximately $150. What is the maximum amount he can pay for a house if his disposable monthly income is $2000? A person wants to buy a home. He has been advised

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 54P: On June 30, 2019, Kelly sold property for 240,000 cash and a 960,000 note due on September 30, 2020....

Related questions

Question

Transcribed Image Text:b)

that his monthly house and property tax payment should not

exceed 35% of his disposable monthly income. After

researching the market, he determines he can obtain a 30-year

home loan for 6.95% annual interest per year, compounded

monthly. His monthly property tax payment will be

approximately $150. What is the maximum amount he can pay

for a house if his disposable monthly income is $2000?

A person wants to buy a home. He has been advised

A worker borrow $3500 for one year from a friend at

an interest rate of 1.5% per month instead of taking a loan

from a bank at a rate of 18% per year. Compare how much

money the worker will save or lose on the transaction.

An instrument can be bought for $10,000 cash or for

d)

$2000 down and payments of $750 per year for 15 years.

What is the annual interest rate for the time payments? (Hint:

you can assume interest rate between 4 and 5 % )

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning