Bank Reconciliation and Related Journal Entries The book balance in the checking account of Johnson Enterprises as of October 31 is $5,690.00. The bank statement shows an ending balance of $5,176.00. The following information is discovered by (1) comparing last month's deposits in transit and outstanding checks with this month's bank statement, (2) comparing deposits and checks written per books and per bank in the current month, and (3) noting service charges and other debit and credit memos shown on the bank statement. Deposits in transit: 10/29 $215.00 10/30 410.00 Outstanding checks: No. 1635 56.40 No. 1639 175.00 No. 1641 131.30 No. 1653 447.30 Unrecorded ATM withdrawal: 200.00 Bank service charge: 36.00 NSF check: 478.00 Error on Check No. 1624 Checkbook shows it was for $76, but it was actually written for $61. Accounts Payable was debited. *Funds were withdrawn by Enoch Johnson for personal use. Required: 1. Prepare a bank reconciliation as of October 31, 20--.

Bank Reconciliation and Related Journal Entries The book balance in the checking account of Johnson Enterprises as of October 31 is $5,690.00. The bank statement shows an ending balance of $5,176.00. The following information is discovered by (1) comparing last month's deposits in transit and outstanding checks with this month's bank statement, (2) comparing deposits and checks written per books and per bank in the current month, and (3) noting service charges and other debit and credit memos shown on the bank statement. Deposits in transit: 10/29 $215.00 10/30 410.00 Outstanding checks: No. 1635 56.40 No. 1639 175.00 No. 1641 131.30 No. 1653 447.30 Unrecorded ATM withdrawal: 200.00 Bank service charge: 36.00 NSF check: 478.00 Error on Check No. 1624 Checkbook shows it was for $76, but it was actually written for $61. Accounts Payable was debited. *Funds were withdrawn by Enoch Johnson for personal use. Required: 1. Prepare a bank reconciliation as of October 31, 20--.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PB

Related questions

Question

Not really sure can't find any videos to know how to work out problems.

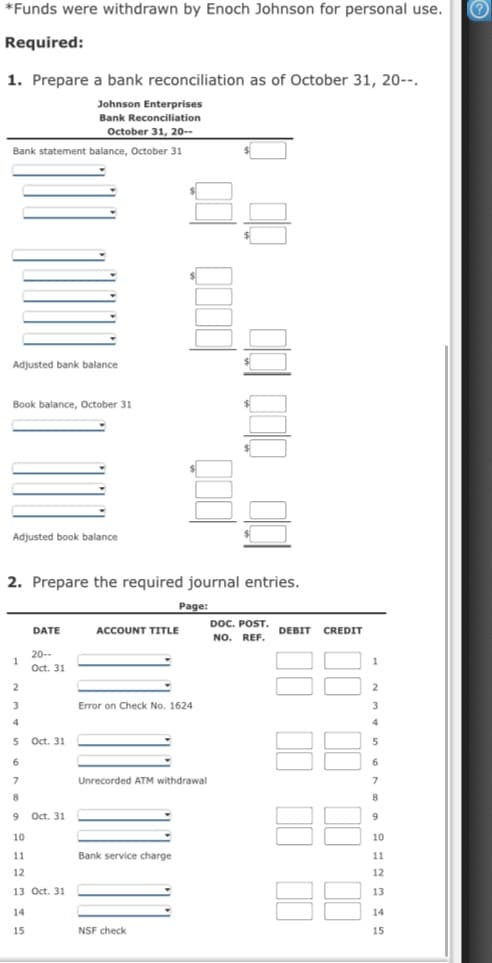

Transcribed Image Text:*Funds were withdrawn by Enoch Johnson for personal use.

Required:

1. Prepare a bank reconciliation as of October 31, 20--.

Johnson Enterprises

Bank Reconciliation

October 31, 20--

Bank statement balance, October 31

Adjusted bank balance

Book balance, October 31

Adjusted book balance

2. Prepare the required journal entries.

Page:

DOC. POST.

NO. REF.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

20--

1

Oct. 31

3

Error on Check No. 1624

5 Oct. 31

6

6

7

Unrecorded ATM withdrawal

9 Oct. 31

9

10

10

11

Bank service charge

11

12

12

13 Oct. 31

13

14

14

15

NSF check

15

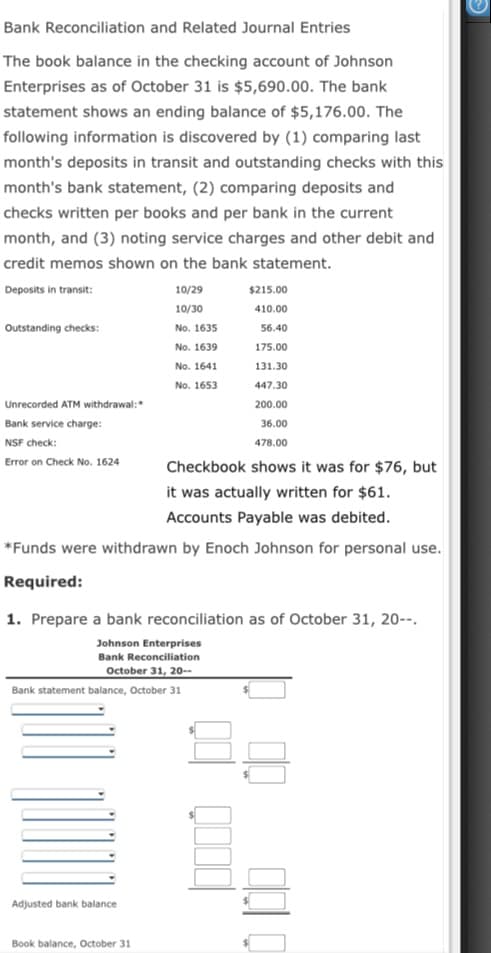

Transcribed Image Text:Bank Reconciliation and Related Journal Entries

The book balance in the checking account of Johnson

Enterprises as of October 31 is $5,690.00. The bank

statement shows an ending balance of $5,176.00. The

following information is discovered by (1) comparing last

month's deposits in transit and outstanding checks with this

month's bank statement, (2) comparing deposits and

checks written per books and per bank in the current

month, and (3) noting service charges and other debit and

credit memos shown on the bank statement.

Deposits in transit:

10/29

$215.00

10/30

410.00

Outstanding checks:

No. 1635

56.40

No. 1639

175.00

No. 1641

131.30

No. 1653

447.30

Unrecorded ATM withdrawal:

200.00

Bank service charge:

36.00

NSF check:

478.00

Error on Check No. 1624

Checkbook shows it was for $76, but

it was actually written for $61.

Accounts Payable was debited.

*Funds were withdrawn by Enoch Johnson for personal use.

Required:

1. Prepare a bank reconciliation as of October 31, 20--.

Johnson Enterprises

Bank Reconciliation

October 31, 20--

Bank statement balance, October 31

Adjusted bank balance

Book balance, October 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College