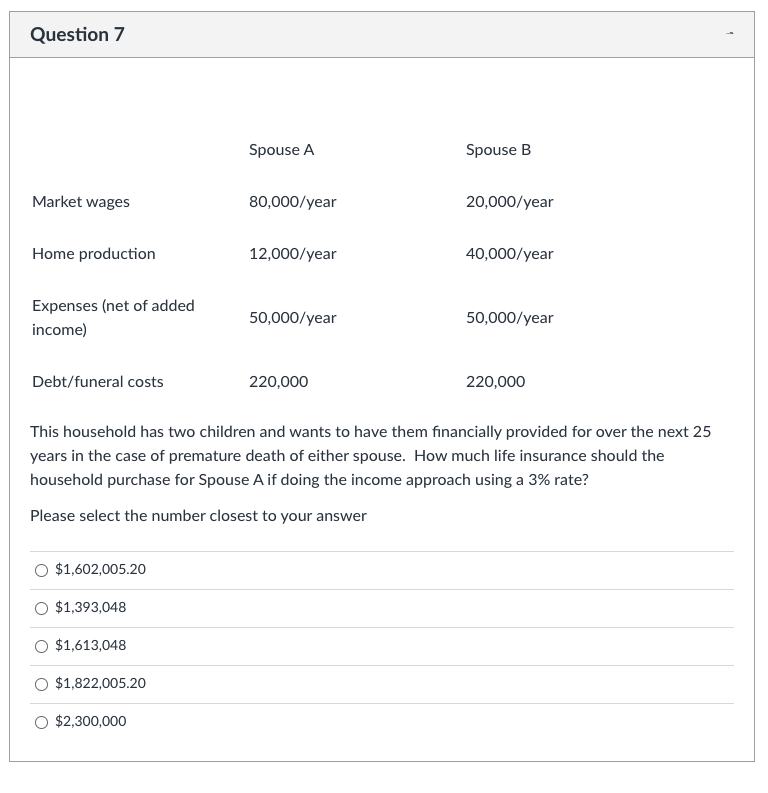

Spouse A Spouse B Market wages 80,000/year 20,000/year Home production 12,000/year 40,000/year Expenses (net of added 50,000/year 50,000/year income) Debt/funeral costs 220,000 220,000 This household has two children and wants to have them financially provided for over the next 25 years in the case of premature death of either spouse. How much life insurance should the household purchase for Spouse A if doing the income approach using a 3% rate? Please select the number closest to your answer

Spouse A Spouse B Market wages 80,000/year 20,000/year Home production 12,000/year 40,000/year Expenses (net of added 50,000/year 50,000/year income) Debt/funeral costs 220,000 220,000 This household has two children and wants to have them financially provided for over the next 25 years in the case of premature death of either spouse. How much life insurance should the household purchase for Spouse A if doing the income approach using a 3% rate? Please select the number closest to your answer

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

1

Transcribed Image Text:Question 7

Spouse A

Spouse B

Market wages

80,000/year

20,000/year

Home production

12,000/year

40,000/year

Expenses (net of added

50,000/year

50,000/year

income)

Debt/funeral costs

220,000

220,000

This household has two children and wants to have them financially provided for over the next 25

years in the case of premature death of either spouse. How much life insurance should the

household purchase for Spouse A if doing the income approach using a 3% rate?

Please select the number closest to your answer

$1,602,005.20

$1,393,048

$1,613,048

$1,822,005.20

$2,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning