In 2022 Quick Burger had capital expenditures of $3,064. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. X Answer is complete but not entirely correct. a. Free cash flow b. Additional tax c. Free cash flow $ 7,776 $ 3,224.31 $ 4,552 million million million

In 2022 Quick Burger had capital expenditures of $3,064. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. X Answer is complete but not entirely correct. a. Free cash flow b. Additional tax c. Free cash flow $ 7,776 $ 3,224.31 $ 4,552 million million million

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

vv.

Subject

Finance

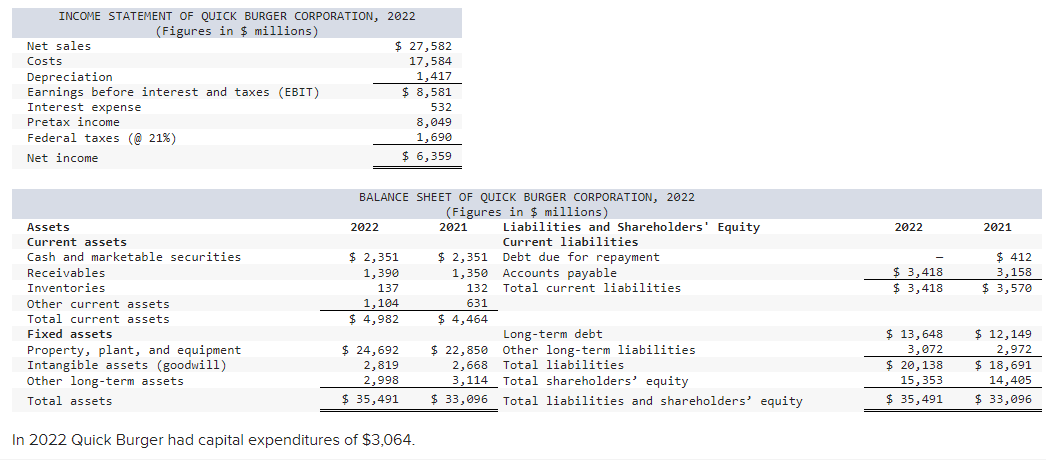

Transcribed Image Text:INCOME STATEMENT OF QUICK BURGER CORPORATION,

(Figures in $ millions)

Net sales

Costs

Depreciation

Earnings before interest and taxes (EBIT)

Interest expense

Pretax income

Federal taxes (@21%)

Net income

Assets

Current assets

Cash and marketable securities

Receivables

Inventories

Other current assets

Total current assets

curr

Fixed assets

Property, plant, and equipment

Intangible assets (goodwill)

Other long-term assets

Total assets

2022

2022

$ 27,582

17,584

1,417

$ 8,581

BALANCE SHEET OF QUICK BURGER CORPORATION, 2022

(Figures in $ millions)

2021

$ 2,351

1,390

137

1,104

$ 4,982

532

8,049

1,690

$ 6,359

$ 24,692

2,819

2,998

$ 35,491

In 2022 Quick Burger had capital expenditures of $3,064.

$ 2,351

1,350

132

631

$ 4,464

Liabilities and Shareholders' Equity

Current liabilities

Debt due for repayment

Accounts payable

Total current liabilities

Long-term debt

$ 22,850

Other long-term liabilities

2,668

Total liabilities

3,114

Total shareholders' equity

$ 33,096 Total liabilities and shareholders' equity

2022

$ 3,418

$3,418

$ 13,648

3,072

$ 20,138

15,353

$ 35,491

2021

$ 412

3,158

$ 3,570

$ 12,149

2,972

$ 18,691

14,405

$ 33,096

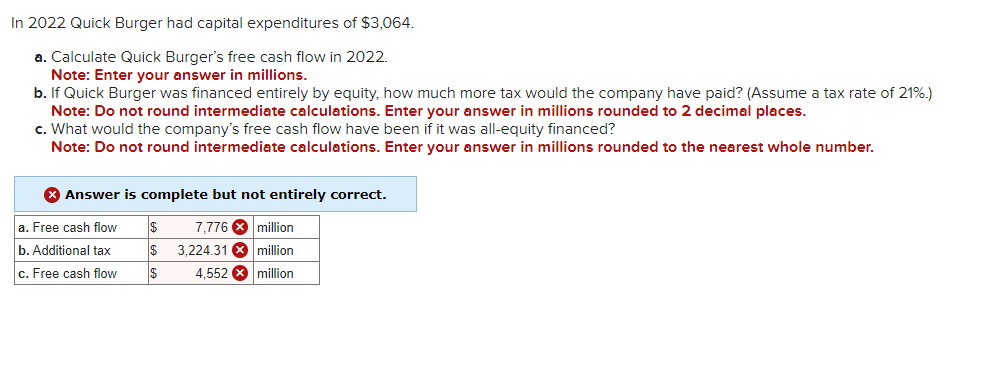

Transcribed Image Text:In 2022 Quick Burger had capital expenditures of $3,064.

a. Calculate Quick Burger's free cash flow in 2022.

Note: Enter your answer in millions.

b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.)

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

c. What would the company's free cash flow have been if it was all-equity financed?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number.

> Answer is complete but not entirely correct.

a. Free cash flow

$ 7,776 million

b. Additional tax

$

3,224.31 x million

c. Free cash flow

$

4.552 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning