b. Compute the following Ratios: iv. Average Collection period v. Profit Margin vi. Debt to Total Assets vii. Return on Asset viii. Times Interest Earned Explain to the Manager, what the different classes of ratios measure and identify the bases of comparison on financial information. C.

b. Compute the following Ratios: iv. Average Collection period v. Profit Margin vi. Debt to Total Assets vii. Return on Asset viii. Times Interest Earned Explain to the Manager, what the different classes of ratios measure and identify the bases of comparison on financial information. C.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 27MCQ

Related questions

Question

Transcribed Image Text:b.

Compute the following Ratios:

iv. Average Collection period

v. Profit Margin

vi. Debt to Total Assets

vii. Return on Asset

viii. Times Interest Earned

Explain to the Manager, what the different classes of ratios measure and identify the

bases of comparison on financial information.

C.

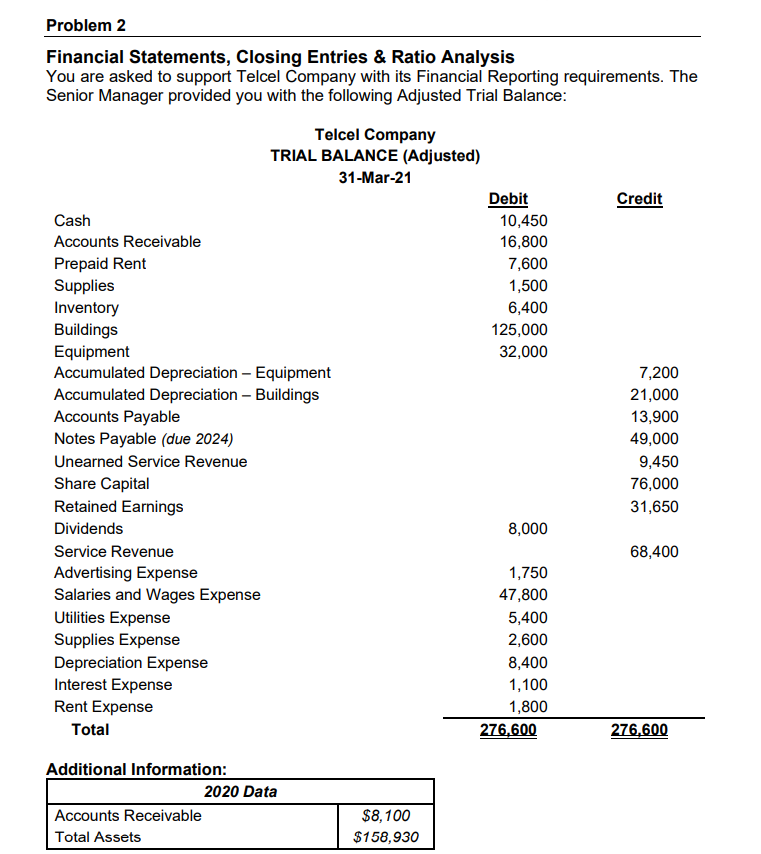

Transcribed Image Text:Problem 2

Financial Statements, Closing Entries & Ratio Analysis

You are asked to support Telcel Company with its Financial Reporting requirements. The

Senior Manager provided you with the following Adjusted Trial Balance:

Telcel Company

TRIAL BALANCE (Adjusted)

31-Mar-21

Debit

10,450

Credit

Cash

Accounts Receivable

16,800

Prepaid Rent

Supplies

7,600

1,500

Inventory

Buildings

Equipment

Accumulated Depreciation – Equipment

Accumulated Depreciation – Buildings

Accounts Payable

Notes Payable (due 2024)

Unearned Service Revenue

6,400

125,000

32,000

7,200

21,000

13,900

49,000

9,450

Share Capital

76,000

Retained Earnings

31,650

Dividends

8,000

Service Revenue

68,400

Advertising Expense

Salaries and Wages Expense

1,750

47,800

Utilities Expense

Supplies Expense

5,400

2,600

Depreciation Expense

Interest Expense

8,400

1,100

Rent Expense

1,800

Total

276,600

276,600

Additional Information:

2020 Data

Accounts Receivable

$8,100

Total Assets

$158,930

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage