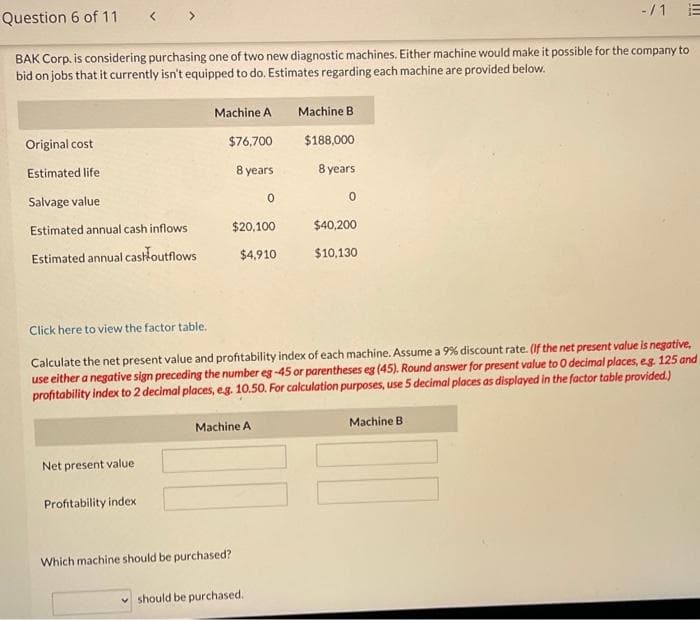

BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Machine B Original cost $76,700 $188,000 Estimated life 8 years 8 years Salvage value Estimated annual cash inflows $20,100 $40,200 Estimated annual castloutflows $4,910 $10,130 Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, eg 125 an profitability index to 2 decimal places, eg. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Machine B Net present value Profitability index Which machine should be purchased? should be purchased.

BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Machine B Original cost $76,700 $188,000 Estimated life 8 years 8 years Salvage value Estimated annual cash inflows $20,100 $40,200 Estimated annual castloutflows $4,910 $10,130 Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, eg 125 an profitability index to 2 decimal places, eg. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Machine B Net present value Profitability index Which machine should be purchased? should be purchased.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 13PROB

Related questions

Question

Please answer competely

Transcribed Image Text:Question 6 of 11

< >

-/1

BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to

bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below.

Machine A

Machine B

Original cost

$76,700

$188,000

Estimated life

8 years

8 years

Salvage value

Estimated annual cash inflows

$20,100

$40,200

Estimated annual castioutflows

$4,910

$10,130

Click here to view the factor table.

Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative,

use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, eg 125 and

profitability index to 2 decimal places, eg. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Machine A

Machine B

Net present value

Profitability index

Which machine should be purchased?

should be purchased.

III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning