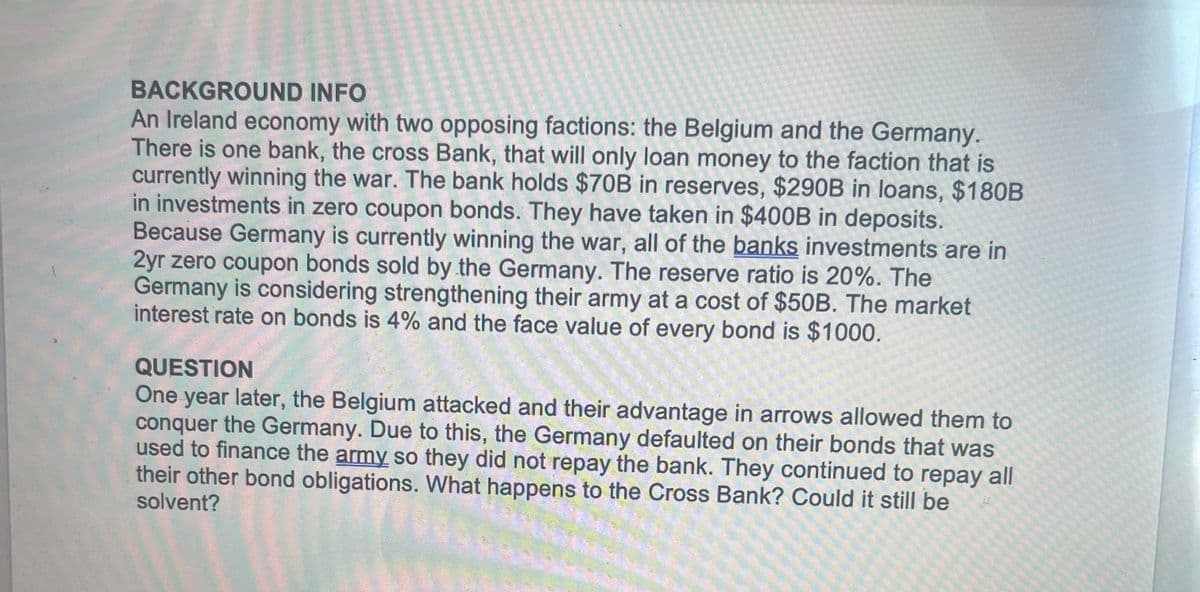

BACKGROUND INFO An Ireland economy with two opposing factions: the Belgium and the Germany. There is one bank, the cross Bank, that will only loan money to the faction that is currently winning the war. The bank holds $70B in reserves, $290B in loans, $180B in investments in zero coupon bonds. They have taken in $400B in deposits. Because Germany is currently winning the war, all of the banks investments are in 2yr zero coupon bonds sold by the Germany. The reserve ratio is 20%. The Germany is considering strengthening their army at a cost of $50B. The market interest rate on bonds is 4% and the face value of every bond is $1000. QUESTION One year later, the Belgium attacked and their advantage in arrows allowed them to conquer the Germany. Due to this, the Germany defaulted on their bonds that was used to finance the army so they did not repay the bank. They continued to repay all their other bond obligations. What happens to the Cross Bank? Could it still be solvent?

BACKGROUND INFO An Ireland economy with two opposing factions: the Belgium and the Germany. There is one bank, the cross Bank, that will only loan money to the faction that is currently winning the war. The bank holds $70B in reserves, $290B in loans, $180B in investments in zero coupon bonds. They have taken in $400B in deposits. Because Germany is currently winning the war, all of the banks investments are in 2yr zero coupon bonds sold by the Germany. The reserve ratio is 20%. The Germany is considering strengthening their army at a cost of $50B. The market interest rate on bonds is 4% and the face value of every bond is $1000. QUESTION One year later, the Belgium attacked and their advantage in arrows allowed them to conquer the Germany. Due to this, the Germany defaulted on their bonds that was used to finance the army so they did not repay the bank. They continued to repay all their other bond obligations. What happens to the Cross Bank? Could it still be solvent?

Chapter4: Exchange Rate Determination

Section: Chapter Questions

Problem 26QA

Related questions

Question

Transcribed Image Text:BACKGROUND INFO

An Ireland economy with two opposing factions: the Belgium and the Germany.

There is one bank, the cross Bank, that will only loan money to the faction that is

currently winning the war. The bank holds $70B in reserves, $290B in loans, $180B

in investments in zero coupon bonds. They have taken in $400B in deposits.

Because Germany is currently winning the war, all of the banks investments are in

2yr zero coupon bonds sold by the Germany. The reserve ratio is 20%. The

Germany is considering strengthening their army at a cost of $50B. The market

interest rate on bonds is 4% and the face value of every bond is $1000.

QUESTION

One year later, the Belgium attacked and their advantage in arrows allowed them to

conquer the Germany. Due to this, the Germany defaulted on their bonds that was

used to finance the army so they did not repay the bank. They continued to repay all

their other bond obligations. What happens to the Cross Bank? Could it still be

solvent?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,