Question text Dickson Manufacturing Corp., a company reporting under IFRS, has a defined benefit pension plan. Pension information concerning the 2020 fiscal year is presented below (in millions): Information provided by the pension plan trustee Fair value of plan assets, January 1, 2020 $1,600 Actual return on plan assets, 2020 224 The discount rate used in actuarial assumptions is 10%. What is the balance of the plan assets as at December 31, 2020? Select one: 17 а. $1,664 b. $1,824

Question text Dickson Manufacturing Corp., a company reporting under IFRS, has a defined benefit pension plan. Pension information concerning the 2020 fiscal year is presented below (in millions): Information provided by the pension plan trustee Fair value of plan assets, January 1, 2020 $1,600 Actual return on plan assets, 2020 224 The discount rate used in actuarial assumptions is 10%. What is the balance of the plan assets as at December 31, 2020? Select one: 17 а. $1,664 b. $1,824

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 9MC

Related questions

Question

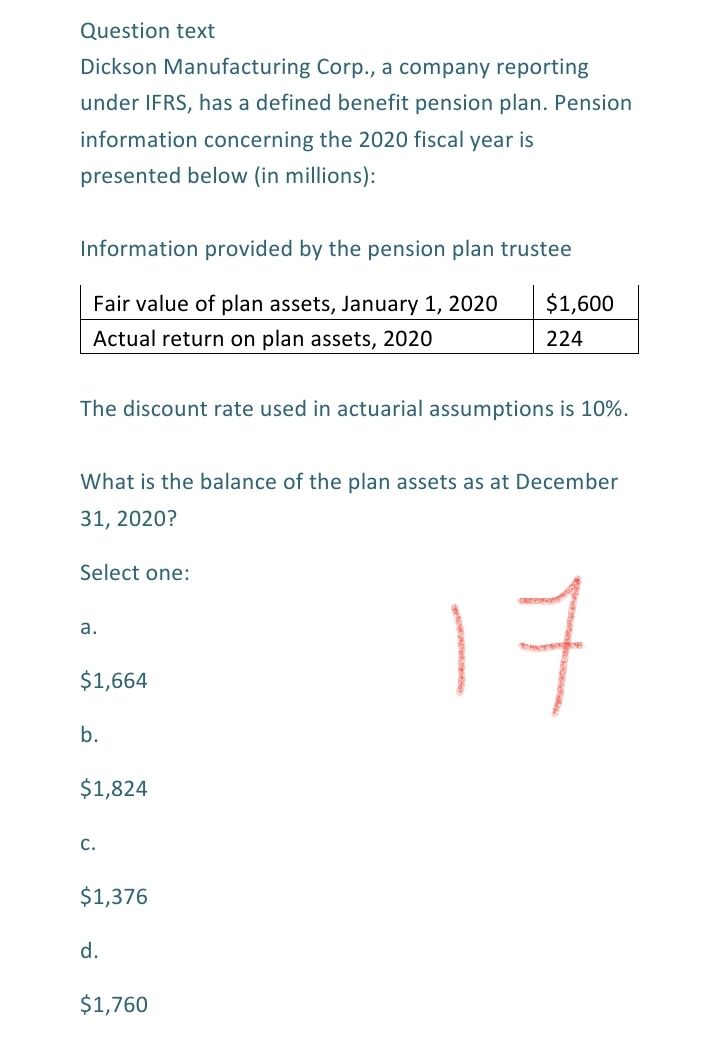

Transcribed Image Text:Question text

Dickson Manufacturing Corp., a company reporting

under IFRS, has a defined benefit pension plan. Pension

information concerning the 2020 fiscal year is

presented below (in millions):

Information provided by the pension plan trustee

Fair value of plan assets, January 1, 2020

$1,600

Actual return on plan assets, 2020

224

The discount rate used in actuarial assumptions is 10%.

What is the balance of the plan assets as at December

31, 2020?

Select one:

17

а.

$1,664

b.

$1,824

c.

$1,376

d.

$1,760

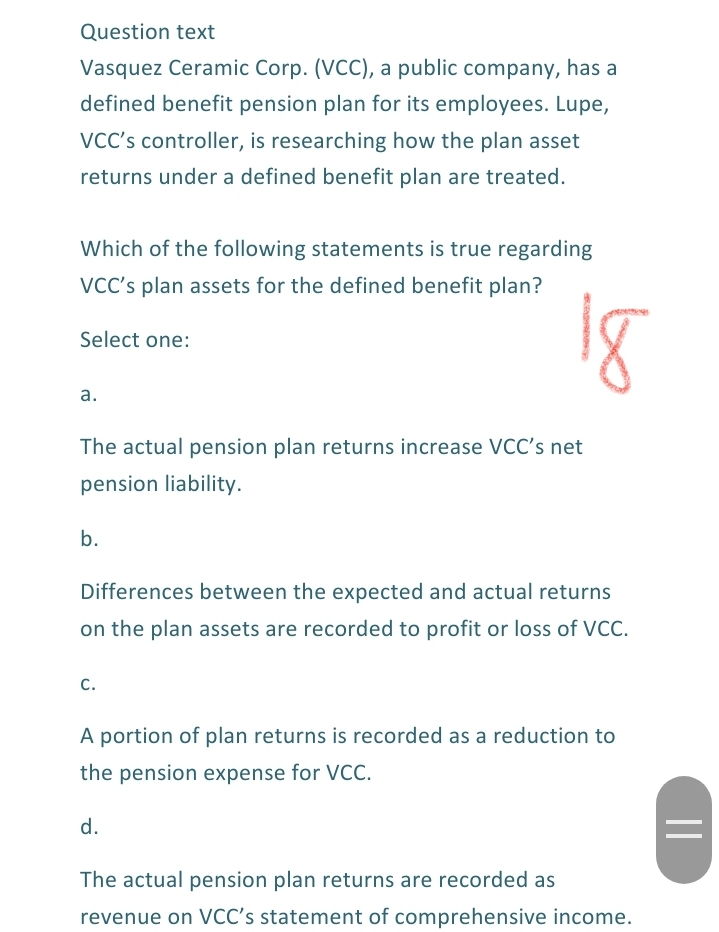

Transcribed Image Text:Question text

Vasquez Ceramic Corp. (VCC), a public company, has a

defined benefit pension plan for its employees. Lupe,

VCC's controller, is researching how the plan asset

returns under a defined benefit plan are treated.

Which of the following statements is true regarding

VCC's plan assets for the defined benefit plan?

Select one:

а.

The actual pension plan returns increase VCC's net

pension liability.

b.

Differences between the expected and actual returns

on the plan assets are recorded to profit or loss of VCC.

c.

A portion of plan returns is recorded as a reduction to

the pension expense for VCC.

d.

The actual pension plan returns are recorded as

revenue on VCC's statement of comprehensive income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning