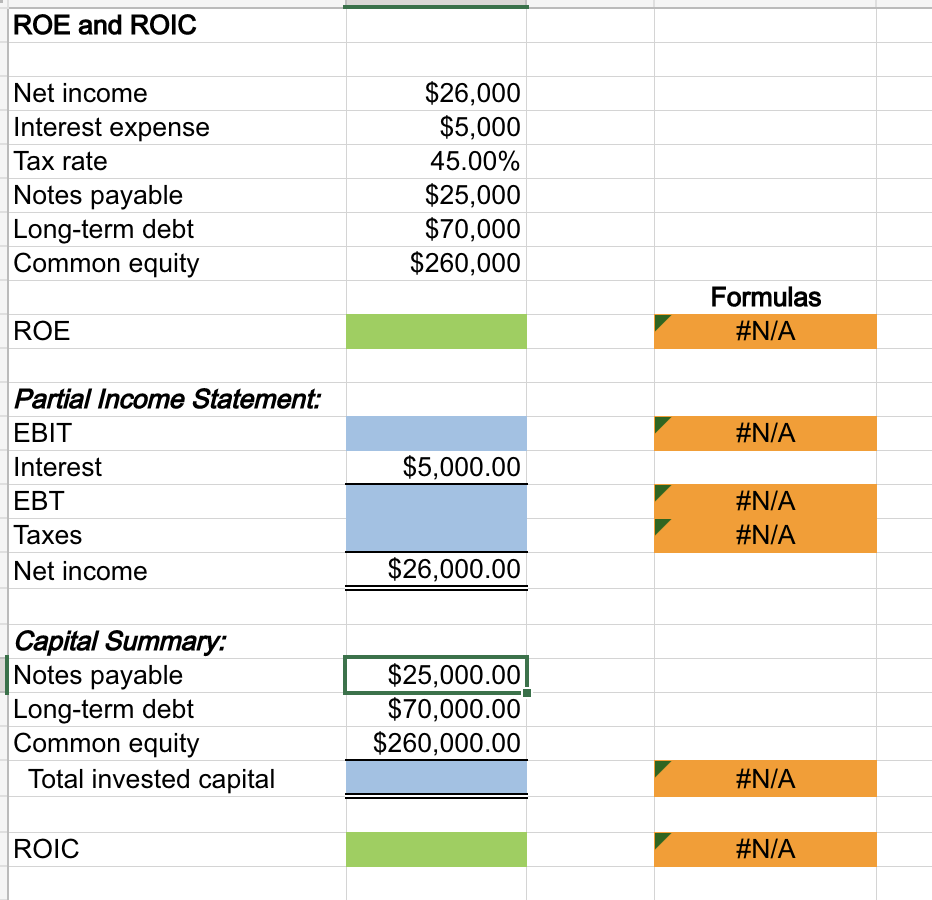

Baker Industries’ net income is $26000, its interest expense is $5000, and its tax rate is 45%. Its notes payable equals $25000, long-term debt equals $70000, and common equity equals $260000. The firm finances with only debt and common equity, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What are the firm’s ROE and ROIC? Round your answers to two decimal places. Do not round intermediate calculations.

Baker Industries’ net income is $26000, its interest expense is $5000, and its tax rate is 45%. Its notes payable equals $25000, long-term debt equals $70000, and common equity equals $260000. The firm finances with only debt and common equity, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What are the firm’s ROE and ROIC? Round your answers to two decimal places. Do not round intermediate calculations.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 1PEB: Brower Co. is considering the following alternative financing plans: Income tax is estimated at 40%...

Related questions

Question

Baker Industries’ net income is $26000, its interest expense is $5000, and its tax rate is 45%. Its notes payable equals $25000, long-term debt equals $70000, and common equity equals $260000. The firm finances with only debt and common equity, so it has no

What are the firm’s ROE and ROIC? Round your answers to two decimal places. Do not round intermediate calculations.

Transcribed Image Text:ROE and ROIC

Net income

Interest expense

Tax rate

Notes payable

Long-term debt

Common equity

ROE

Partial Income Statement:

EBIT

Interest

EBT

Taxes

Net income

Capital Summary:

Notes payable

Long-term debt

Common equity

Total invested capital

ROIC

$26,000

$5,000

45.00%

$25,000

$70,000

$260,000

$5,000.00

$26,000.00

$25,000.00

$70,000.00

$260,000.00

Formulas

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning