Balances or Values at December 31, 2020 Projected benefit obligation Accumulated benefit obligation $2,758,700 1,977,400 Fair value of plan assets Accumulated OCI (PSC) Accumulated OCI–Net loss (1/1/20 balance, 0) Pension liability 2,259,100 209,600 45,300 499,600 Other pension plan data for 2020: Service cost $94,100 Prior service cost amortization 41,600 Actual return on plan assets Expected return on plan assets 130,300 175,600 254,600 Interest on January 1, 2020, projected benefit obligation Contributions to plan 93,700 Benefits paid 141,100

Balances or Values at December 31, 2020 Projected benefit obligation Accumulated benefit obligation $2,758,700 1,977,400 Fair value of plan assets Accumulated OCI (PSC) Accumulated OCI–Net loss (1/1/20 balance, 0) Pension liability 2,259,100 209,600 45,300 499,600 Other pension plan data for 2020: Service cost $94,100 Prior service cost amortization 41,600 Actual return on plan assets Expected return on plan assets 130,300 175,600 254,600 Interest on January 1, 2020, projected benefit obligation Contributions to plan 93,700 Benefits paid 141,100

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.5BE

Related questions

Question

I need help computing the amount of accumulated other comprehensive income

Transcribed Image Text:Compute the amount of accumulated other comprehensive income reported at December 31, 2020. (Enter los

or parentheses e.g. (45).)

Accumulated other comprehensive income (los

Click if you would like to Show Work for thi question: Open Show Work

LINK TO TEXT

Question At

t Privacy Policy @ 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc.

pe here to search

OF

hp

abro

f5

f7

f10

f12

f6

10

144

3

5.

6

8.

E

R TY

U

4+

%24

23

Transcribed Image Text:CALCU

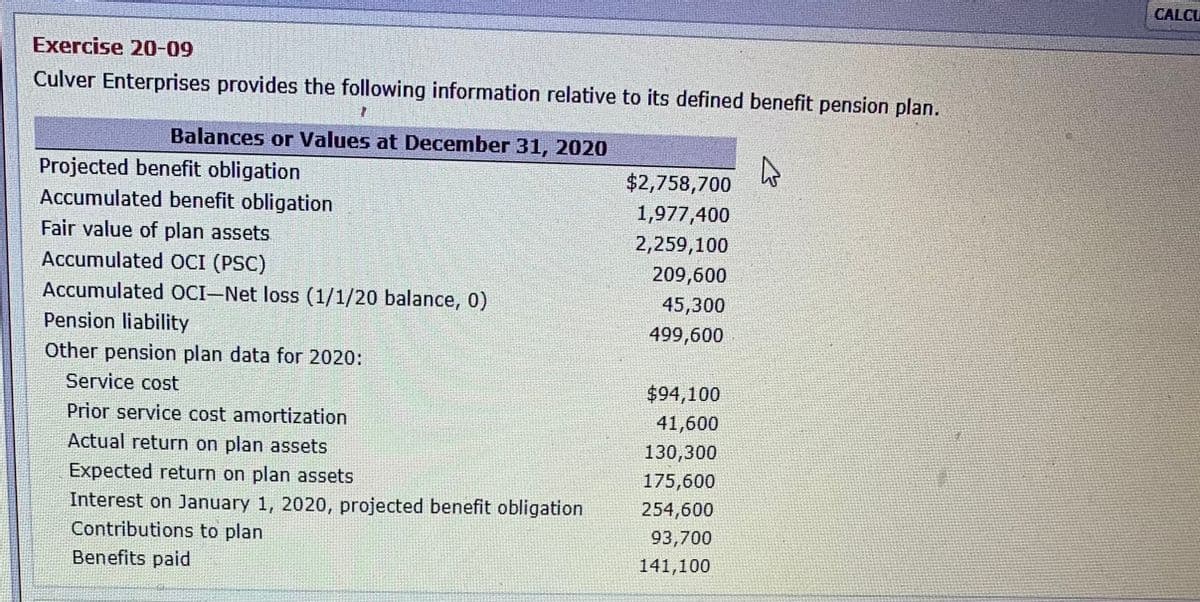

Exercise 20-09

Culver Enterprises provides the following information relative to its defined benefit pension plan.

Balances or Values at December 31, 2020

Projected benefit obligation

$2,758,700

Accumulated benefit obligation

Fair value of plan assets

Accumulated OCI (PSC)

Accumulated OCI–Net loss (1/1/20 balance, 0)

1,977,400

2,259,100

209,600

45,300

Pension liability

499,600

Other pension plan data for 2020:

Service cost

$94,100

Prior service cost amortization

41,600

Actual return on plan assets

130,300

Expected return on plan assets

175,600

Interest on January 1, 2020, projected benefit obligation

254,600

Contributions to plan

93,700

Benefits paid

141,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning