Calculate the following ratios a. Gross profit ration b.Net Profit ratio c. Current Ratio d. Liquid ratio.

Calculate the following ratios a. Gross profit ration b.Net Profit ratio c. Current Ratio d. Liquid ratio.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 14P: Investments in Equity Securities Noonan Corporation prepares quarterly financial statements and...

Related questions

Question

Calculate the following ratios

a. Gross profit ration

b.Net Profit ratio

c. Current Ratio

d. Liquid ratio.

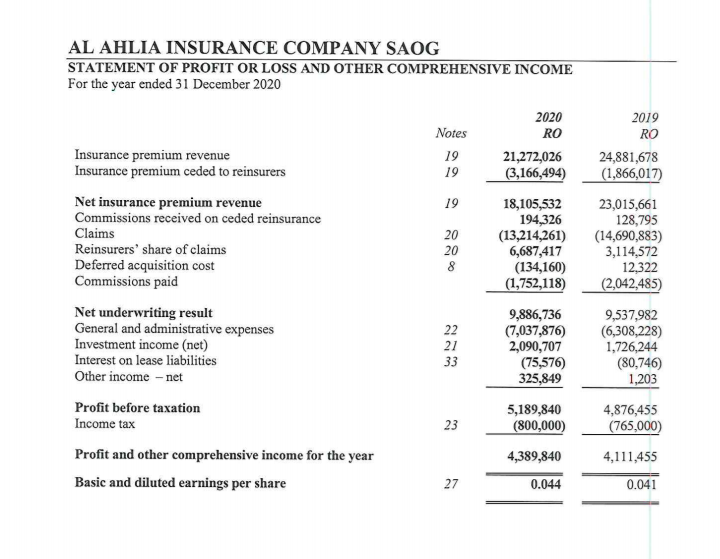

Transcribed Image Text:AL AHLIA INSURANCE COMPANY SAOG

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

For the year ended 31 December 2020

2020

2019

Notes

RO

RO

Insurance premium revenue

Insurance premium ceded to reinsurers

19

21,272,026

(3,166,494)

24,881,678

19

(1,866,017)

Net insurance premium revenue

Commissions received on ceded reinsurance

Claims

Reinsurers' share of claims

Deferred acquisition cost

Commissions paid

19

18,105,532

194,326

(13,214,261)

6,687,417

(134,160)

(1,752,118)

23,015,661

128,795

(14,690,883)

3,114,572

12,322

(2,042,485)

20

20

8

Net underwriting result

General and administrative expenses

Investment income (net)

Interest on lease liabilities

Other income - net

9,886,736

(7,037,876)

2,090,707

(75,576)

325,849

9,537,982

(6,308,228)

1,726,244

(80,746)

1,203

22

21

33

Profit before taxation

5,189,840

4,876,455

Income tax

23

(800,000)

(765,000)

Profit and other comprehensive income for the year

4,389,840

4,111,455

Basic and diluted earnings per share

27

0.044

0.041

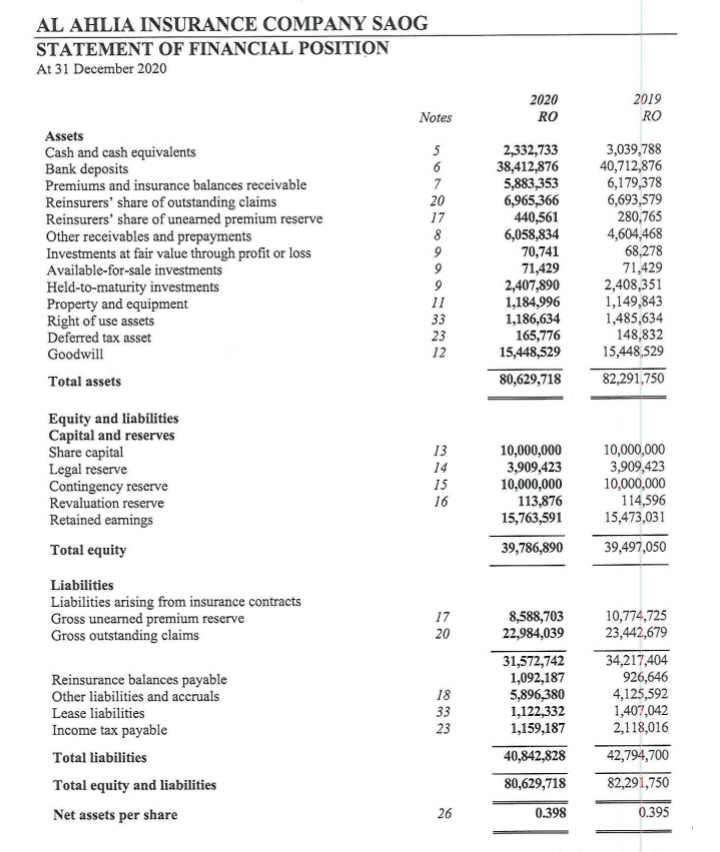

Transcribed Image Text:AL AHLIA INSURANCE COMPANY SAOG

STATEMENT OF FINANCIAL POSITION

At 31 December 2020

2020

RO

2019

Notes

RO

Assets

2,332,733

38,412,876

5,883,353

6,965,366

440,561

6,058,834

70,741

71,429

2,407,890

1,184,996

1,186,634

165,776

15,448,529

3,039,788

40,712,876

6,179,378

6,693,579

280,765

4,604,468

68,278

71,429

2,408,351

1,149,843

1,485,634

148,832

15,448,529

5

Cash and cash equivalents

Bank deposits

Premiums and insurance balances receivable

Reinsurers' share of outstanding claims

Reinsurers' share of unearned premium reserve

Other receivables and prepayments

Investments at fair value through profit or loss

Available-for-sale investments

Held-to-maturity investments

Property and equipment

Right of use assets

Deferred tax asset

6

7

20

17

8

11

33

23

Goodwill

12

Total assets

80,629,718

82,291,750

Equity and liabilities

Capital and reserves

Share capital

Legal reserve

Contingency reserve

10,000,000

3,909,423

10,000,000

113,876

15,763,591

10,000,000

3,909,423

10,000,000

114,596

15,473,031

13

14

15

Revaluation reserve

16

Retained earnings

Total equity

39,786,890

39,497,050

Liabilities

Liabilities arising from insurance contracts

Gross unearned premium reserve

Gross outstanding claims

10,774,725

23,442,679

17

8,588,703

22,984,039

20

31,572,742

1,092,187

5,896,380

1,122,332

1,159,187

34,217,404

926,646

4,125,592

1,407,042

2,118,016

Reinsurance balances payable

Other liabilities and accruals

18

Lease liabilities

33

Income tax payable

23

Total liabilities

40,842,828

42,794,700

Total equity and liabilities

80,629,718

82,291,750

Net assets per share

26

0.398

0.395

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning