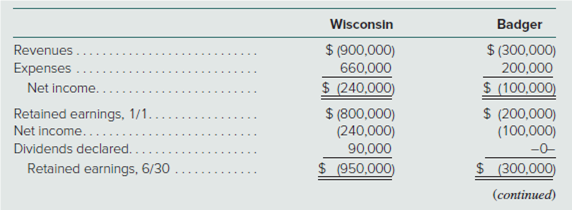

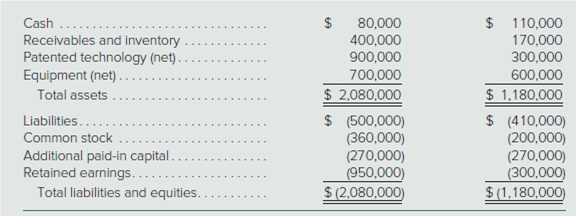

Badger Wisconsin $ (900,000) $ (300,000) 200,000 $ (100,000) Revenues. Expenses Net income. 660,000 $ (240,000) Retained earnings, 1/1. Net income... Dividends declared. Retained earnings, 6/30 $ (800,000) (240,000) $ (200,000) 90,000 $ (950,000) -0- $ (300,000) (continued) Cash ... Receivables and inventory Patented technology (net). Equipment (net).. Total assets . Liabilities.. Common stock Additional paid-in capital. Retained earnings.... Total liabilities and equities.. $ 110,000 80,000 400,000 900,000 300,000 $ 2,080,000 600,000 $ 1,180,000 $ (500,000) $ (410,000) (270,000) (950,000) $ (2,080,000) (270,000) $ (1,180,000)

On June 30, 2017, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month period ending June 30, 2017, were as follows:

Wisconsin also paid $30,000 to a broker for arranging the transaction. In addition, Wisconsin paid $40,000 in stock issuance costs. Badger’s equipment was actually worth $700,000, but its patented technology was valued at only $280,000.

What are the consolidated balances for the following accounts?

a. Net income.

b.

c. Patented technology.

d. Goodwill.

e. Liabilities.

f. Common stock.

g. Additional paid-in capital.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images