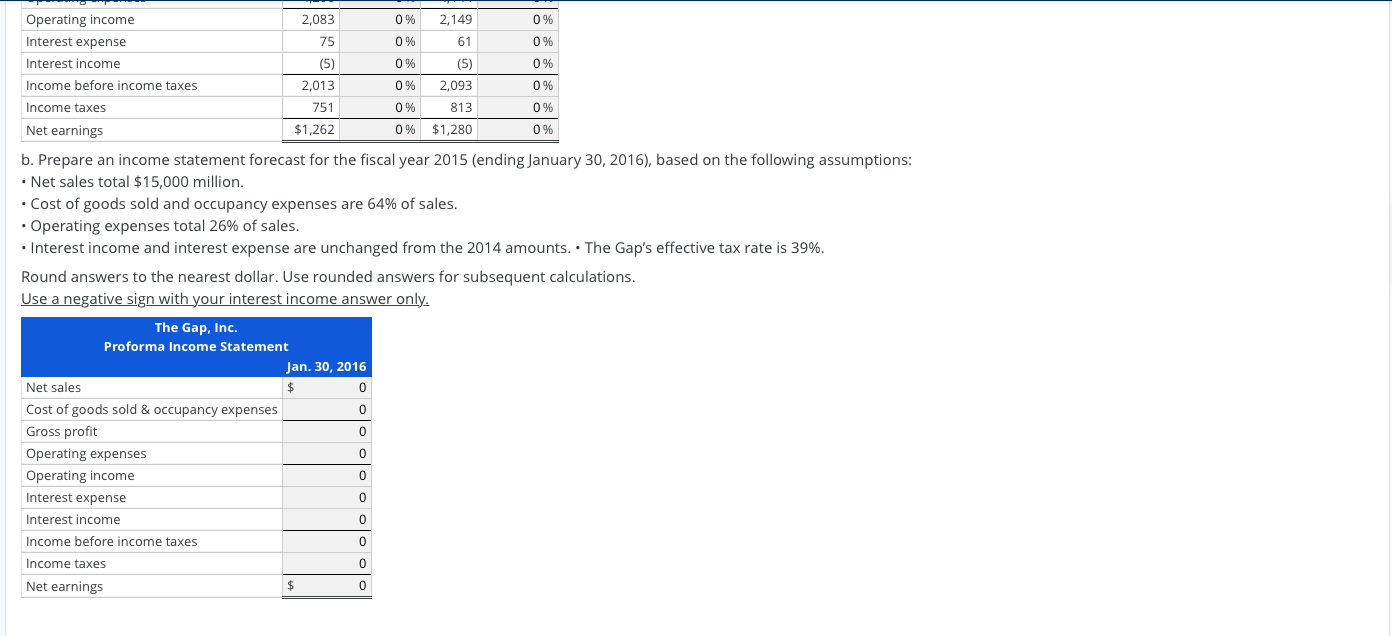

b. Prepare an income statement forecast for the fiscal year 2015 (ending January 30, 2016), based on the following assumptions: • Net sales total $15,000 million. • Cost of goods sold and occupancy expenses are 64% of sales. • Operating expenses total 26% of sales. • Interest income and interest expense are unchanged from the 2014 amounts. • The Gap's effective tax rate is 39%. Round answers to the nearest dollar. Use rounded answers for subsequent calculations. Use a negative sign with your interest income answer only. The Gap, Inc. Proforma Income Statement Jan. 30, 2016 Net sales Cost of goods sold & occupancy expenses Gross profit Operating expenses Operating income Interest expense Interest income Income before income taxes Income taxes Net earnings 24

b. Prepare an income statement forecast for the fiscal year 2015 (ending January 30, 2016), based on the following assumptions: • Net sales total $15,000 million. • Cost of goods sold and occupancy expenses are 64% of sales. • Operating expenses total 26% of sales. • Interest income and interest expense are unchanged from the 2014 amounts. • The Gap's effective tax rate is 39%. Round answers to the nearest dollar. Use rounded answers for subsequent calculations. Use a negative sign with your interest income answer only. The Gap, Inc. Proforma Income Statement Jan. 30, 2016 Net sales Cost of goods sold & occupancy expenses Gross profit Operating expenses Operating income Interest expense Interest income Income before income taxes Income taxes Net earnings 24

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 20Q: What is the difference between a multi-step and simple income statement?

Related questions

Question

Need detailed help with the proforma income statement

Transcribed Image Text:b. Prepare an income statement forecast for the fiscal year 2015 (ending January 30, 2016), based on the following assumptions:

• Net sales total $15,000 million.

• Cost of goods sold and occupancy expenses are 64% of sales.

• Operating expenses total 26% of sales.

• Interest income and interest expense are unchanged from the 2014 amounts. • The Gap's effective tax rate is 39%.

Round answers to the nearest dollar. Use rounded answers for subsequent calculations.

Use a negative sign with your interest income answer only.

The Gap, Inc.

Proforma Income Statement

Jan. 30, 2016

Net sales

Cost of goods sold & occupancy expenses

Gross profit

Operating expenses

Operating income

Interest expense

Interest income

Income before income taxes

Income taxes

Net earnings

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning