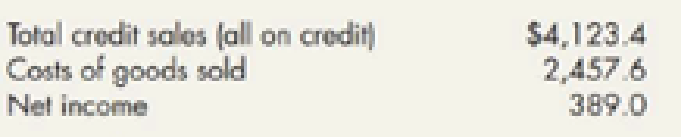

Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for 20X3 it as follows (amounts in millions):

Required:

Next Level Compute the following for 20X3. Provide a brief description of what each ratio reveals about McCormick

- 1. return on common equity

- 2. debt-to-assets

- 3. debt-toequity

- 4. current

- 5. quick (McCormick uses cash and equivalents, short-term securities and receivables in their quick ratio calculation.)

- 6. inventory turnover days

- 7. accounts receivable turnover days

- 8. accounts payable turnover days

- 9. operating cycle (in days)

- 10. total asset turnover

Use the following information for 14-17 and 14-18:

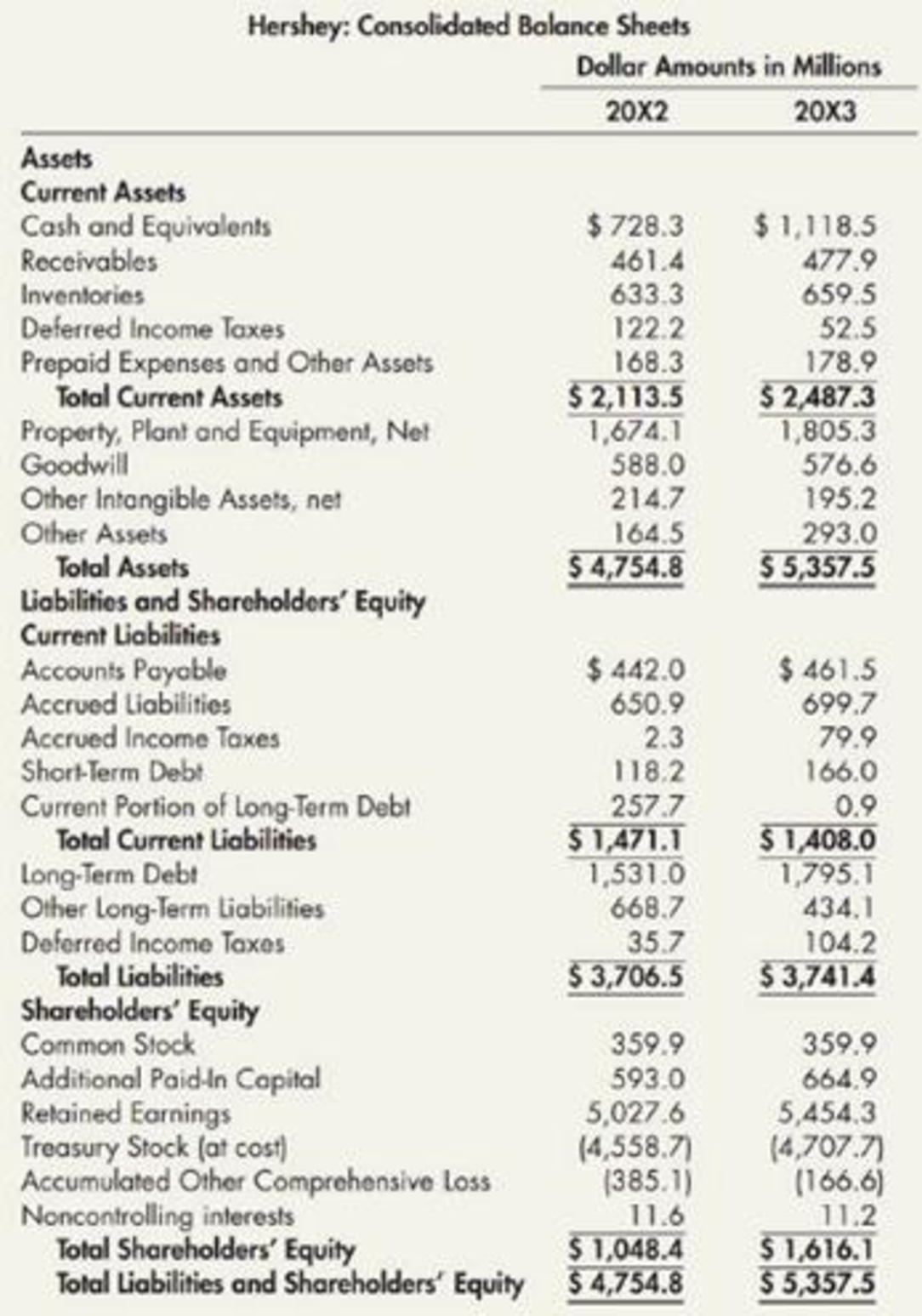

The Hershey Company is one of the world’s leading producers of chocolates, candies, and confections. It sells chocolates and candies, mints and gums, baking ingredients, toppings, and beverages. Hershey’s consolidated balance sheets for 20X2 and 20X3 follow.

Requirement 1:

Determine the return on common equity ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the return on common equity ratio of C&C Incorporation for 20X3:

Step 1: Calculate the average total common stockholders’ equity.

Step 2: Calculate the return on common equity ratio of C&C Incorporation for 20X3.

Hence, the return on common equity ratio of C&C Incorporation for 20X3 is 0.213.

Comment:

Return on common equity ratio indicates that C&C Incorporation generated a 21.3% return for its common shareholders.

Requirement 2:

Determine the debt-to-assets ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the debt-to-assets ratio of C&C Incorporation for 20X3:

Hence, the debt-to-assets ratio of C&C Incorporation for 20X3 is 0.562.

Comment:

Debt-to-assets ratio indicates that C&C Incorporation’s 56.2% of total assets are financed by its creditors.

Requirement 3:

Determine the debt-to-equity ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the debt-to-equity ratio of C&C Incorporation for 20X3:

Hence, the debt-to- equity ratio of C&C Incorporation for 20X3 is 1.28.

Comment:

Debt-to-assets ratio indicates that C&C Incorporation has $1.28 in total liabilities for every of $1.00 in equity.

Requirement 4:

Determine the current ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the current ratio of C&C Incorporation for 20X3:

Hence, the current ratio of C&C Incorporation for 20X3 is 1.29.

Comment:

Current ratio indicates that C&C Incorporation has $1.29 in current assets for every of $1.00 in current liabilities.

Requirement 5:

Determine the quick ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the quick ratio of C&C Incorporation for 20X3:

Hence, the quick ratio of C&C Incorporation for 20X3 is 0.53.

Comment:

Quick ratio indicates that C&C Incorporation has $0.53 in quick assets (cash and receivables) for every of $1.00 in current liabilities.

Requirement 6:

Determine the inventory turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the inventory turnover in days of C&C Incorporation for 20X3:

Step 1: Calculate the average inventory.

Step 2: Calculate the inventory turnover.

Step 3: Calculate the inventory turnover in days of C&C Incorporation for 20X3.

Hence, the inventory turnover days of C&C Incorporation for 20X3 are 95.93 days.

Comment:

On an average C&C Incorporation takes 100 days to convert inventory into sales in the operation cycle.

Requirement 7:

Determine the accounts receivable turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the accounts receivable turnover in days of C&C Incorporation for 20X3:

Step 1: Calculate the average accounts receivable.

Step 2: Calculate the accounts receivable turnover.

Step 3: Calculate the accounts receivable turnover in days of C&C Incorporation for 20X3.

Hence, the accounts receivable turnover days of C&C Incorporation for 20X3 are

Comment:

On an average C&C Incorporation takes 43 days to collect its receivables from its customers.

Requirement 8:

Determine the accounts payable turnover in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the accounts payable turnover in days of C&C Incorporation for 20X3:

Step 1: Determine the amount of inventory purchases.

Step 2: Calculate the average accounts payable.

Step 3: Calculate the accounts payable turnover.

Step 4: Determine the accounts payable turnover in days.

Hence, the accounts payable turnover in days of C&C Incorporation for 20X3 is 55.3 days.

Comment:

On an average C&C Incorporation takes 55 days to pay its payables to its suppliers.

Requirement 9:

Determine the operating cycle in days of C&C Incorporation for 20X3.

Explanation of Solution

Determine the operating cycle in days of C&C Incorporation for 20X3:

Hence, the operating cycle in days of C&C Incorporation for 20X3 is 83.2 days.

Comment:

C&C Incorporation takes 83.2days to complete an operating cycle (the purchase of inventory and collection of cash from accounts receivable).

Requirement 10:

Determine the total assets turnover ratio of C&C Incorporation for 20X3.

Explanation of Solution

Determine the total assets turnover ratio of C&C Incorporation for 20X3:

Step 1: Calculate average total assets.

Step 2: Calculate the total assets turnover ratio of C&C Incorporation for 20X3.

Hence, the total assets turnover ratio of C&C Incorporation for 20X3 is 0.96.

Comment:

Total assets turnover ratio indicates that C&C Incorporation has generated $0.96 in sales for every of $1.00 in assets

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

- Liquidity Ratios NWAs financial statements contain the following information: Note: Round answers to two decimal places. Required: 1. What is its current ratio? 2. What is its quick ratio? 3. What is its cash ratio? 4. Discuss NWAs liquidity using these ratios.arrow_forwardComparative Analysis: Under Armour, Inc., versus Columbia Sportswear Refer to the 10-K reports of Under Armour, Inc., and Columbia Sportswear that are available for download from the companion website at CengageBrain.com. Required: Compare the values and trends of these ratios when evaluating Under Armours and Columbias short-term liquidity.arrow_forwardA Preparation of Ratios Refer to the financial statements for Burch Industries in Problem 12-89A and the following data. Required: 1. Prepare all the financial ratios for Burch for 2019 and 2018 (using percentage terms where appropriate and rounding all answers to two decimal places). 2. CONCEPTUAL CONNECTION Explain whether Burchs short-term liquidity is adequate. 3. CONCEPTUAL CONNECTION Discuss whether Burch uses its assets efficiently. 4. CONCEPTUAL CONNECTION Determine whether Burch is profitable. 5. CONCEPTUAL CONNECTION Discuss whether long-term creditors should regard Burch as a high-risk or a low-risk firm. 6. Perform a Dupont analysis (rounding to two decimal places) for 2018 and 2019.arrow_forward

- Liquidity Ratios JRLs financial statements contain the following information: Required: 1. What is its current ratio? 2. What is its quick ratio? 3. What is its cash ratio? 4. Discuss JRLs liquidity using these ratios.arrow_forwardUsing Ratios to Determine Account Balance.We are givem the following information for Cathy Corporation Sales(credit) . 3,000,000 Cash 150,000 Inventory 850,000 Current liabilities 700,000 Asset turnover 1.25 times Current ratio 2.50 times Debt-to assets ratio 40% Receivable turnover 6 times Current assets are composed of cash, marketable securities, accounts receivable and inventory. a.Calculate the amount receivable b.Calculate the marketable securities c.Calculate the fixed assets d.Calculate the long term debtarrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Find the following financial ratios for Smolira Golf Corporation (use year-end figures rather than average values where appropriate): (Enter the profitability ratio answers as a percent rounded to 2 decimal places, e.g., 32.16. Round the remaining answers to 2 decimal places, e.g., 32.16.) 1. Long-term Solvency Ratios 2020 2021 Total debt ratio times times Debt-equity ratio times times Equity multiplier times times 2. Times interest earned times Cash coverage ratio times 3. Profitability Ratios Profit margin % Return on Assets % Return on Equity %arrow_forward

- Use the financial ratios of company A and company B to answer the questions below. Company A Company B Yr t+1 Year t Yr t+1 Year t Current ratio 0.55 0.59 0.56 0.55 Accounts receivable turnover 6.22 6.25 5.06 4.87 Debt to total assets 40.5% 40% 67.8% 65.9% Times interest earned 8.80 30.6 5.97 6.33 Free cash flows (in millions) ($3,819) $3,173 $168 $550 Return on stockholders’equity 7.7% 7.7% 26.6% 23.3% Return on assets 4.3% 4.3% 8.9% 7.9% Profit margin…arrow_forwardCalculate the following ratios for 2021 using working Excel formulas. Make sure to label each appropriately using the following cell (number of days, number of times, etc.) Round each answer to 2 decimal places (example: ROE of .1678 should display as 16.78%): Current Ratio Quick Ratio Debt to Equity Ratio Equity Multiplier Times Interest Earned Dividend Yield Inventory Turnover Days’ Sales in Inventory Receivables Turnover Days’ Sales in Receivables Total Asset Turnover Profit Margin Return on Assets Return on Equity P/E Ratio 2.Calculate Return on Equity (ROE) for 2021 using the Dupontarrow_forwardData pertaining to the current position of Forte Company follow:Cash $412,500Marketable securities 187,500Accounts and notes receivable (net) 300,000Inventories 700,000Prepaid expenses 50,000Accounts payable 200,000Notes payable (short-term) 250,000Accrued expenses 300,000 Instructions1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. Round ratios in parts b through j to one decimal place.2. List the following captions on a sheet of paper:Transaction Working Capital Current Ratio Quick Ratio Compute the working capital, the…arrow_forward

- The following data apply to the next six problems. Consider Fisher & Company's financial data as follows (unit: millions of dollars except ratio figures):Cash and marketable securities $100Fixed assets $280Sales $1,200Net income $358Inventory $180Current ratio 3.2Average collection period 45 daysAverage common equity $500 Calculate the amount of the long-term debt.(a) $134 (b) $500(c) $74 (d) $208arrow_forwardSABC Limited has the following information: The market values of the different components are: Debt (long-term loans): R200m. and Ordinary Shares: R500m. The current (market related) cost of the different components was already calculated as being. Debt (long-term loan) 6% (after-tax) and Ordinary Shares: 14%. Required: Calculate the WACC of SABC Limited by: a. Using the mathematical formula b. Completing the WACC tablearrow_forwardUsing the statements provided Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on assets Return on stockholders’ equity For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2% A competitor of ACME has for the same time period reported the following three ratios: Current ratio 1.52Long-term debt to equity .25 or 25%Net profit margin .08 or 8% Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning