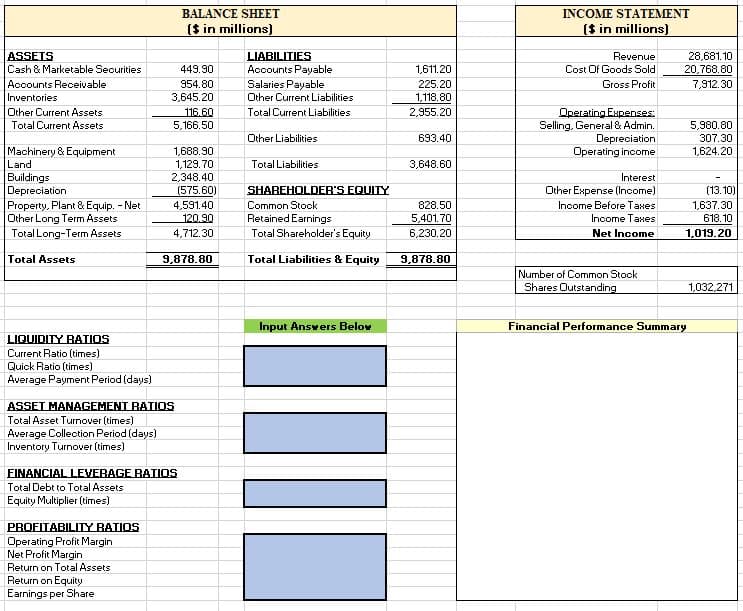

BALANCE SHEET INCOME STATEMENT ($ in millions) ($ in millions) ASSETS Cash & Marketable Securities LIABILITIES Revenue 28,681.10 Cost Of Goods Sold Accounts Payable Salaries Payable 449.90 1,611.20 20,768.80 Accounts Receivable 954.80 225.20 Gross Profit 7.912.30 Inventories 3,645.20 Other Current Liabilities 1,118.80 Operating Expenses: Selling, General & Admin. Depreciation Operating income 116.60 5,166.50 Other Current Assets Total Current Liabilities 2,955.20 Total Current Assets 5,980.80 Other Liabilities 693.40 307.30 1,688.90 1,129.70 2,348.40 (575.60) Machinery & Equipment Land 1,624.20 Total Liabilities 3,648.60 Buildings Depreciation Property, Plant & Equip. - Net Other Long Term Assets Total Long-Term Assets Interest SHAREHOLDER'S EQUITY Other Expense (Income) (13.10) 4,591.40 120.90 Common Stock 828.50 Income Before Taxes 1,637.30 Retained Earnings 5,401.70 Income Taxes 618. 10 4,712.30 Total Shareholder's Equity 6,230.20 Net Income 1,019.20 Total Assets 9,878.80 Total Liabilities & Equity 9,878.80 Number of Common Stock Shares Outstanding 1,032,271 Input Answers Below Financial Performance Summary LIQUIDITY RATIOS Current Ratio (times) Quick Ratio (times) Average Payment Period (days) ASSET MANAGEMENT BATIOS Total Asset Turnover (times) Average Colleotion Period (days) Inventory Turnover (times) FINANCIAL LEVERAGE RATIOS Total Debt to Total Assets Equity Multiplier (times) PROFITABILITY RATIOS Operating Profit Margin Net Profit Margin Return on Total Assets Return on Equity Earnings per Share IIII

BALANCE SHEET INCOME STATEMENT ($ in millions) ($ in millions) ASSETS Cash & Marketable Securities LIABILITIES Revenue 28,681.10 Cost Of Goods Sold Accounts Payable Salaries Payable 449.90 1,611.20 20,768.80 Accounts Receivable 954.80 225.20 Gross Profit 7.912.30 Inventories 3,645.20 Other Current Liabilities 1,118.80 Operating Expenses: Selling, General & Admin. Depreciation Operating income 116.60 5,166.50 Other Current Assets Total Current Liabilities 2,955.20 Total Current Assets 5,980.80 Other Liabilities 693.40 307.30 1,688.90 1,129.70 2,348.40 (575.60) Machinery & Equipment Land 1,624.20 Total Liabilities 3,648.60 Buildings Depreciation Property, Plant & Equip. - Net Other Long Term Assets Total Long-Term Assets Interest SHAREHOLDER'S EQUITY Other Expense (Income) (13.10) 4,591.40 120.90 Common Stock 828.50 Income Before Taxes 1,637.30 Retained Earnings 5,401.70 Income Taxes 618. 10 4,712.30 Total Shareholder's Equity 6,230.20 Net Income 1,019.20 Total Assets 9,878.80 Total Liabilities & Equity 9,878.80 Number of Common Stock Shares Outstanding 1,032,271 Input Answers Below Financial Performance Summary LIQUIDITY RATIOS Current Ratio (times) Quick Ratio (times) Average Payment Period (days) ASSET MANAGEMENT BATIOS Total Asset Turnover (times) Average Colleotion Period (days) Inventory Turnover (times) FINANCIAL LEVERAGE RATIOS Total Debt to Total Assets Equity Multiplier (times) PROFITABILITY RATIOS Operating Profit Margin Net Profit Margin Return on Total Assets Return on Equity Earnings per Share IIII

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 16MCQ

Related questions

Question

Transcribed Image Text:BALANCE SHEET

INCOME STATEMENT

($ in millions)

($ in millions)

ASSETS

Cash & Marketable Securities

LIABILITIES

Revenue

Cost Of Goods Sold

28,681. 10

Accounts Payable

Salaries Payable

449.90

1,611.20

20,768.80

Accounts Receivable

954.80

225.20

Gross Profit

7.912.30

Inventories

3,645.20

Other Current Liabilities

1,118.80

Operating Expenses:

Selling, General & Admin.

Depreciation

Operating income

Other Current Assets

Total Current Assets

116.60

5,166.50

Total Current Liabilities

2,955.20

5,980.80

Other Liabilities

693.40

307.30

1,688.90

1,129.70

2,348.40

(575.60)

Machinery & Equipment

Land

1,624.20

Total Liabilities

3,648.60

Buildings

Depreciation

Property, Plant & Equip. - Net

Other Long Term Assets

Total Long-Term Assets

Interest

SHAREHOLDER'S EQUITY

Other Expense (Income)

(13.10)

4,591.40

120.90

828.50

5.401.70

1,637.30

618.10

1,019.20

Common Stock

Income Before Taxes

Retained Earnings

Total Shareholder's Equity

Income Taxes

4,712.30

6,230.20

Net Income

Total Assets

9,878.80

Total Liabilities & Equity

9,878.80

Number of Common Stock

Shares Outstanding

1,032,271

Input Answers Belov

Financial Performance Summary

LIQUIDITY RATIOS

Current Ratio (times)

Quick Ratio (times)

Average Payment Period (days)

ASSET MANAGEMENT BATIOS

Total Asset Turnover (times)

Average Colleotion Period (days)

Inventory Turnover (times)

FINANCIAL LEVERAGE RATIOS

Total Debt to Total Assets

Equity Multiplier (times)

PROFITABILITY RATIOS

Operating Profit Margin

Net Profit Margin

Return on Total Assets

Return on Equity

Earnings per Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College