B. Gulded Practice Activity Activity: Situation Your grandparents have decided to sell their real estate property in Labason, Zamboanga del Norte and they are planning to purchase an agriculture land in Titay, Zamboanga Sibugay. They posted an online advertisement for this. A week after, two offers came. Offer 1: P500,000 down payments plus P1,500,000 lump-sum payment 10 years from now. Offer 2: P500,000 down payments plus P12,500 per month for 10 years. Which among the two offers should your grandparents choose if the payments will have an interest of 12% compounded monthly? Find the fair market value of the two offers. Solution.

B. Gulded Practice Activity Activity: Situation Your grandparents have decided to sell their real estate property in Labason, Zamboanga del Norte and they are planning to purchase an agriculture land in Titay, Zamboanga Sibugay. They posted an online advertisement for this. A week after, two offers came. Offer 1: P500,000 down payments plus P1,500,000 lump-sum payment 10 years from now. Offer 2: P500,000 down payments plus P12,500 per month for 10 years. Which among the two offers should your grandparents choose if the payments will have an interest of 12% compounded monthly? Find the fair market value of the two offers. Solution.

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 24P

Related questions

Question

Answer the situation

Transcribed Image Text:ilippine

B. Gulded Practice Activity

Activity: Situation

Your grandparents have decided to sell their real estate property in

Labason, Zamboanga del Norte and they are planning to purchase an agriculture

land in Titay, Zamboanga Sibugay. They posted an online advertisement for this.

A week after, two offers came,

Offer 1: P500,000 down payments plus P1,500,000 lump-sum

payment 10 years from now.

Offer 2: P500,000 down payments plus P12,500 per month for

10 years.

Which among the two offers should your grandparents choose if the

payments will have an interest of 12% compounded monthly? Find the fair market

value of the two offers.

Solution.

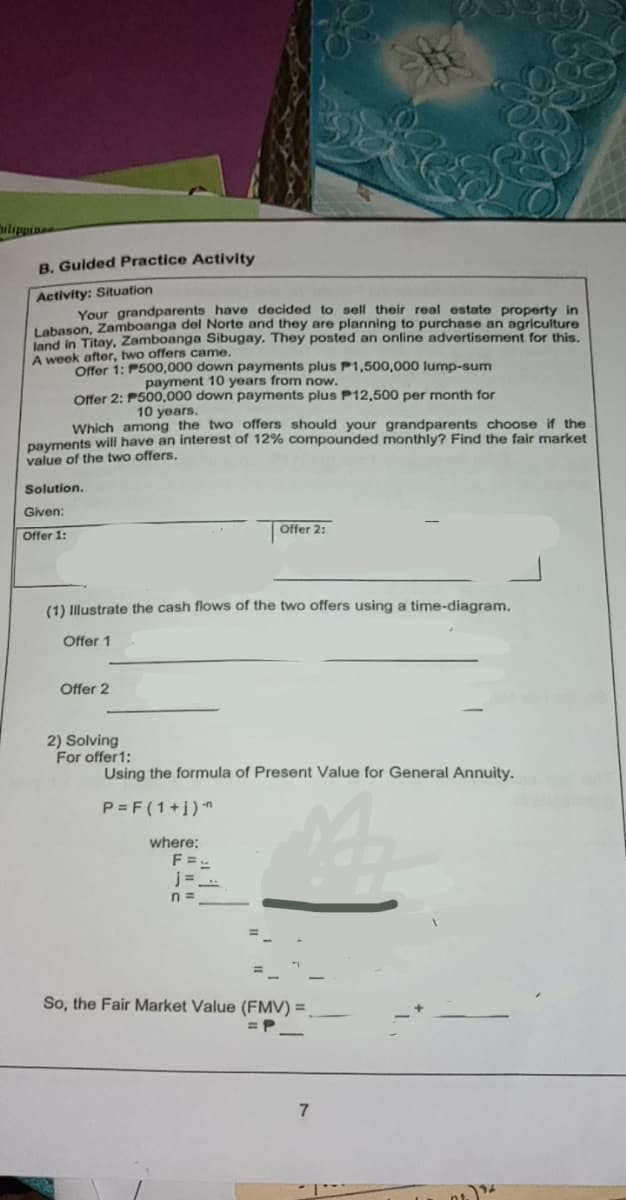

Given:

Offer 2:

Offer 1:

(1) Illustrate the cash flows of the two offers using a time-diagram.

Offer 1

Offer 2

2) Solving

For offer1:

Using the formula of Present Value for General Annuity.

P =F(1+j)

where:

F ==

n =

So, the Fair Market Value (FMV) =

=P-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT