Balance sheet ($ in millions) Income statement (S in millions) Assets 2010 Liabilities and 2010 owners' equity 2010 Current assets: Current liabilities: Sales 3,400 Cash 200 Accounts payable 400 Cost of goods sold 1,200 Accounts receivable 500 Bills payable 100 Office and selling 600 400 Total current liabilities Inventory expenses 500 Depreciation 102 Total current assets 1.100 Long-term liabilities: Earnings before interest and taxes 1,498 Long-term debt 200 Interest expense 10 Total long-term liabilities Fixed assets: 200 Earnings before taxes 1,488 2.400 Shareholders' funds: Property, plant, and equipment Тахes 607 Net income 881 2,100 Equity share capital (Si per share) 300 Reserves & Surplus Total owners' equity 700 Less: Accumulated 200 depreciation Dividends 635 Net fixed assets 500 Transfer to reserves and 246 surplus Other information Number of shares 200 1.400 Total liability and owners' equity Total assets 1,400 Outstanding (millions) Price per share 7.31

Balance sheet ($ in millions) Income statement (S in millions) Assets 2010 Liabilities and 2010 owners' equity 2010 Current assets: Current liabilities: Sales 3,400 Cash 200 Accounts payable 400 Cost of goods sold 1,200 Accounts receivable 500 Bills payable 100 Office and selling 600 400 Total current liabilities Inventory expenses 500 Depreciation 102 Total current assets 1.100 Long-term liabilities: Earnings before interest and taxes 1,498 Long-term debt 200 Interest expense 10 Total long-term liabilities Fixed assets: 200 Earnings before taxes 1,488 2.400 Shareholders' funds: Property, plant, and equipment Тахes 607 Net income 881 2,100 Equity share capital (Si per share) 300 Reserves & Surplus Total owners' equity 700 Less: Accumulated 200 depreciation Dividends 635 Net fixed assets 500 Transfer to reserves and 246 surplus Other information Number of shares 200 1.400 Total liability and owners' equity Total assets 1,400 Outstanding (millions) Price per share 7.31

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Practice Pack

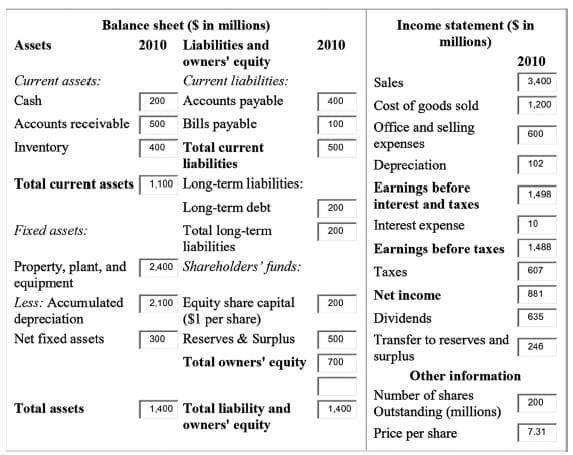

Following are the financial statements of AB Ltd. for 2010.

From the aforementioned table, calculate the following:

1. Current ratio

2. Liquid ratio

3. Receivables turnover ratio and collection period

4. Inventory turnover and holding period

5. Fixed assets turnover

6. Total assets turnover

7. Debt ratio

8. D/E ratio

9. Interest coverage ratio

10. PAT margin

11. ROA

12. ROE

13. EPS

14. D/P ratio

15. P/E ratio

16. Book value per share

Transcribed Image Text:Balance sheet ($ in millions)

Income statement (S in

millions)

2010 Liabilities and

owners' equity

Assets

2010

2010

Current assets:

Current liabilities:

Sales

3,400

200 Accounts payable

Accounts receivable 500 Bills payable

Cash

400

Cost of goods sold

1,200

100

Office and selling

600

Inventory

400 Total current

expenses

500

liabilities

Depreciation

102

Total current assets 1.100 Long-term liabilities:

Earnings before

interest and taxes

1,498

Long-term debt

200

Interest expense

10

Total long-term

liabilities

Fixed assets:

200

Earnings before taxes

1,488

2.400 Shareholders' funds:

Property, plant, and

equipment

Тахes

607

Net income

881

2,100 Equity share capital

(Si per share)

300 Reserves & Surplus

Less: Accumulated

200

depreciation

Dividends

635

Net fixed assets

500

Transfer to reserves and

246

Total owners' equity 700

surplus

Other information

Number of shares

Outstanding (millions)

200

1,400 Total liability and

owners' equity

Total assets

1,400

Price per share

7.31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning