bank assesses a 3% finance fee and charges interest on the note at 6%. The journal entry to record thi would not include a a. Debit to cash for P970,000 b. Debit to finance charge for P30,000 c. Credit to notes payable for P1,000,000 d. Credit to accounts receivable for P1,000,000 mbers 2-3 ine Company factored P5,000,000 of accounts receivable. Control was surrendered by the entity. npany assessed a fee of 2% and retains a holdback equal to 10% of the accounts receivable. In addition npany charged 12% interest computed on a weighted average time to maturity of the accounts receivabl What is the amount initially received from the factoring of accounts receivable? a. 4,250,000 c. 4,700,685

bank assesses a 3% finance fee and charges interest on the note at 6%. The journal entry to record thi would not include a a. Debit to cash for P970,000 b. Debit to finance charge for P30,000 c. Credit to notes payable for P1,000,000 d. Credit to accounts receivable for P1,000,000 mbers 2-3 ine Company factored P5,000,000 of accounts receivable. Control was surrendered by the entity. npany assessed a fee of 2% and retains a holdback equal to 10% of the accounts receivable. In addition npany charged 12% interest computed on a weighted average time to maturity of the accounts receivabl What is the amount initially received from the factoring of accounts receivable? a. 4,250,000 c. 4,700,685

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

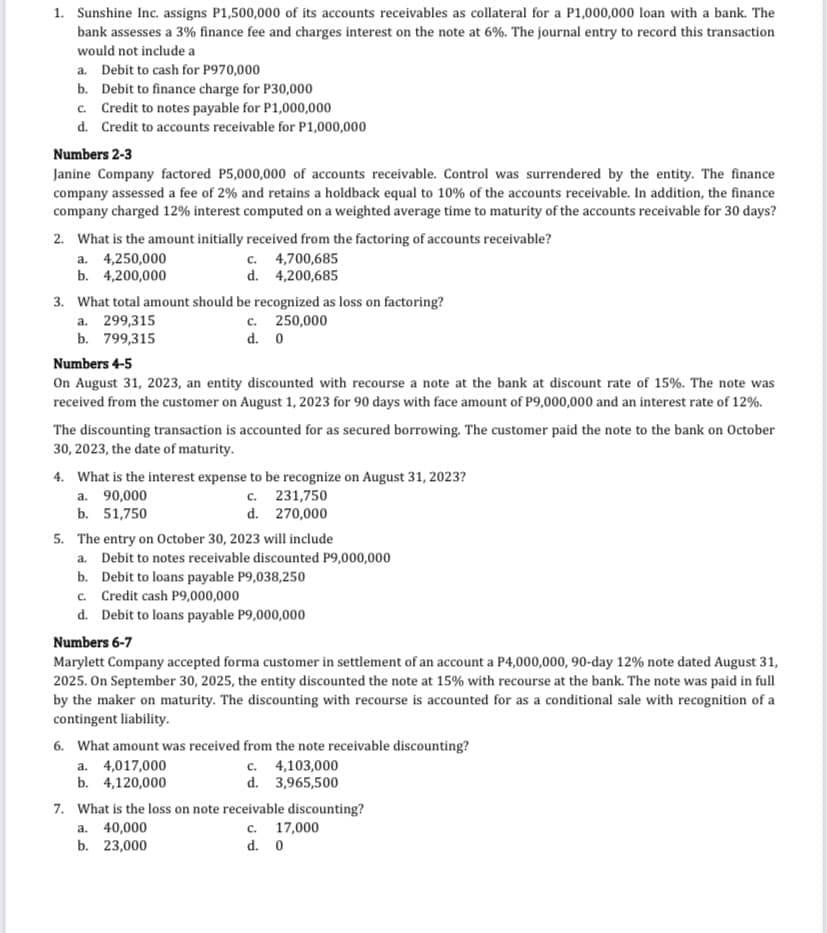

Transcribed Image Text:1. Sunshine Inc. assigns P1,500,000 of its accounts receivables as collateral for a P1,000,000 loan with a bank. The

bank assesses a 3% finance fee and charges interest on the note at 6%. The journal entry to record this transaction

would not include a

a. Debit to cash for P970,000

b. Debit to finance charge for P30,000

c. Credit to notes payable for P1,000,000

d. Credit to accounts receivable for P1,000,000

Numbers 2-3

Janine Company factored P5,000,000 of accounts receivable. Control was surrendered by the entity. The finance

company assessed a fee of 2% and retains a holdback equal to 10% of the accounts receivable. In addition, the finance

company charged 12% interest computed on a weighted average time to maturity of the accounts receivable for 30 days?

2. What is the amount initially received from the factoring of accounts receivable?

a. 4,250,000

b. 4,200,000

c. 4,700,685

d. 4,200,685

3. What total amount should be recognized as loss on factoring?

a. 299,315

b. 799,315

c. 250,000

d. 0

Numbers 4-5

On August 31, 2023, an entity discounted with recourse a note at the bank at discount rate of 15%. The note was

received from the customer on August 1, 2023 for 90 days with face amount of P9,000,000 and an interest rate of 12%.

The discounting transaction is accounted for as secured borrowing. The customer paid the note to the bank on October

30, 2023, the date of maturity.

4. What is the interest expense to be recognize on August 31, 2023?

a. 90,000

b. 51,750

c. 231,750

d. 270,000

5. The entry on October 30, 2023 will include

a. Debit to notes receivable discounted P9,000,000

b. Debit to loans payable P9,038,250

c. Credit cash P9,000,000

d. Debit to loans payable P9,000,000

Numbers 6-7

Marylett Company accepted forma customer in settlement of an account a P4,000,000, 90-day 12% note dated August 31,

2025. On September 30, 2025, the entity discounted the note at 15% with recourse at the bank. The note was paid in full

by the maker on maturity. The discounting with recourse is accounted for as a conditional sale with recognition of a

contingent liability.

6. What amount was received from the note receivable discounting?

с. 4,103,000

d. 3,965,500

a. 4,017,000

b. 4,120,000

7. What is the loss on note receivable discounting?

a. 40,000

c. 17,000

b. 23,000

d. 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning