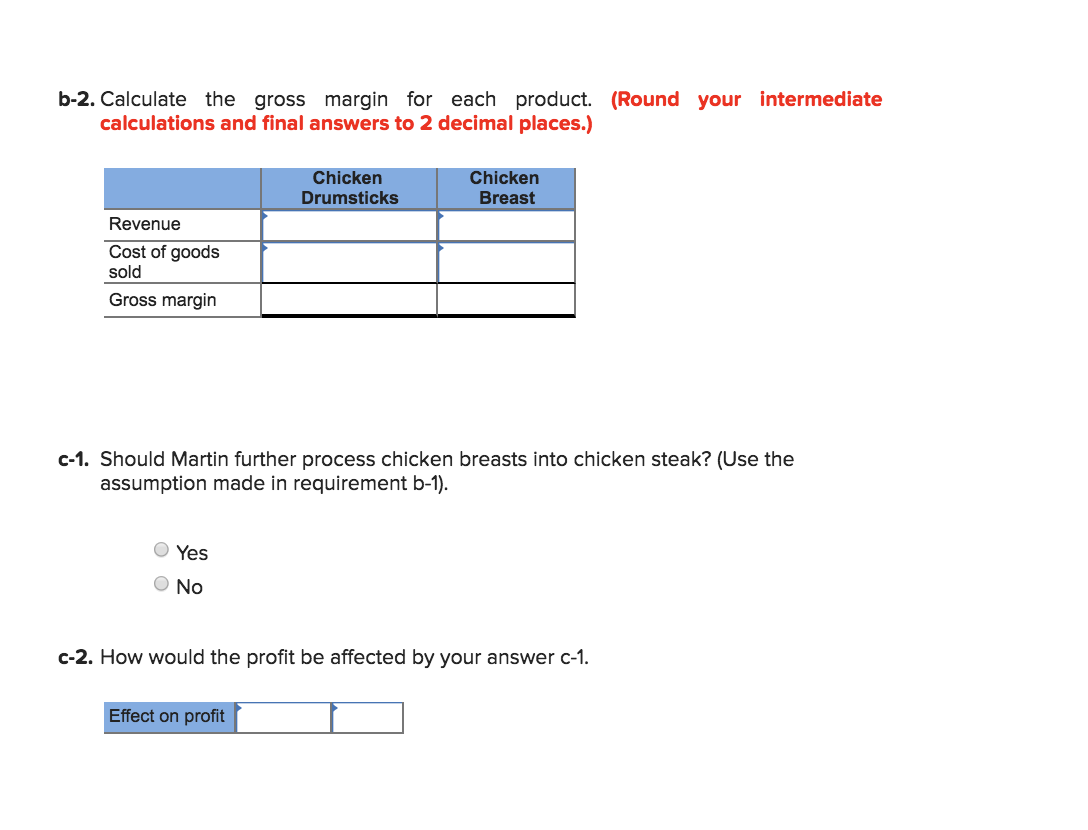

b-2. Calculate the gross margin for each product. (Round your intermediate calculations and final answers to 2 decimal places.) Chicken Chicken Drumsticks Breast Revenue Cost of goods sold Gross margin c-1. Should Martin further process chicken breasts into chicken steak? (Use the assumption made in requirement b-1) Yes ONo c-2. How would the profit be affected by your answer c-1 Effect on profit Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,00o. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20.

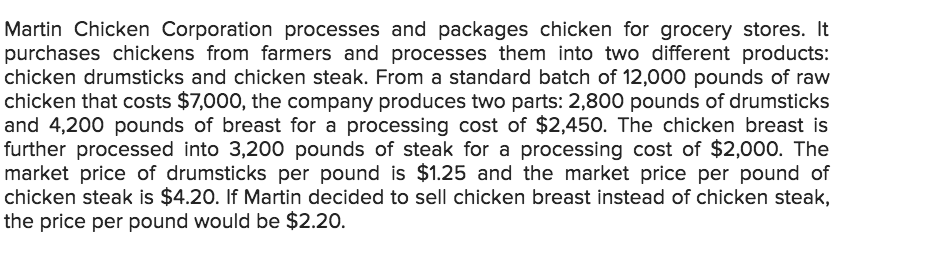

b-2. Calculate the gross margin for each product. (Round your intermediate calculations and final answers to 2 decimal places.) Chicken Chicken Drumsticks Breast Revenue Cost of goods sold Gross margin c-1. Should Martin further process chicken breasts into chicken steak? (Use the assumption made in requirement b-1) Yes ONo c-2. How would the profit be affected by your answer c-1 Effect on profit Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,00o. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20.

Chapter10: Inventory

Section: Chapter Questions

Problem 4MC: If goods are shipped FOB destination, which of the following is true? A. Title to the goods will...

Related questions

Question

Transcribed Image Text:b-2. Calculate the gross margin for each product. (Round your intermediate

calculations and final answers to 2 decimal places.)

Chicken

Chicken

Drumsticks

Breast

Revenue

Cost of goods

sold

Gross margin

c-1. Should Martin further process chicken breasts into chicken steak? (Use the

assumption made in requirement b-1)

Yes

ONo

c-2. How would the profit be affected by your answer c-1

Effect on profit

Transcribed Image Text:Martin Chicken Corporation processes and packages chicken for grocery stores. It

purchases chickens from farmers and processes them into two different products:

chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw

chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks

and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is

further processed into 3,200 pounds of steak for a processing cost of $2,00o. The

market price of drumsticks per pound is $1.25 and the market price per pound of

chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak,

the price per pound would be $2.20.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub