Calculate the following ratios for 2020 for Holiday Gifts Galore, Inc.: Industry avergage Average Collection Period: 35 days Debt ratio: 60% Return on Equity: 10.5% Current Ratio: 1.3 Inventory Turnover: 8.1 TImes interest earned: 2.5 Net Profit Margin: 3.78% Return on total assets: 4.36% Based on the ratios you have calculated above, does Holiday Gifts Galore, Inc. appear to be stronger or weaker than the industry average data? Which specific ratios led you to this conclusion?

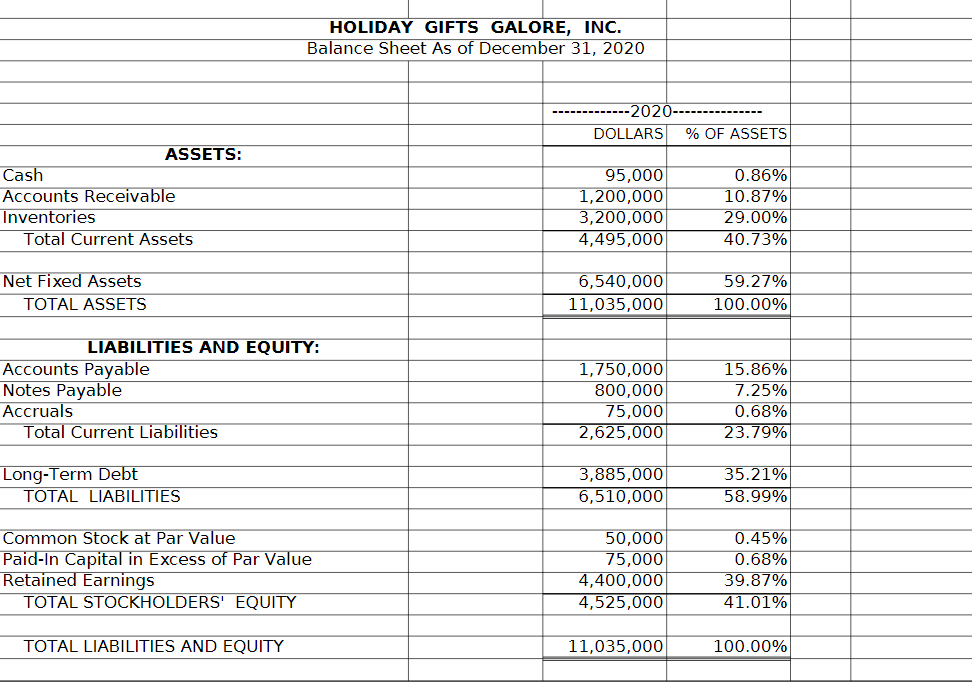

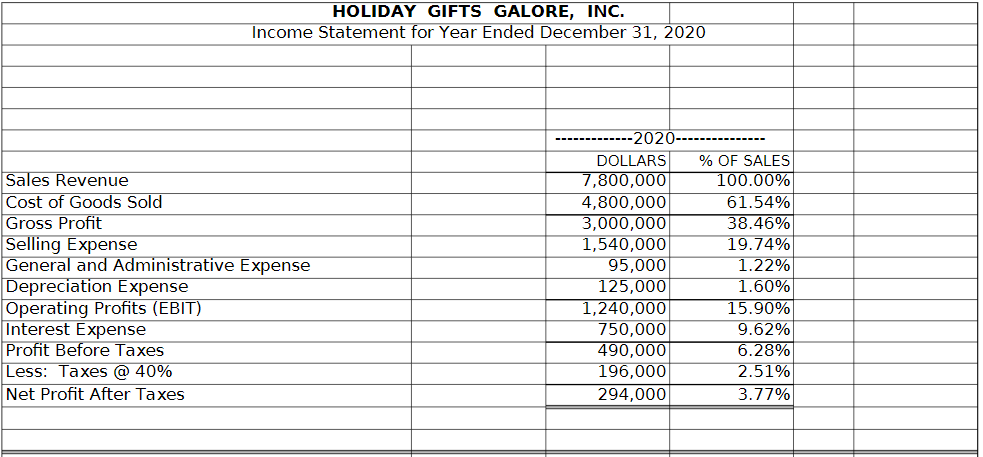

Calculate the following ratios for 2020 for Holiday Gifts Galore, Inc.:

Industry avergage

Average Collection Period: 35 days

Debt ratio: 60%

Return on Equity: 10.5%

Inventory Turnover: 8.1

TImes interest earned: 2.5

Net Profit Margin: 3.78%

Return on total assets: 4.36%

Based on the ratios you have calculated above, does Holiday Gifts Galore, Inc. appear

to be stronger or weaker than the industry average data? Which specific ratios led you to

this conclusion?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images